CUET Accountancy Previous Year Solved Paper 1 (20 July 2022 Slot-1) - Humanities/Arts MCQ

30 Questions MCQ Test - CUET Accountancy Previous Year Solved Paper 1 (20 July 2022 Slot-1)

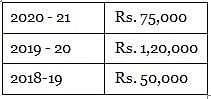

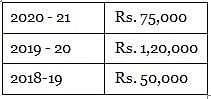

A firm earns a profit in last three years as follows:

Additional Information:

Closing stock of 2020 - 21 was undervalued by

Rs. 10,000.

Calculate the Average Profit.

Additional Information:

Closing stock of 2020 - 21 was undervalued by

Rs. 10,000.

Calculate the Average Profit.

Identify the right combination of type of Account in making Final Accounts of Partnership Firm.

A. Profit and Loss A/c

B. Profit and Loss Suspense A/c

C. Profit and Loss Appropriation A/c

D. Profit and Loss Adjustment A/c

E. Partner’s Capital A/c

Choose the correct answer from the options given below:

B. Profit and Loss Suspense A/c

C. Profit and Loss Appropriation A/c

D. Profit and Loss Adjustment A/c

E. Partner’s Capital A/c

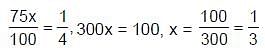

Interest on drawings of a partner has been calculated Rs. 3,000 @ 8% p.a. who has drawn equal amount in each quarter; commencing from end of the first quarter throughout the year. The amount of drawing of partner per quarter would be:

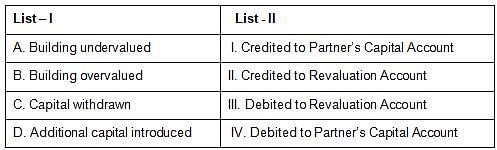

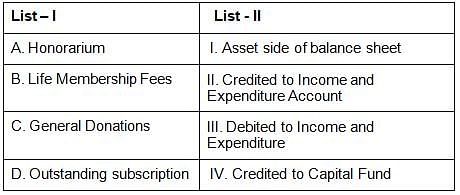

Match List - I with List - II.

Choose the correct answer from the options given below:

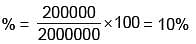

If average capital employed in a firm is Rs. 15,00,000 and fair rate of return in the same industry was 8%. Goodwill was valued at Rs. 90,000 on the basis of three times of super profit. The Average Profit of the firm is?

business studiesA and B are partners sharing profits in the ratio of 5 : 4. C is admitted as a partner and he acquires 25% of his share from A. B surrenders 1/4th from his share in favour of C. Calculate C’s share in profit.

From the following information, identify when goodwill is required to be calculated.

A. Admission of a Partner

B. Amalgamation of partnership firms

C. Dissolution of partnership firm

D. Retirement and Death of any partner

E. Preparation of Balance sheet

Choose the correct answer from the options given below:

At the time of admission of a partner, if nothing is specified then new partner acquires his share from old partners.

Identify the statement that is/are not true from the following.

A. Shares can be forfeited for non payment of call money.

B. The profit on forfeited shares is transferred to capital reserve.

C. Balance of share forfeiture account is shown is the balance sheet under reserves and surplus.

D. Application money should be at least 10% of the face value of the share.

Choose the correct answer from the options given below:

PQR Ltd. issued 40,000 Equity shares of Rs. 10 each at par payable Rs. 3 on application, Rs. 4 on allotment and balance on first and final call. Application were received for 1,10,000 shares. Applications for 20,000 shares were refused and allotment was made prorate to remaining applicants. Amount received on allotment is:

Arrange the following steps as per the procedure of issue of shares:

A. Receipt of applications

B. Allotment of shares

C. Reissue of forfeited shares

D. Issue of prospectus

E. Forfeiture of shares

Choose the correct answer from the options given below:

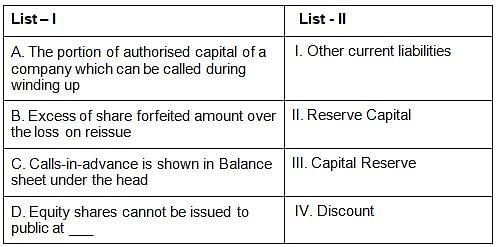

Match List - I with List - II.

