CUET Accountancy Previous Year Solved Paper 3 (23 August 2022 Slot-2) - Humanities/Arts MCQ

30 Questions MCQ Test - CUET Accountancy Previous Year Solved Paper 3 (23 August 2022 Slot-2)

On dissolution of a firm, bank overdraft is transferred to:

Rearrange the following items in a sequence while preparing common size statement.

A. Calculate percentage of the total as per common base

B. Prepare the format of Balance sheet and Profit and Loss A/c

C. List out absolute figures in rupees at two points of time

D. Choose a common base

Choose the correct answer from the options given below:

B. Prepare the format of Balance sheet and Profit and Loss A/c

C. List out absolute figures in rupees at two points of time

D. Choose a common base

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

All of them are shown under the sub-heading ‘Reserve and Surplus’ except:

As issue of shares made by the company to the public in general for subscription is called:

Forfeiture of shares results in the reduction of:

Which of the following is not included in Non-current liabilities, while preparing a Balance Sheet of a company:

Which among the following are sources of cash inflow from Investing Activities?

A. Dividend Received from investment

B. Cash Receipt from Disposal of shares

C. Cash Receipt from Disposal of Fixed Assets

D. Cash proceeds from issuing Shares and Debentures

Choose the correct answer from the options given below:

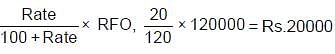

If there is Revenue from Operation Rs. 1,20,000 and gross profit is 20% of cost, then the amount of gross profit will be:

The ideal Debt Equity Ratio is:

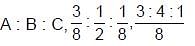

A, B and C are partner’s sharing profits and losses in the ratio of  If A dies, then the new ratio

If A dies, then the new ratio

of B and C will be:

Which among the following items appear in the Receipt and Payment Account?

A. Life membership fees

B. Depreciation of fixed assets

C. Provision of doubtful debts

D. Profit/loss on sale of fixed assets

Choose the correct answer from the options given below:

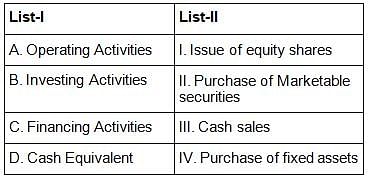

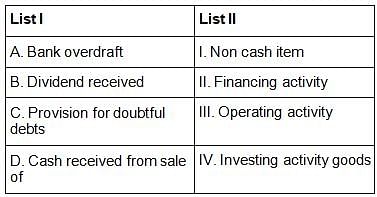

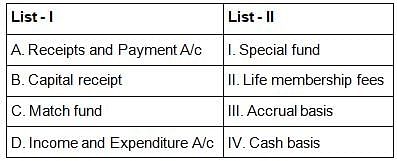

Match List-I with List-II.

Choose the correct answer from the options given below:

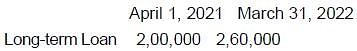

From the following information of X Ltd, calculate Cash Flow from Financing Activities.

During the year, the company repaid a loan of Rs. 1,00,000. Long-term loan carried interest rate of 10%. The loan was repaid on 1st April 2021 and a fresh loan was taken on 31st March 2022.

Securities Premium Reserve as per section 52(2) of the companies Act 2013 can be used:

A. To write-off preliminary expenses of the company

B. To issue fully paid bonus shares to the extent not exceeding unissued share capital of the company

C. To pay premium on the redemption of preference shares or debentures

D. To write off discount allowed on the goods sold on credit

Choose the correct answer from the options given below:

Uncalled capital that can be called up only in event of winding up of the company is called:

For calculating EPS, the following order will be followed.

A. Calculate number of equity shares

B. Calculate earning available for equity share holders

C. Compute profit after tax

D. Compute EPS

Choose the correct answer from the options given below:

On 1st April 2022, A, B and C decided to dissolve their firm On the date of dissolution, Sundry debtors appeared in Balance Sheet at Rs. 6,00,000 and Provision for doubtful debt at Rs. 30,000 Debtors to extent of Rs. 60,000 were bad. In journal entry for realisation of debtors.

Match List I with List II.

Choose the correct answer from the options given below:

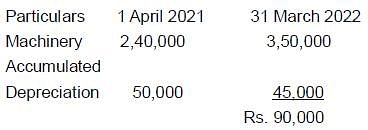

Nitin Ltd. provides you the following information.

