Kerala SET Paper 2 Mock Test - 5 (Commerce) - KTET MCQ

30 Questions MCQ Test Kerala SET Mock Test Series 2024 - Kerala SET Paper 2 Mock Test - 5 (Commerce)

Consider the following statement

A company can be compared to a river, which maintains its identity. Although its the parts from which it is made are constantly changing.

Which of the following characteristics of the company is implicit in the above statement?

Which of the following is not the basic assumption of cardinal utility analysis?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

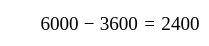

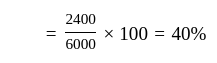

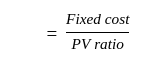

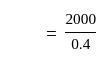

If the sales are Rs. 6000, variable cost is Rs. 3600, and the fixed cost is Rs. 2000 then the break-even point will be -

Assertion (A): Interest on Loan taken to construct a residential house which is let out will be deducted in full.

Reasoning (R): Interest on Loan taken to construct a residential house is allowed to the extent of Rs.1,50,000.

Codes:

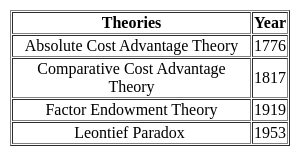

Arrange the following theories in order in which they appeared.

1. Leontief Paradox

2. Absolute Cost Advantage Theory

3. Factor Endowment Theory

4. Comparative Cost Advantage Theory

Codes :

Assertion (A): Both tax planning and tax

Reasoning (R): Tax planning follows the

Codes:

Which of the following tests are not recommended for the top-level positions?

The IMF's _______ purpose is to ensure the stability of the international monetary system.

Arrange the following in the correct chronological order:

(i) Value and Capital

(ii) Principles of Political Economy and Taxation

(iii) A Revision of Demand Theory

(iv) The General Theory of Employment, Interest, and Money

Which of the following is covered under Section 80 D of the Income Tax Act, 1961?

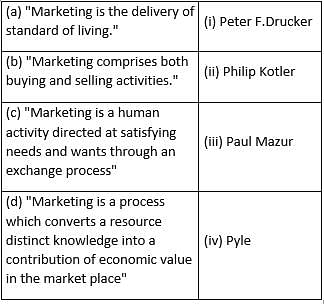

Match the following statements with their authors.

The stage in the product life cycle that focuses on expanding the market and creating product awareness and the trial is the:

Money can be transferred using mobile phones through the service called:

In India a scheduled commercial bank is one which is

Risk arising from the unique uncertainties of individual securities is known as

Assertion: The study of consumer behavior demands a multidisciplinary approach.

Reasoning: It involves understanding psychological, sociological, and economic factors influencing purchasing decisions.

Assertion: Psychographic segmentation is crucial for tailoring marketing strategies.

Reasoning: It helps marketers connect with specific consumer segments based on their preferences and values.

The total area of a normal distribution between average value ± 1.96 of standard deviation is:

Arrange these in the order of their emergence considering the rise of AI:

a) Need for AI Ethicists.

b) Displacement of manual roles.

c) Demand for AI specialists for algorithm development.

d) Augmentation of human roles.

Which of the following is the best example of an Agreement between Oligopolists?

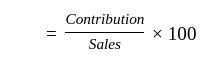

ratio

ratio

Sales

Sales  Variable cost

Variable cost

Rs. 5000

Rs. 5000