Test: Accounting & Financial Management of Banking - 5 - Bank Exams MCQ

30 Questions MCQ Test - Test: Accounting & Financial Management of Banking - 5

Trial balance of the personal ledgers is prepared in every ______ time interval.

Banks maintain contra accounts with a view to control over transactions which have no direct effect on the bank’s position. For which of the following contra account is used by banks

I. letters of credit opened

II. bills received or sent for collection

I. letters of credit opened

II. bills received or sent for collection

D limited company sold Rs 2000, 12% perpetual debentures 10 years ago. Interest rates have risen since then so debentures of this company are now selling at a 15 per cent yield basis, determine the expected market price.

___ Bonds have variable coupon rates which is reset at preannounced intervals.

Direction: Read the information carefully and answer the questions based on the given informations below:

In the books of Siva, the following transactions related to bills takes place,

(i) Jan 9. Sold goods to Varun for Rs.34000 and draws a bill for 45 days.

(ii) Mar 1. Sold goods to Bhuvanesh and draws a bill at three months for Rs.500000.

But on May 1, he retires his acceptance under rebate of 12% p.a.

(iii) Oct 1, Bill for 3 months was drawn on Sita for the amount of Rs.100000 owed by her. She accepted the bill. On Oct 3, Siva got the bill discounted with the bank for Rs.99000.

Q. The book with assorted transactions of an Account is called ______?

Direction: Read the information carefully and answer the questions based on the given informations below:

In the books of Siva, the following transactions related to bills takes place,

(i) Jan 9. Sold goods to Varun for Rs.34000 and draws a bill for 45 days.

(ii) Mar 1. Sold goods to Bhuvanesh and draws a bill at three months for Rs.500000.

But on May 1, he retires his acceptance under rebate of 12% p.a.

(iii) Oct 1, Bill for 3 months was drawn on Sita for the amount of Rs.100000 owed by her. She accepted the bill. On Oct 3, Siva got the bill discounted with the bank for Rs.99000.

Q. What will balance to be c/d in the cash account after preparing the ledgers?

Direction: Read the information carefully and answer the questions based on the given informations below:

In the books of Siva, the following transactions related to bills takes place,

(i) Jan 9. Sold goods to Varun for Rs.34000 and draws a bill for 45 days.

(ii) Mar 1. Sold goods to Bhuvanesh and draws a bill at three months for Rs.500000.

But on May 1, he retires his acceptance under rebate of 12% p.a.

(iii) Oct 1, Bill for 3 months was drawn on Sita for the amount of Rs.100000 owed by her. She accepted the bill. On Oct 3, Siva got the bill discounted with the bank for Rs.99000.

Q. Pass journal entry for the sale of goods on Jan 9.

Direction: Read the information carefully and answer the questions based on the given informations below:

In the books of Siva, the following transactions related to bills takes place,

(i) Jan 9. Sold goods to Varun for Rs.34000 and draws a bill for 45 days.

(ii) Mar 1. Sold goods to Bhuvanesh and draws a bill at three months for Rs.500000.

But on May 1, he retires his acceptance under rebate of 12% p.a.

(iii) Oct 1, Bill for 3 months was drawn on Sita for the amount of Rs.100000 owed by her. She accepted the bill. On Oct 3, Siva got the bill discounted with the bank for Rs.99000.

Q. How many days are added as grace days for the bill of exchange after the end of due date?

Direction: Read the information carefully and answer the questions based on the given informations below:

In the books of Siva, the following transactions related to bills takes place,

(i) Jan 9. Sold goods to Varun for Rs.34000 and draws a bill for 45 days.

(ii) Mar 1. Sold goods to Bhuvanesh and draws a bill at three months for Rs.500000.

But on May 1, he retires his acceptance under rebate of 12% p.a.

(iii) Oct 1, Bill for 3 months was drawn on Sita for the amount of Rs.100000 owed by her. She accepted the bill. On Oct 3, Siva got the bill discounted with the bank for Rs.99000.

