Test: Depreciation Accounting - 4 - SSC CGL MCQ

30 Questions MCQ Test SSC CGL Tier 2 - Study Material, Online Tests, Previous Year - Test: Depreciation Accounting - 4

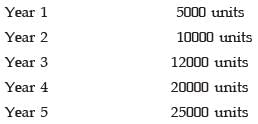

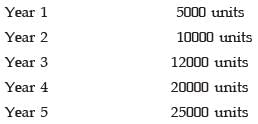

A new machine costing Rs.1 lakh was purchased by a company to manufacture a special product. Its useful life is estimated to be 5 years and scrap value at Rs.10000. The production plan for the next 5 years using the above machine is as follows:

Q.The depreciation expenditure for the 2nd year under units-of-production method will be

A new machine costing Rs.1 lakh was purchased by a company to manufacture a special product. Its useful life is estimated to be 5 years and scrap value at Rs.10000. The production plan for the next 5 years using the above machine is as follows:

Q.The depreciation expenditure for the 3rd year under units-of-production method will be

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

A new machine costing Rs.1 lakh was purchased by a company to manufacture a special product. Its useful life is estimated to be 5 years and scrap value at Rs.10000. The production plan for the next 5 years using the above machine is as follows:

Q.The depreciation expenditure for the 4th year under units-of-production method will be

A new machine costing Rs.1 lakh was purchased by a company to manufacture a special product. Its useful life is estimated to be 5 years and scrap value at Rs.10000. The production plan for the next 5 years using the above machine is as follows:

Q.The depreciation expenditure for the 5th year under units-of-production method will be

Consider the following information:

I. Rate of depreciation under the written down method = 20%.

II. Original cost of the asset = Rs.1,00,000.

III. Residual value of the asset at the end of useful life = Rs.40,960.

Q.The estimated useful life of the asset, in years, is

Consider the following information:

I. Rate of depreciation under the written down method = 20%.

II. Original cost of the asset = Rs.1,00,000.

III. Residual value of the asset at the end of useful life = Rs.40,960.

Q.Depreciation for 1st year =

Consider the following information:

I. Rate of depreciation under the written down method = 20%.

II. Original cost of the asset = Rs.1,00,000.

III. Residual value of the asset at the end of useful life = Rs.40,960.

Q.Depreciation for 2nd year =

Consider the following information:

I. Rate of depreciation under the written down method = 20%.

II. Original cost of the asset = Rs.1,00,000.

III. Residual value of the asset at the end of useful life = Rs.40,960.

Q.Depreciation for 3rd year =

Consider the following information:

I. Rate of depreciation under the written down method = 20%.

II. Original cost of the asset = Rs.1,00,000.

III. Residual value of the asset at the end of useful life = Rs.40,960.

Q.Depreciation for 4th year =

On October 1, 2001 two machines costing Rs.20,000 and Rs.15,000 respectively, were purchased.

On March 31, 2005, both the machines had to be discarded because of damage and had to be replaced by two machines costing Rs.25,000 and Rs.20,000 respectively.

One of the discarded machine was sold for Rs.10,000 and against the other it was expected that Rs.5,000 would be realized. The firm provides depreciation @15% on written down value

Q.Depreciation for the 2003-04 year =

On October 1, 2001 two machines costing Rs.20,000 and Rs.15,000 respectively, were purchased.

On March 31, 2005, both the machines had to be discarded because of damage and had to be replaced by two machines costing Rs.25,000 and Rs.20,000 respectively.

One of the discarded machine was sold for Rs.10,000 and against the other it was expected that Rs.5,000 would be realized. The firm provides depreciation @15% on written down value

Q.The total amount of depreciation written off on the two machines till they were discarded is

In the books of D Ltd. the machinery account shows a debit balance of Rs.60,000 as on April 1,2003.The machinery was sold on September 30,2004 for Rs.30,000. The company charges depreciation @20% p.a. on diminishing balance method.

