Test: Depreciation Accounting - 2 - Commerce MCQ

25 Questions MCQ Test Accountancy Class 11 - Test: Depreciation Accounting - 2

A company purchased a vehicle for $6000. I will be used for 5 years and its residual value is expected to be $1000. What is the annual amount of deprecation using straight line method of depreciation?

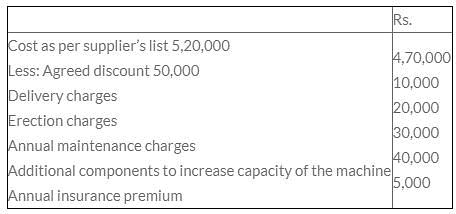

In the year 2004-2005, C Ltd. purchased a new machine and made the following payments in relation to it:

If depreciation is provided @ 10%p.a. WDV, depreciation for 3rd year is

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Glass, Cutlery etc.: Balance on 01.01.2004 is Rs. 28,000. Glass, Cutlery, etc. purchased during the year Rs. 16,000. Depreciation is to be charged on the above assets as follows- 1/5th of their values is to be written off in the year of purchase and 2/5th in each of the next 2 years. Of the stock of Glass, Cutlery, etc. as on 01.01.2004, ½ was one year old and ½ was 2 years old. Purchases are made on 1st January. Closing Balance in Glass, Cutlery A/c = _________.

On 01.01.2001, a new plant was purchased by Mrs. Shweta Periwal for Rs. 1,00,000 and a further sum of Rs. 5,000 was spent on installation. On 01.06.2002, another plant was acquired for Rs. 65,000. On 02.01.2003, the first plant was totally destroyed and the amount of Rs. 2,500 only was realized by selling the scraps. It was not insured. On 20.10.2003, a second hand plant was purchased for Rs. 75,000 and a further sum of Rs. 7,500 was spent for repairs and Rs. 2,500 on its erection. It came into use on 15.11.2003. Depreciation has been provided @ 10% on the original cost annually on 31st December. It was the practice to provide depreciation for full year on all acquisitions made at any time during the year and to ignore the depreciation on any time sold during the year. In December 2003, it is decided to change the method of depreciation and to follow the rate of 15% on diminishing balance method with retrospective effect in respect of the existing items of plant and to make necessary adjustments on 31.12.2003.

Closing balance in Plant A/c = __________.

A new machine costing Rs. 1 lakh was purchased by a company to manufacture a special product. Its useful life is estimated to be 5 years and scarp value at Rs. 10,000. The production plan for the next 5 years using the above machine is as follows :

The depreciation expenditure for the 2nd year under units of production method will be

H Ltd. purchased a machinery on April 01, 2000 for Rs. 3,00,000. It is estimated that the machinery will have a useful life of 5 years after which it will have no salvage value. If the company follows sum-of-the –years’-digits method of depreciation, the amount of depreciation charged during the year 2004-05 was

On October 1, 2007 two machines costing Rs. 20,000 and Rs. 15,000 respectively, were purchased.

On March 31, 2011, both the machines had to be discarded because of damage and had to be replaced by two machines costing Rs. 25,000 and Rs. 20,000 respectively.

One of the discarded machines was sold for Rs.10,000 and against the other it was expected that Rs.5,000 would be realized. The firm provides depreciation @ 15% on written down value method.

Depreciation for the 2009-010 year =

Consider the following information:

I. Rate of depreciation under the written down method = 20%.

II. Original cost of the asset = Rs. 1,00,000.

III. Residual value of the asset at the end of useful life = Rs. 40,960.

The estimated useful life of the asset, in years, is

In the books of D Ltd. the machinery account shows a debit balance of Rs. 60,000 as on April 1,2010. The machinery was sold on September 30, 2011 for Rs. 30,000. The company charges depreciation @ 20% p.a. on diminishing balance method.

Depreciation for 2011-12 =

On 01.01.2001, a new plant was purchased by Mrs. Shweta Periwal for Rs. 1,00,000 and a further sum of R.s 5,000 was spent on installation. On 01.06.2002, another plant was acquired for Rs. 65,000. On 02.01.2003, the first plant was totally destroyed and the amount of Rs. 2,500 only was realized by selling the scraps. It was not insured. On 20.10.2003, a second hand plant was purchased for Rs. 75,000 and a further sum of Rs. 7,500 was spent for repairs and Rs. 2,500 on its erection. It came into use on 15.11.2003. Depreciation has been provided @ 10% on the original cost annually on 31st December. It was the practice to provide depreciation for full year on all acquisitions made at any time during the year and to ignore the depreciation on any time sold during the year. In December 2003, it is decided to change the method of depreciation and to follow the rate of 15% on diminishing balance method with retrospective effect in respect of the existing items of plant and to make necessary adjustments on 31.12.2003.

