Test: Rectification Of Errors - 1 - Commerce MCQ

30 Questions MCQ Test Accountancy Class 11 - Test: Rectification Of Errors - 1

A Machine was Purchased for Rs. 3,000 which was wrongly recorded in Purchase A/c. due to this error :

Sale to Mr. Z of Rs. 3,000 on credit was recorded twice in the sales book. The rectification entry is :

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

‘A’ sold goods to ‘B’ on credit for Rs. 15,000 but debited to ‘C’ instead of ‘B’. The entry would affect:

When the total of trial balance is not reconciled, the account opened at this juncture is :

Total of sales book was understated by Rs. 200. Rectification entry will be:

The goods sold for Rs. 900 but the amount was entered in the sales Account as Rs. 1080. On Rectification, suspense account will be:

An amount of Rs. 6,000 due from Anshul, which had been written off as a bad debt in a previous year, was unexpectedly recovered and had been posted to his personal account. The rectification entry is :

Sale of old furniture is wrongly transferred to Sales Account. Which type of error is this ?

Wages paid for the erection of a machine debited to Wages A/c is an example of :

A purchase of computer was debited to Office Expenditure Account. This is an error of :

Credit sale of Rs. 10,000 made to Sallu was passed through purchase book. The proper entry for rectification was the following :

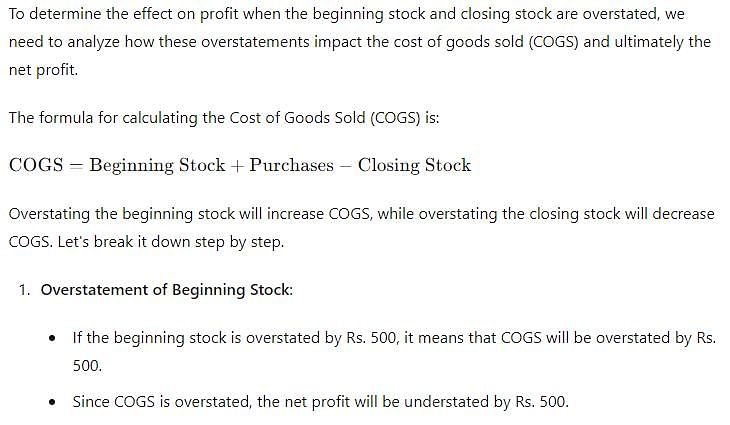

The beginning stock of the current year is overstated by Rs. 500 and closing stock is overstated by Rs. 1200. Effect on profit:

An amount of Rs. 8,765 paid to M was debited to N’s a/c. The rectification of the error will-

When check is not paid by the bank, it is called?

A bank reconciliation statement is prepared by?

Debit balance as per cash book of ABC Enterprises as on 31st March, 2012 was Rs. 1,500. Cheques deposited but not cleared amount to Rs. 100. Cheques issued but not presented amount to Rs. 150. The bank allowed interest amounting to Rs. 50 and collected dividend Rs. 50 on behalf of ABC Enterprises. Balance as per Pass Book as on 31st March 2012, should be:

On purchase of old furniture, the amount of Rs. 1,000 spent on its repair should be debited to

Sales of office furniture should be credited to

If a purchase return of Rs. 1,000 has been wrongly posted to the debit of the sales returns account, but has been correctly entered in the suppliers’ account, the total of the

A debit balance in the depositor’s Cash Book will be shown as:

The main purpose of preparing a bank reconciliation statement is?

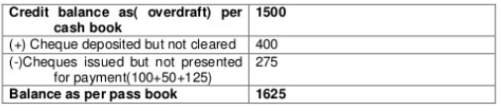

The cash book showed an overdraft of Rs. 1,500 as cash at bank, but the pass book made up to the same date showed that cheques of Rs. 100, Rs. 50 and Rs. 125 respectively had not been presented for payments; and the cheque of Rs. 400 paid into account had not been cleared. The balance as per the pass book will be

Which of the following items is not a reason for difference between bank balance as per cash book and pass book?

While preparing bank reconciliation statement with favourable balance as per cash book which of the following will not be added?

Payment done by the account holder through issuing a cheque is entered in

An amount of Rs. 5,000 debited twice in pass book to prepare Bank Reconciliation Statement, when overdraft as per the cash book in the starting point:

|

64 videos|153 docs|35 tests

|

|

64 videos|153 docs|35 tests

|