Q. The Bills Receivable Book is a part of _____?

Which of the following should be taken into consideration, While calculating NPV cash flow

- Taxes

- Salvage

- Depreciation

- Working Capital

Under which among the following head is Salary of MP/MLA/MLC is taxable?

Direction: Using the following case study , choose the appropriate answers for the questions carefully.

M/s. No Ltd Bank is a commercial bank. The No Ltd bank has classified their advances into Performing assets and Non-Performing Assets. Non - Performing assets are further classified into Sub-Standard assets, Doubtful assets & Loss Assets. All the assets of M/s. XYZ ltd are secured assets.

As per RBI guidelines, loan upon becoming an NPA would first be classified as sub-standard for a period not exceeding 12 months and beyond that, it would have to be classified as DOUBTFUL. The doubtful assets are further categorised into Doubtful-1, Doubtful-2 and Doubtful-3 on the basis of their ageing from the date of classification of NPA. After if it become due it is classified as Loss Assets.

Taking into account the time lag between an asset becoming substandard/doubtful turning into loss asset, RBI has directed that bank should make provision against all assets (i.e) Loans & advances. The Management of XYZ Ltd want your help in creation Provision for Assets for the year ended 31-Mar-2022 as per the RBI Guidelines. The Following are details of XYZ Ltd for the year ending 31-Mar-2022.

Asset which do not carry Normal risk - Rs. 2500

Asset which carries risk less than 12 Months (NPA) - Rs. 2000

- Doubtful Assets

- from 01-04-2021 - 400

- from 01-04-2019 - 300

- from 01-04-2015 - 100

- Loss Assets - 500

Q. What is the Rate of Provision for Substandard assets?

Direction: Using the following case study , choose the appropriate answers for the questions carefully.

M/s. No Ltd Bank is a commercial bank. The No Ltd bank has classified their advances into Performing assets and Non-Performing Assets. Non - Performing assets are further classified into Sub-Standard assets, Doubtful assets & Loss Assets. All the assets of M/s. XYZ ltd are secured assets.

As per RBI guidelines, loan upon becoming an NPA would first be classified as sub-standard for a period not exceeding 12 months and beyond that, it would have to be classified as DOUBTFUL. The doubtful assets are further categorised into Doubtful-1, Doubtful-2 and Doubtful-3 on the basis of their ageing from the date of classification of NPA. After if it become due it is classified as Loss Assets.

Taking into account the time lag between an asset becoming substandard/doubtful turning into loss asset, RBI has directed that bank should make provision against all assets (i.e) Loans & advances. The Management of XYZ Ltd want your help in creation Provision for Assets for the year ended 31-Mar-2022 as per the RBI Guidelines. The Following are details of XYZ Ltd for the year ending 31-Mar-2022.

Asset which do not carry Normal risk - Rs. 2500

Asset which carries risk less than 12 Months (NPA) - Rs. 2000

- Doubtful Assets

- from 01-04-2021 - 400

- from 01-04-2019 - 300

- from 01-04-2015 - 100

- Loss Assets - 500

Q. What is the Rate of Provision for Doubtful assets from 1 year to 3 years?

Direction: Using the following case study , choose the appropriate answers for the questions carefully.

M/s. No Ltd Bank is a commercial bank. The No Ltd bank has classified their advances into Performing assets and Non-Performing Assets. Non - Performing assets are further classified into Sub-Standard assets, Doubtful assets & Loss Assets. All the assets of M/s. XYZ ltd are secured assets.

As per RBI guidelines, loan upon becoming an NPA would first be classified as sub-standard for a period not exceeding 12 months and beyond that, it would have to be classified as DOUBTFUL. The doubtful assets are further categorised into Doubtful-1, Doubtful-2 and Doubtful-3 on the basis of their ageing from the date of classification of NPA. After if it become due it is classified as Loss Assets.