Choose the correct answer from the options given below:

MNO Ltd. forfeited 1,000 shares of Rs. 10 each on which shareholders had paid only application money of Rs. 3 per share. Out of these, 400 equity shares were reissued as fully paid for Rs. 9 per share. The gain on reissue of shares transferred to Capital reserve is:

Identify the items NOT be shown under Investing Activities while making Cash Flow statement.

A. Proposed Dividend

B. Purchase of non-current Investments

C. Interest paid on long term borrowings

D. Sale of machinery

E. Marketable securities

Choose the most appropriate answer from the options given below:

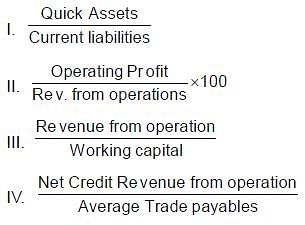

Match List- I with List- II.

List - I

A. Working Capital Turnover Ratio

B. Acid Test Ratio

C. Operating Profit Ratio

D. Trade Payables Turnover Ratio

List - II

Choose the correct answer from the options given below:

Calculate Current Ratio from the following given information.

Liquid Ratio 0.75 : 1

Current Liabilities Rs. 1,80,000

Prepaid Expenses Rs. 20,000

Inventory Rs. 47,250

Payment made for stationary during the year 2021 - 22 is Rs. 46,000.

Stock of stationary as on 1-4-2021 Rs. 8,000

Stock of stationary as on 31-3-2022 Rs. 6,000

Advance for stationary as on 1-4-2021 Rs. 18,000

Advance for stationary as on 31-3-2022 Rs. 5,000

What will be the amount of stationary consumed during the year 2021-22?

The closing balance of Receipts and Payments Account depicts _______.

Income and Expenditure Account is prepared on (A) _______ basis, while Receipts and Payments Account is prepared on (B) ______ basis.

Match List - I with List - II.

Choose the correct answer from the options given below:

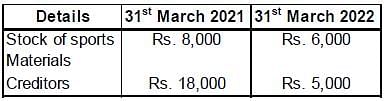

The Receipts and Payments Account of Lead Sports Club showed payment for sports materials as Rs. 46,000 for the year ended 31st March 2022. Additional Information provided is as follows:

Calculate the amount of Sports Materials consumed during the year ended 31st March 2022.

A, B and C were partners sharing profits and losses in the ratio of 3 : 2 : 1. C died on 1st August, 2022 and his share of profit from the beginning of the accounting year upto the date of death amounted to Rs. 70,000. C’s share of profit will be debited to:

At the time of retirement of a Partner if retiring Partner’s whole amount is treated as loan, then the total amount is Debited is:

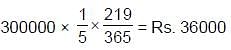

Monu, Sonu and Golu are partners in a firm sharing profits in the ratio of 2 : 2 : 1. Golu died on 5th November 2021. Under the partnership deed, the executors of the deceased partner are entitled to his share of profit to the date of death, calculated on the basis of last year’s profit. Profit for the year ended 31st March 2022 was Rs. 3,00,000. Golu’s share of profit will be:

On the death of a partner, his share in the loss of the firm till the date of his death is transferred to:

In the balance sheet Total Debtor s appear at Rs. 1,50,000 and provision for doubtful debts appear at Rs. 1,500. How much amount will be realised from debtors, if bad debts amounted to Rs. 20,000 and remaining debtors realised at a discount of 15%?

A firm may not be dissolv ed by court in the following condition:

On the dissolution of the partnership firm the amount realised from sale of assets shall be applied in following order.

A. Distributing the amount left among the partners in their profit sharing ratio

B. Paying amount due to partner on account of loan advanced by him

C. Paying am ount due to the creditors

D. Paying partner’s capital account balances

Choose the correct answer from the options given below:

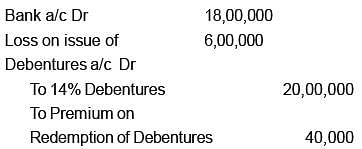

The following journal entry is recorded in the books of RST Ltd. on issue of debentures:

Debentures have been issued at a discount of:

If a share of Rs. 100 on which Rs. 45 has been paid is forfeited at what minimum price can it be reissued: