MCQ Test: Important Committees - 2 - Bank Exams MCQ

15 Questions MCQ Test General Awareness & Knowledge - MCQ Test: Important Committees - 2

After attaining independence, the Government of India constituted the 'National income Committee' in 1949 to compile authoritative estimates of national income. The committee consisted of:

A. Dr. B. R. Ambedkar

B. Prof. R.C. Dutt

C. Prof. P.C. Mahalanobis

D. Prof. D.R. Gadgil

E. Prof. Sukhamoy Chakravarthy

F. Prof. V.K.R.V. Rao

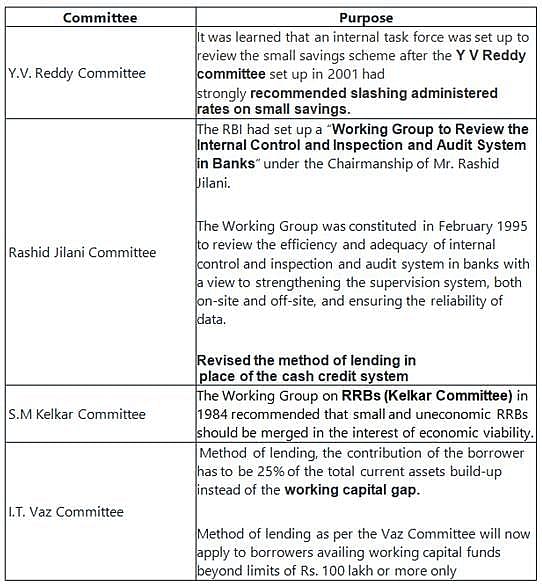

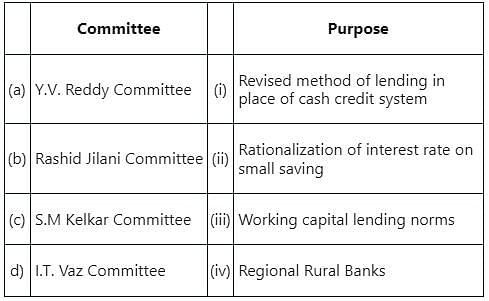

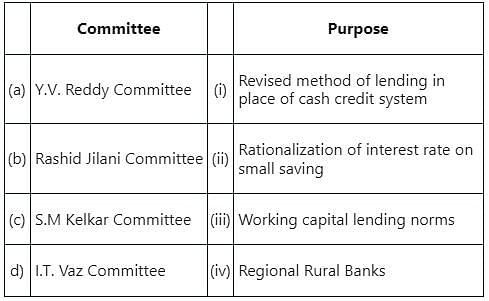

Match the following Banking sector reform committees with their respective purposes:

Choose the correct option from those given below

Choose the correct option from those given below

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

The Securities and Exchange Board of India (SEBI) has recently constituted a committee on Social Stock Exchanges (SSE) under the chairmanship of ______.

Who among the following is not a member of Monetary Policy Committee?

RBI has set up a committee for development of housing finance securitisation market, headed by?

Arrange the following committees formed for small scale sector in chronological order and select the correct answer from the codes given below:

I. Nayak Committee

II. Abid Hussain Committee

III. S. S. Kohli Committee

IV. Karve Committee

Codes:

Which of the following areas was investigated by the Chelliah Committee?

Which committee was appointed to give a detailed report on the Non Performing Assets of public sector banks?

Which committee appointed by the Government of India recommended the formation of lead banks in 1969?

The amalgamation of Vijaya Bank and Dena Bank with Bank of Baroda (BoB) came into effect from _________.

Which among the following is correct regarding the recommendations of the Narsimhan Committee-I in 1991?

Which among the following was the main recommendation of the Narsimhan Committee-II in 1998?

RBI formed a sub-committee to study the issues and concerns in the microfinance sector under the chairmanship of _____.

Which committee was formed to address the issue of Non-Performing Assets (NPAs) in Indian banks?

Which committee recommended the establishment of the National Payments Corporation of India (NPCI)?

|

390 videos|545 docs|149 tests

|

|

390 videos|545 docs|149 tests

|