TS SET Paper 2 Mock Test - 3 (Commerce) - TS TET MCQ

30 Questions MCQ Test TS SET Mock Test Series 2024 - TS SET Paper 2 Mock Test - 3 (Commerce)

"The life expectancy of people in Kerala is more than that of Tamil Nadu." This statement is an example of:

Which of the given combinations of the following factors influence the working capital requirement?

I. Market conditions

II. Production policy

III. Firm's goodwill

IV. Supply conditions

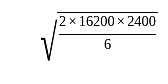

A manufacturing enterprise monthly consumes 1,350 units of raw material at the cost of Rs. 20 per unit. Determine its economic order quantity given the ordering cost of Rs. 2,400 and carrying cost of inventory being 30 percent of the price paid.

Which of the following can be inferred from below statement?

‘Given the complexity of the legacy taxes that GST subsumed and replaced and the teething troubles of operating a new tax system, ensuring optimal outcomes has proved an abiding challenge’?

Why has the GST legislation and its successful implementation become a challenge?

Identify the correct statement from the following.

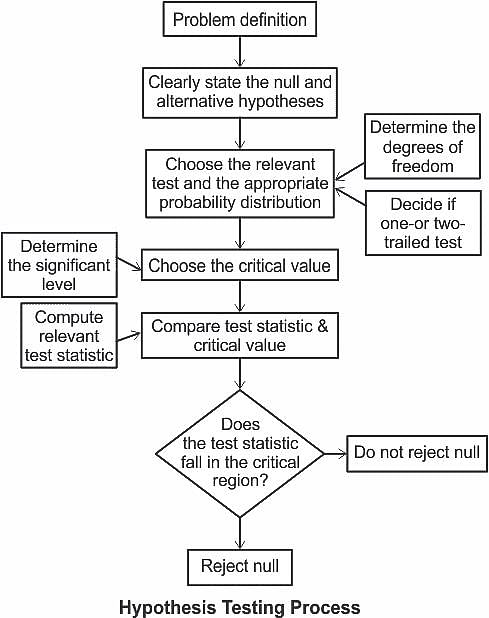

Which one among the following statement is true in the context of the testing of hypothesis ?

Which of the following relationship is true?

Assertion (A): Weighted average cost of capital should be used as a hurdle rate for accepting or rejecting a capital budgeting proposal.

Reason (R): It is because by financing in the proportions specified and accepting the project, yielding more than the weighted average required return, the firm is able to increase the market price of its stock.

Anil retired from XYZ Ltd. after 28 years of service and received a gratuity of Rs.12 lakh. His last drawn salary (basic + DA) was Rs. 1,00,000 per month. If Anil is not covered by the Payment of Gratuity Act, 1972, the exemption under sec 10(10) in respect of gratuity is:

Which of the following function is performed by the National Financial Reporting Authority (NFRA), established under the Companies Act, 2013?

Which of the following will be charged to GST?

(I) Electricity

(II) Sale of Property

(III) Petrol

(IV) Alcohol liquor for human consumption

Under the provisions of the Industries (Development and Regulation) Act, 1951, a license is necessary for:

Which of the following does NOT come under the purview of 'paper taxes'?

A _________ letter of credit is a type of financial guarantee, known as a letter of credit.

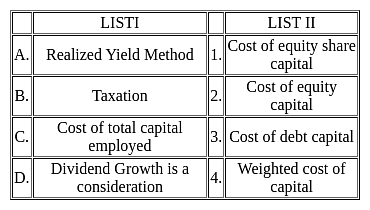

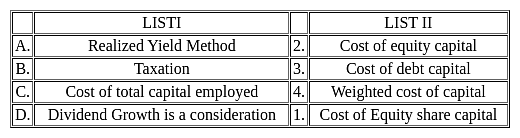

Match the given lists and select the correct code for the answer.

Financial management is concerned with the:

Budgetary control helps in the implementation of:

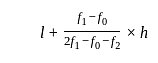

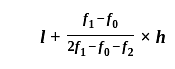

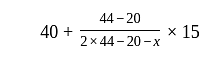

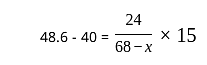

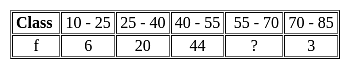

If the mode of the above distribution is 48.6, then the missing frequency will be

The explicit cost is the ________, which equates the present value of cash inflows with the present value of cash outflows.

|

60 tests

|