TS SET Paper 2 Mock Test - 9 (Commerce) - TS TET MCQ

30 Questions MCQ Test TS SET Mock Test Series 2024 - TS SET Paper 2 Mock Test - 9 (Commerce)

Indicate the code for proper sequencing for the process of venture capital financing from the following :

(i) Deal origination

(ii) Due diligence

(iii) Screening

(iv) Deal structuring

(v) Exit plan

Choose the correct answer from the code given below:

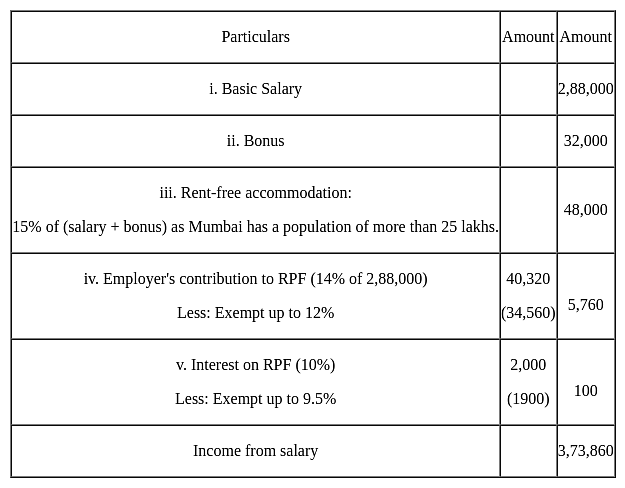

An individual received a salary of Rs. 2,88,000 and bonus of Rs. 32,000. He contributed 15% of the salary to RPF to which his employer contributed 14 percent. He is provided with a rent-free house in Mumbai. The interest credited to his RPF is Rs. 2,000 @ 10% per annum. His income from salary for the A.Y. 2015-16 will be:

Identify the principles of trade policy framework from the followings under the WTO:

(A) Reciprocity and transparent

(B) Benefactory and resilient

(C) Non-discriminatory

(D) Binding and enforceable commitments

(E) Protective and benevolent

Choose the correct answer from the options given below:

How are the following items arranged on the liability side of the Balance Sheet of a Company?

(i) Current liability and provisions

(ii) Secured loans

(iii) Share capital

(iv) Unsecured loans

(v) Reserve and surplus

Following are the information for a House Property:

Municipal value Rs. 4,50,000

Fair rental value Rs. 5,00,000

Standard rent Rs. 4,80,000

Actual rent Rs. 4,90,000

What is the Gross Annual Value of the House Property?

With reference to social accounting, which of the following is correct?

The risk associated with the use of fixed cost securities is called:

The accounting principle that states companies and owners should be accounted for separately is:

Given below are two statements.

Statement I: GST is the destination-based tax on the consumption of goods and services.

Statement II: 'I' stands for integrated in IGST.

In light of the above statements, choose the correct answer from the options given below:

Match the following theories of international trade in List-I with their propounders in List-II:

A product line strategy is where a company adds a higher priced product to a line in order to attract a broader market, which helps the sale of its existing lower priced products. This strategy is called:

For the purpose of extending rural banking and agro finance, the NABARD :

Which of the following items are included in the negative list of imports?

1. Canalised items

2. Banned items

3. Restricted items

4. Items of the open general license

What is the rate of the consumer price inflation for the first half of the current fiscal year?

What is the minimum amount of the securities purchases through GSAP in the first quarter of the current fiscal year?

The budgets are classified on the basis of:

When a partnership dissolves, the balance of a partner's capital account on the assets side of a balance sheet is transferred to:

|

60 tests

|