CUET Accountancy Previous Year Solved Paper 2 (18 August 2022 Slot-1) - Humanities/Arts MCQ

30 Questions MCQ Test - CUET Accountancy Previous Year Solved Paper 2 (18 August 2022 Slot-1)

There are 50 members in a Rotary Club, which provide medical services to people. Each member pays Rs. 1,000 as subscription. During financial year 2021-22, 10 members paid only Rs. 7,000 out of total subscription, 5 members paid subscription, for financial year 2020-21. 2 members left the organisation without any payment. Amount credited to Income and Expenditure Account will be:

Amount received as per the will of a deceased personis termed as:

Shikha Ltd. invited application for 30,000 shares of Rs. 10 each and received 50,000 applications. Which of the following alternative can be followed?

A. Refund the excess money and full allotment to rest of the applicants

B. Reject few applications, allot full shares to some applicants and allot shares on prorate basis to remaining.

C. Not all allot shares to some applicants and make prorate allotment to other applicants

D. Make prorate allotment to all applicants

Choose the correct answer from the options given below:

B. Reject few applications, allot full shares to some applicants and allot shares on prorate basis to remaining.

C. Not all allot shares to some applicants and make prorate allotment to other applicants

D. Make prorate allotment to all applicants

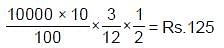

Devarth withdraws Rs. 5,000 at the end of each quarter for six months. Interest on drawing is charged @10% p.a. Interest on drawings will be:

Honorarium paid for guest lecture by a Not for Profit organisation is shown in:

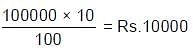

A company issues 1,000 9% debentures of Rs. 100 each at a premium of 5% and redeemable at a premium of 10%. The amount of loss on issue of Debentures account will be:

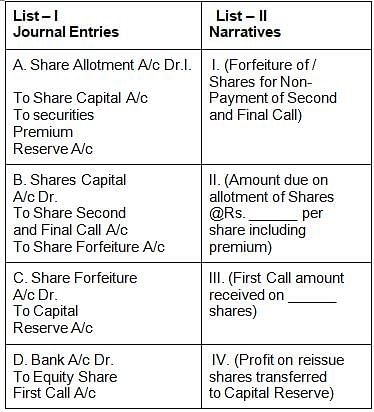

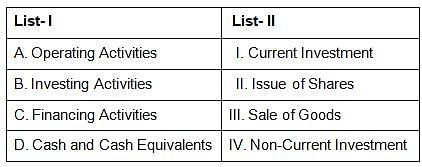

Match List I with List II.

Choose the correct answer from the options given below:

Funds raised from Not-for-Profit organisation through various sources are credited to:

P and T partners sharing profits and losses in the ratio of 3 : 2. They admitted R for 1/5th share. General Reserve appeared in the books at Rs. 45,000. New profit sharing ratio among partners is 5 : 3 : 2. General Reserve will be treated follows:

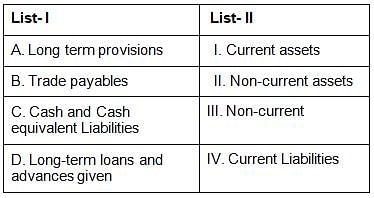

Match List- I with List- II.

Choose the correct answer from the options given below:

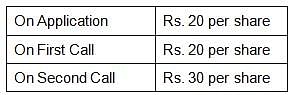

Reena Ltd. issued a prospectus inviting applications for 3000 shares of Rs. 100 each at a premium of Rs. 20 payable as follows:

Radha to whom 360 shares were allotted, failed to pay Allotment Money and Call Money and her shares were forfeited. Amount of Securities Premium Reserve in Balance Sheet will be:

Out of subscribed Capital of Company, 200 Equity Shares of Rs. 100 each were forfeited for nonpayment of the Final Call of Rs. 30 per share. Out of these, 150 shares were reissued at Rs. 60 per share. Amount to be transferred to Capital Reserve will be:

Which of the following is correct about Financial Analysis?

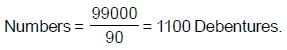

TL Ltd. purchased assets of the book value of Rs. 99,000 from another firm. Purchase consideration was to be paid by issuing 11% Debentures of Rs. 100 each, at a discount of 10%. Number of Debentures company needs to issue will be:

Opening Stock (+) Purchase (–) Closing Stock formula applies to the following while calculating consumptions:

A. Machinery

B. Stationery

C. Furniture

D. Sports Equipment

E. Medicine

Choose the correct answer from the options given below:

Match List- I with List- II.

Choose the correct answer from the options given below:

On dissolution of a firm, stock was appearing in the balance sheet Rs. 1,00,000. Part of the stock was taken once by a partner at 10% discount at Rs. 49,500 and balance sold at a profit of 20%. How much amount will be credited to Realisation A/c?

W Ltd. has given you the following information:

Machinery as on April 1, 2020 - Rs. 50,000

Machinery as on March 31, 2021 - Rs. 60,000

Accumulated Depreciation on April 01, 2020 - Rs. 25,000

Accumulated Depreciation on March 31, 2021 - Rs. 15,000

During the year, a machine, costing Rs. 25,000 with accumulated depreciation of Rs. 15,000 was sold for Rs. 13,000. Cash flow from Investing Activities will be:

Which one from the following can be called cash equivalents:

M, N and R are partners sharing Profit and Losses in the Ratio of 3 : 3 : 2. They decided to change their ratio equally. On that date goodwill appearing in the Balance Sheet was Rs. 2,40,000. Journal Entry will be passed as _____

On dissolution of a firm, bank overdraft is transferred to:

Unrecorded liabilities when paid are shown in:

On Dissolution of the firm, Partner’s Capital accounts are closed through:

Which of the following options given below are correct?

A. A balancing figure on credit side of Income and Expenditure Account denotes excess of

expenses over incomes.

B. Surplus of Income and Expenditure Account is deducted from the Capital/General Fund.

C. Receipts and Payments Account is equivalent to Profit and Loss Account.

D. Receipts and Payments Account records the receipts and payments of revenue nature only

E. Receipts and Payments Account does not differentiate between capital and revenue receipts

Choose the correct answer from the options givenbelow:

Which of the following options given below are correct?

A. If there appears a sports fund, the expenses incurred on sports activities will be shown on the debit side of Income and Expenditure Account.

B. Donations for specific purposes are always capitalized.

C. Scholarships granted to students out of funds provided by Government will be debited to Income

and Expenditure Account.

D. Opening balance sheet is prepared when the opening balance of capital fund is not given.

E. If donations received is to be utilised to achieve specified, it is called Specific Donations.

Choose the correct answer from the options given below:

On Dissolution of a firm Investment fluctuation reserve appearing in the balance sheet will be:

On the admission of a new partner increase in the value of assets is debited to:

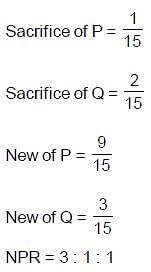

P and Q are partners sharing profit in 2 : 1 ratio. They admitted R into partnership giving him 1/5 share which he acquired from P and Q in 2 : 1 ratio. New Profit Sharing Ratio will be:

In the absence of any information regarding the acquisition of share in Profit of the retiring/decreased partner by the remaining Partner, it is assumed that they will acquire his/her share in:

The old profit sharing ratio among Rajender, Satish, Tejpal were 2 : 2 : 1. The new Profit Sharing Ratio after Satish’s retirement is 3 : 2. The gaining ratio is:

is book value in Rs. 49500

is book value in Rs. 49500