Test: Trial Balance - Commerce MCQ

30 Questions MCQ Test - Test: Trial Balance

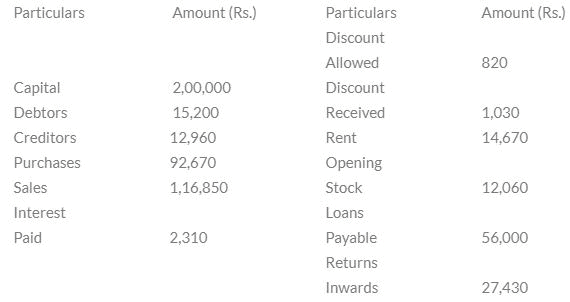

Find out the total of Debit side of the Trial Balance from the following list of balances extracted from the books of Mr. Yoshin as on 31st March, 2014.

In trial balance, which accounts with normal balance are recorded at the credit side?

Bhandari’s trial balance was showing difference of Rs. 5,000 (debit side exceeds). While checking of total sales register, he found that the total is overcast by Rs. 2,000. After correction in sales register what would be the difference in his trial balance.

Difference of totals of both debit and credit side of trial balance is transferred to :

After the preparation of ledgers, the next step is the preparation of

Which of the following is not a process in the preparation of a Trial Balance ?

The Trial Balance of M/S RAM & Co. shows closing Stock of Rs. 30,000. It will be recorded in :

Rs. 1500 received from sub-tenant for rent and entered correctly in the cash book is posted to the debit of the rent account. In the trial balance

Which of the following will not affect the agreement of Trial Balance ?

Difference of totals of both debit and credit side of trial balance is transferred to :

__________ is prepare to ascertain the arithmetical accuracy of posting and balancing

A list which contains balances of accounts to know whether the debit and credit balances are matched.

After preparing the trial balance the accountant finds that the total of debit side is short by Rs. 1,500. This difference will be

Agreement of Trial Balance is not a _______ proof of accuracy.

Opening and Closing Balance of Debtors A/c were Rs. 30,000 and 40,000 respectively cash collected from the debtors during the year was Rs. 2,40,000. Discount allowed to debtors for timely payment amounted to Rs. 15,000 and bad debts written off were Rs. 10,00. Goods sold on credit were:

Which of the following in Trial Balance is contradictory to each other? __________.