Q.Depreciation for 2003-04 =

In the books of D Ltd. the machinery account shows a debit balance of Rs.60,000 as on April 1,2003.The machinery was sold on September 30,2004 for Rs.30,000. The company charges depreciation @20% p.a. on diminishing balance method.

Q.Depreciation for 2004-05 =

In the books of D Ltd. the machinery account shows a debit balance of Rs.60,000 as on April 1,2003.The machinery was sold on September 30,2004 for Rs.30,000. The company charges depreciation @20% p.a. on diminishing balance method.

Q.Profit / Loss on sale =

Consider the following data pertaining to M/s. E Ltd. who constructed a cinema house:

H Ltd. purchased a machinery on April 01, 2000 for Rs.3,00,000. It is estimated that the machinery will have a useful life of 5 years after which it will have no salvage value. If the company follows sum-of-the-years’-digits method of depreciation, the amount of depreciation charged during the year 2004-05 was

On August 01,2002, K Travels Ltd. bought four Matador vans costing Rs.1,20,000 each.The company expected to fetch a scrap value of 25% of the cost price of the vehicles after ten years. The vehicles were depreciated under the fixed installment method up to March 31, 2005. With effect from April 01, 2005, the company decided to introduce the diminishing balance method of depreciation @ 20% p.a. instead of the fixed installment method. The company sold one of the vans at Rs.70,000 on March 31, 2005. The rate of depreciation charged up to March 31, 2005 was

Akhil Ltd. imported a machine on 01.07.2002 for Rs 1,28,000, paid customs duty and freight Rs 64,000 and incurred erection charges Rs 48,000. Another local machinery costing Rs 80,000 was purchased on 01.01.2003. On 01.07.2004, a portion of the imported machinery ( value one-third ) got out of order and was sold for Rs 27,840. Another machinery was purchased to replace the same for Rs 40,000. Depreciation is to be calculated at 20% p.a.

Q.Profit / Loss on sale = ______.

Akhil Ltd. imported a machine on 01.07.2002 for Rs 1,28,000, paid customs duty and freight Rs 64,000 and incurred erection charges Rs 48,000. Another local machinery costing Rs 80,000 was purchased on 01.01.2003. On 01.07.2004, a portion of the imported machinery ( value one-third ) got out of order and was sold for Rs 27,840. Another machinery was purchased to replace the same for Rs 40,000. Depreciation is to be calculated at 20% p.a.

Q.Closing balance of Machinery = ___________.

On 01.01.2001, a new plant was purchased by Mrs. Shweta Periwal for Rs 1,00,000 and a further sum of Rs 5,000 was spent on installation. On 01.06.2002, another plant was acquired for Rs 65,000. On 02.10.2003, the first plant was totally destroyed and the amount of Rs 2,500 only was realized by selling the scraps. It was not insured. On 20.10.2003, a second hand plant was purchased for Rs 75,000 and a further sum of Rs 7,500 was spent for repairs and Rs 2,500 on its erection. It came into use on 15.11.2003. Depreciation has been provided @ 10% on the original cost annually on 31st December. It was the practice to provide depreciation for full year on all acquisitions made at any time during the year and to ignore the depreciation on any time sold during the year.

In December 2003, it is decided to change the method of depreciation and to follow the rate of 15% on diminishing balance method with retrospective effect in respect of the existing items of plant and to make necessary adjustments on 31.12.2003.

Q.Closing balance in Plant A/c = ____________.

On 01.01.2001, a new plant was purchased by Mrs. Shweta Periwal for Rs 1,00,000 and a further sum of Rs 5,000 was spent on installation. On 01.06.2002, another plant was acquired for Rs 65,000. On 02.10.2003, the first plant was totally destroyed and the amount of Rs 2,500 only was realized by selling the scraps. It was not insured. On 20.10.2003, a second hand plant was purchased for Rs 75,000 and a further sum of Rs 7,500 was spent for repairs and Rs 2,500 on its erection. It came into use on 15.11.2003. Depreciation has been provided @ 10% on the original cost annually on 31st December. It was the practice to provide depreciation for full year on all acquisitions made at any time during the year and to ignore the depreciation on any time sold during the year.