Closing balance in Provision for Depreciation A/c = ___________

On 01.01.2001, a new plant was purchased by Mrs. Shweta Periwal for Rs. 1,00,000 and a further sum of R.s 5,000 was spent on installation. On 01.06.2002, another plant was acquired for Rs. 65,000. On 02.01.2003, the first plant was totally destroyed and the amount of Rs. 2,500 only was realized by selling the scraps. It was not insured. On 20.10.2003, a second hand plant was purchased for Rs. 75,000 and a further sum of Rs. 7,500 was spent for repairs and Rs. 2,500 on its erection. It came into use on 15.11.2003. Depreciation has been provided @ 10% on the original cost annually on 31st December. It was the practice to provide depreciation for full year on all acquisitions made at any time during the year and to ignore the depreciation on any time sold during the year. In December 2003, it is decided to change the method of depreciation and to follow the rate of 15% on diminishing balance method with retrospective effect in respect of the existing items of plant and to make necessary adjustments on 31.12.2003.

Depreciation over / under charged = __________.

Glass, Cutlery etc.: Balance on 01.01.2004 is Rs. 28,000. Glass, Cutlery, etc. purchased during the year Rs. 16,000. Depreciation is to be charged on the above assets as follows- 1/5th of their values is to be written off in the year of purchase and 2/5th in each of the next 2 years. Of the stock of Glass, Cutlery, etc. as on 01.01.2004, ½ was one year old and ½ was 2 years old. Purchases are made on 1st January.

Closing Balance in Glass, Cutlery A/c = _________.

In the books of D Ltd. the machinery account shows a debit balance of Rs. 60,000 as on April 1,2010. The machinery was sold on September 30, 2011 for Rs. 30,000. The company charges depreciation @ 20% p.a. on diminishing balance method.Depreciation for 2011-12 =

In the year 2004-2005, C Ltd. purchased a new machine and made the following payments in relation to it:

The cost of the machine is

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs. 5,67,000. The machine was purchased on April 01,2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01,2004, the company acquired a new machine at a cost of Rs. 60,000 and incurred Rs. 6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same. The company decided to made necessary adjustment in respect of depreciation due to the change in the method in the yea 2004-2005.

The balance outstanding to the debit of machinery account as on March 31, 2005 after effecting the above changes was

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs. 5,67,000. The machine was purchased on April 01,2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01,2004, the company acquired a new machine at a cost of Rs. 60,000 and incurred Rs. 6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same. The company decided to made necessary adjustment in respect of depreciation due to the change in the method in the yea 2004-2005.

Depreciation provided in 2002-03 = _________.

Which one of the following most closely defines 'Amortization'?

On April 01, 2004 the debit balance of the machinery account of A Ltd. was Rs. 5,67,000. The machine was purchased on April 01,2002. The company charged depreciation at the rate of 10% per annum under diminishing balance method. On October 01,2004, the company acquired a new machine at a cost of Rs. 60,000 and incurred Rs. 6,000 for installation of the new machine. The company decided to change the system of providing depreciation from the diminishing balance method to the straight line method with retrospective effect from April 01, 2002. The rate of depreciation will remain the same. The company decided to made necessary adjustment in respect of depreciation due to the change in the method in the yea 2004-2005.Depreciation under new method for 2002-03 and 2003-04 = ______.

In case of reducing balance method of charging depreciation, depreciation is charged on the:

The balance in the accumulated provision for depreciation account of a company as at the beginning of the year 2010-11 was Rs. 2,00,000 when the original cost of the assets amounted to Rs. 10,00,000. The company charges 10% depreciation on a straight line basis for all the assets including those which have been either purchased or sold during the year. One such asset costing Rs. 5,00,000 with accumulated depreciation as at the beginning of the year of Rs. 1,00,000 was disposed off during the year.The balance of the accumulated depreciation account at the end of the year considering the current year’s depreciation charge would be

Depreciation is to be calculated from the date of:

B Ltd. has been charging depreciation on the straight line method. It charges a full year depreciation even if the machinery is utilized only for part of the year. An equipment which was purchased for Rs. 3,50,000 now stands at Rs. 2,97,500 after depreciating at the rate of 5% on a straight line basis. Now the company decides to change the method of depreciation with retrospective effect. The applicable reducing balance rate for this machinery would be 8% p.a. Assuming that before the effect of this change could be accounted, depreciation for the current year is already charged based on straight line method and is reflected in depreciated value of Rs. 2,97,500.

Number of years for which depreciation has been charged on this basis is

A machine was bought at a cost of Rs. 5 lacs on 1.1.02. During its life of 10 years, it will be depreciated on SLM basis. On 31.12.08, the machine was sold for Rs. 50,000. Find out the profit/loss?

A company purchased a machine on 1/4/00 at Rs. 3,10,000. Its working life is estimated to be 15 years and the residual value is estimated as Rs. 10,000. The company charged depreciation on straight line basis till 31/3/10. On 1/4/10, the technology expert recommend that the asset may be used for another 10 years. Residual value of the machine remains unchanged. What would be the amount of annual depreciation from the accounting year 2010-11 following the relevant accounting standard:

Which method of depreciation is effective if repairs and maintenance cost of an asset increases as it grows old:

|

64 videos|152 docs|35 tests

|

|

64 videos|152 docs|35 tests

|