Taking into account the time lag between an asset becoming substandard/doubtful turning into loss asset, RBI has directed that bank should make provision against all assets (i.e) Loans & advances. The Management of XYZ Ltd want your help in creation Provision for Assets for the year ended 31-Mar-2022 as per the RBI Guidelines. The Following are details of XYZ Ltd for the year ending 31-Mar-2022.

Asset which do not carry Normal risk - Rs. 2500

Asset which carries risk less than 12 Months (NPA) - Rs. 2000

- Doubtful Assets

- from 01-04-2021 - 400

- from 01-04-2019 - 300

- from 01-04-2015 - 100

- Loss Assets - 500

Q. Out of the above information, what is the value of Standard assets?

Direction: Following are the sales figures for different months.

- Jan - 15000

- Feb - 20000

- Mar - 30000

- Apr - 20000

- May - 25000

Of the above 20% are cash sales.

50% of the customers pay in the next month and balance in the following month

Q. Find the amount of debtors realized for the month of April

For services rendered in hospitals, they use which type of cost?

In the accounting system of banks, at the end, all the vouchers related to the transactions in all the savings banks account at the branch will be entered in the _____ book.

In a manufacturing unit, The difference between sales revenue and total variable costs is known as _________.

Seperate blocked account should be shown in balance sheet under _____.

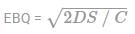

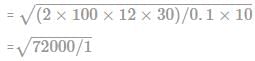

Calculate the minimum inventory holding cost from the following information

Monthly demand for a product of 100 units

Setting-up cost per batch is Rs 30

Cost of manufacturing per unit Rs 10

Rate of interest 10% p.a

Carrying cost per unit per month Rs 1

Which of the following items temporally recorded in suspense account?

At the end, all the entries related to income and expenditure should be transferred to _________.

Direction: Read the below case study carefully and answer the given questions:

ABC limited company was registered with the authorised capital of Rs 55 lakhs in the memorandum of association. The company issued 40000 equity shares of Rs.100 each payable at Rs.30 on application, Rs.30 on allotment, Rs.20 on first call, Rs.20 on final call and 36000 shares have been subscribed by the public. All the money was duly received except one member holding 100 shares who was not paid first call money. Final call was not made.

Q. If the public subscribed 42000 equity shares instead of 36000 equity shares, this indicates ____________.

Direction: Read the below case study carefully and answer the given questions:

ABC limited company was registered with the authorised capital of Rs 55 lakhs in the memorandum of association. The company issued 40000 equity shares of Rs.100 each payable at Rs.30 on application, Rs.30 on allotment, Rs.20 on first call, Rs.20 on final call and 36000 shares have been subscribed by the public. All the money was duly received except one member holding 100 shares who was not paid first call money. Final call was not made.

Q. ABC Ltd. company is one of the type of companies based on _____.

A bond, with a par value of Rs. 2,000, bears a coupon rate of 12 per cent and has a maturity period of 4 years. The required rate of return on the bond is 11 per cent. What is the value of this bond?

Costs which do not involve immediate cash payment and are not recorded in books of accounts are known as __________

The income or gain expected from the second-best use of resources lost due to the best use of the scarce resources is known as:

Direction: Read the information carefully and answer the questions based on the given informations below:

A machinery was purchased on 1-1-2013 for Rs.180000. Installation was done on 1-3-2013 and costs Rs.20000. It was put to use from 1-4-2013. The depreciation to be provided for the machinery is decided at 10% p.a in diminishing balance method.

On 31-12-2014 the machinery was sold for Rs.160000. The books were closed on 31st December every year.

Q. Under the diminishing balance method, the depreciation amount will be ______?

Direction: Read the information carefully and answer the questions based on the given informations below:

A machinery was purchased on 1-1-2013 for Rs.180000. Installation was done on 1-3-2013 and costs Rs.20000. It was put to use from 1-4-2013. The depreciation to be provided for the machinery is decided at 10% p.a in diminishing balance method.

On 31-12-2014 the machinery was sold for Rs.160000. The books were closed on 31st December every year.

Q. What will be the profit/loss will arise from selling the machinery?