Test: Standard Costing - UGC NET MCQ

10 Questions MCQ Test Crash Course for UGC NET Commerce - Test: Standard Costing

What is the primary purpose of standard costs in a cost accounting system?

What is the primary objective of using Standard Costing in a company?

Assertion (A): Standard costing is not suitable for non-standardized products in industries like catering, tailoring, and printing.

Reason (R): The nature of non-standardized products makes it difficult to determine precise standard costs that align with actual costs, leading to inconsistencies and inaccuracies in cost control.

Assertion (A): Setting up Cost Centers is a crucial step in establishing a standard cost system in a business.

Reason (R): Cost centers help in identifying responsibilities clearly and are essential for effective cost control.

What is the primary purpose of setting standard costs in a business organization?

Which of the following are the underlying assumptions of cost-volume profit (CVP) analysis?

(A) Number of units produced and sold are equal

(B) Cost inputs and the output produced are linearly related

(C) Sales price and sales mix remain constant

(D) Zero base budgeting underly costs and pricing decisions

(E) Total fixed costs and variable cost per unit are constant

Choose the correct answer from the options given below:

Assertion (A): Standard costing systems are discouraged in small industries due to the high costs associated with establishing and implementing standards.

Reason (R): Small firms find it expensive to operate a standard costing system because of the initial high costs involved in setting standards and their revisions.

Assertion (A): Standard costing systems often incorporate different types of standards, such as current standards and basic standards.

Reason (R): Current standards are typically revised at regular intervals and are related to current circumstances, while basic standards remain unchanged for an indefinite period.

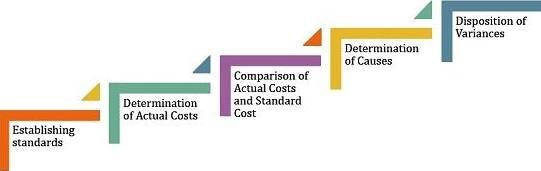

Sequence the following activities in the process of standard costing.

A. Establishing standard costs

B. Measurement of actual costs

C. Identifying variances and causes of variance

D. Disposing the variances to cost and profit centers

E. Comparision of actual and standard costs

Choose the correct answer from the options given below:

|

145 videos|236 docs|166 tests

|