In December 2003, it is decided to change the method of depreciation and to follow the rate of 15% on diminishing balance method with retrospective effect in respect of the existing items of plant and to make necessary adjustments on 31.12.2003.

Q.Closing balance in Provision for Depreciation A/c = _________.

On 01.01.2001, a new plant was purchased by Mrs. Shweta Periwal for Rs 1,00,000 and a further sum of Rs 5,000 was spent on installation. On 01.06.2002, another plant was acquired for Rs 65,000. On 02.10.2003, the first plant was totally destroyed and the amount of Rs 2,500 only was realized by selling the scraps. It was not insured. On 20.10.2003, a second hand plant was purchased for Rs 75,000 and a further sum of Rs 7,500 was spent for repairs and Rs 2,500 on its erection. It came into use on 15.11.2003. Depreciation has been provided @ 10% on the original cost annually on 31st December. It was the practice to provide depreciation for full year on all acquisitions made at any time during the year and to ignore the depreciation on any time sold during the year.

In December 2003, it is decided to change the method of depreciation and to follow the rate of 15% on diminishing balance method with retrospective effect in respect of the existing items of plant and to make necessary adjustments on 31.12.2003.

Q.Profit / Loss on Plant sold = _________.

On 01.01.2001, a new plant was purchased by Mrs. Shweta Periwal for Rs 1,00,000 and a further sum of Rs 5,000 was spent on installation. On 01.06.2002, another plant was acquired for Rs 65,000. On 02.10.2003, the first plant was totally destroyed and the amount of Rs 2,500 only was realized by selling the scraps. It was not insured. On 20.10.2003, a second hand plant was purchased for Rs 75,000 and a further sum of Rs 7,500 was spent for repairs and Rs 2,500 on its erection. It came into use on 15.11.2003. Depreciation has been provided @ 10% on the original cost annually on 31st December. It was the practice to provide depreciation for full year on all acquisitions made at any time during the year and to ignore the depreciation on any time sold during the year.

In December 2003, it is decided to change the method of depreciation and to follow the rate of 15% on diminishing balance method with retrospective effect in respect of the existing items of plant and to make necessary adjustments on 31.12.2003.

Q.Depreciation over / under charged = _________.

Glass, Cutlery etc. : Balance on 01.01.2004 is Rs 28,000. Glass, Cutlery, etc. purchased during the year Rs 16,000. Depreciation is to be charged on the above assets as follows – 1/5th of their values is to be written off in the year of purchase and 2/5th in each of the next 2 years. Of the stock of Glass, Cutlery, etc. as on 01.01.2004, ½ was one year old and ½ was 2 years old. Purchases are made on 1st January.

Q.Depreciation for 3rd year = ________.

Glass, Cutlery etc. : Balance on 01.01.2004 is Rs 28,000. Glass, Cutlery, etc. purchased during the year Rs 16,000. Depreciation is to be charged on the above assets as follows – 1/5th of their values is to be written off in the year of purchase and 2/5th in each of the next 2 years. Of the stock of Glass, Cutlery, etc. as on 01.01.2004, ½ was one year old and ½ was 2 years old. Purchases are made on 1st January.

Q.Closing Balance in Glass, Cutlery A/c = ________.

Choose the correct answer(more than one)

Q.Which of the following is correct? Depreciable assets are those assets which –

In which of the following methods, the cost of the asset is not spread over in equal proportion during its useful economic life?

Which of the following assets is usually assumed to be not depreciating?

|

1365 videos|1312 docs|1010 tests

|

|

1365 videos|1312 docs|1010 tests

|