During the year, a machine costing Rs. 90,000 with accumulated depreciation of Rs. 31,500 was sold for Rs. 52,000.

Calculate Cash Flow from Investing Activities on the basis of the above information.

Identify the correct sequence in calculation of Cash Flow from Operating Activities.

A. Addition and subtraction of Non cash/Non operating items

B. Payment of income tax

C. Calculation of operating profit before working capital changes.

D. Calculation of net profit/loss before tax and extraordinary items

Choose the correct answer from the options given below:

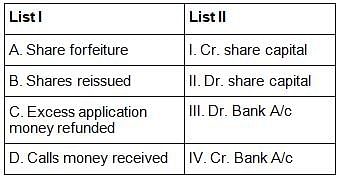

Match List I with List II.

Choose the correct answer from the options given below:

If a share of Rs. 10 on which Rs. 7 has been paid is forfeited, at what minimum price can it be reissued?

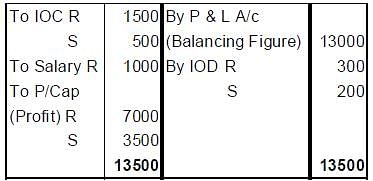

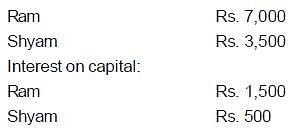

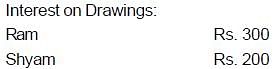

Calculate net profit as per P & L A/c for the year ending 31 March, 2022 from the following information: share of profit transferred to Capital A/c’s of partners:

Ram’s salary Rs. 1,000

M and R are partners sharing profits and losses in the ratio of 3 : 2. Their capital A/c’s showed the balance of Rs. 4,00,000 and Rs. 3,00,000 respectively on 1 April, 2021. M introduced additional capital on 1 August, 2021. Interest on capital is allowed @ 6% p.a. Total interest on capital of both the partners is Rs. 50,000.

Calculate additional capital introduced by M on August, 2021 and interest on capital earned on additional capital. Books are closed on 31 March.

Match List - I with List - II.

Choose the correct answer from the options given below:

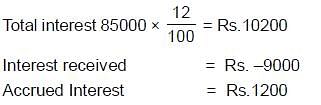

Value of 12% government securities as at 31 March 2021 was Rs. 85,000 which were purchased at the date at par. Additional 12% securities worth Rs. 50,000 were purchased on 31 March, 2022. Total interest debited to receipts and payment A/c during the year on the above securities is Rs. 9,000 calculate Accrued interest on 31 March, 2022.

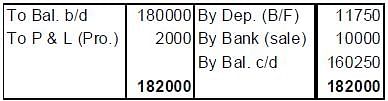

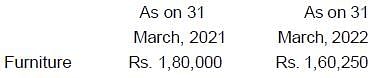

From the following information calculate how much amount of depreciation will be shown in the Income and Expenditure A/c for the year 2021-22:

Furniture worth Rs. 8,000 was sold for Rs. 10,000on 1 April, 2021.

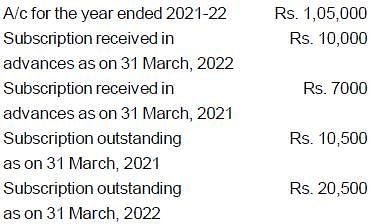

Calculate subscription received during the year 2021-22 from the following information:

Amount of subscription credited to Income and Expenditure

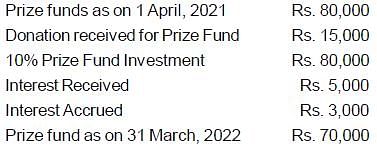

Calculate prize fund expenses incurred during the year 2021-22 from the following information

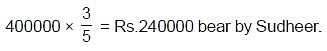

Sudhir and Vimal came into partnership with profit sharing ratio of 3 : 2. Due to paucity of time, Sudhir was unable to given time to business so Vimal acted as principle and took all financial and operational decisions.

Due to break down of Covid 19, business suffered a loss of 4,00,000. State the amount of loss to be borne by Sudhir.