Test: Treatment Of Goodwill In Partnership Accounts - 2 - Commerce MCQ

30 Questions MCQ Test - Test: Treatment Of Goodwill In Partnership Accounts - 2

Goodwill is to be calculated at one and half years purchase of average profit of last 5 years. The firm earned profits during first 3 years as, Rs. 20,000, Rs. 18,000 and Rs. 9,000 and suffered losses of Rs. 2,000 and 5,000 in last 2 years. Goodwill amount will be:

Neeraj and Gopi are partners in a firm with capitals of Rs. 5,00,000 each. They admit Champak as a partner with 1/4th share in the profits of the firm. Champak brings Rs. 8,00,000. The Profit and Loss Account showed a credit balance of Rs. 4,00,000 as on the date of admission. The value of hidden goodwill is:

The capital of B and D are Rs. 90,000 and Rs. 30,000 respectively with the profit sharing ratio 3:1. The new ratio, admissible after 01.04.2006 is 5:3. Goodwill valued on 02.04.2006 as Rs. 84.000 will be credited to B and D’s capital by Rs……….and Rs…………..

Profits of last three years were Rs. 6,000, Rs. 13,000 and Rs. 8,000. Calculate goodwill for two years of purchase

When there is no Goodwill Account in the books and goodwill is raised, ______ account will be debited

A firm earned net profits during last 3 years:

2004 Rs. 17,000

2005 Rs. 20,000

2006 Rs. 23,000

The Capital employed Rs. 80,000. Return on capital employed 15%. Calculate the value of goodwill on the basis of two years purchase of average super profits earned:

The profits of last four years are:

2000 Rs. 40,000

2001 Rs. 50,000

2002 Rs. 60,000

2003 Rs. 50,000

The value of goodwill on the basis of three years purchase of average profits based on last four years:

Goodwill is to be calculated at 1.5 years of purchase of average profit of last 6 years. Profit earned during the first 3 years is Rs. 30,000, Rs. 20,000 and Rs. 20,000 and losses suffered of Rs. 5,000, Rs. 3,000 and Rs. 2000 in the last three years. Goodwill will be :

The capital of A and B sharing profits and losses equally are Rs. 90,000 and Rs. 30,000 respectively. They value the goodwill of the firm at Rs. 84,000, which was not recorded in the books. If goodwill is be raised now, by what amount each partner’s capital account will be debited:

Capital employed in a business is Rs. 1,50,000. Profits are Rs. 50,000 and the normal rate of profit is 20%. The amount of goodwill as per capitalization method will be:

What do you mean by purchasing years?

A and B are equal partners. They admit C as a partner with 1/7th share. What is the new profit sharing ratio of A and B?

The profits of last five years are Rs. 85,000; Rs. 90,000; Rs. 70,000; Rs. 100,000 and Rs. 80,000. Find the value of goodwill, if it is calculated on average profits of last five years on the basis of 3 years of purchase

Weighted average method of calculating goodwill is used when :

Radha, Seeta and Laxmi were partners sharing profits and losses in the ratio of 2:3:5. Seeta retired on 1st June, 2013 and Goodwill of the firm is to valued at Rs. 1,20,000 on that date, Goodwill A/c is to be raised. What will be the treatment for goodwill?

The profits and losses for the last years are 2001-02 Losses Rs. 10,000; 2002-03 Losses Rs. 2,500; 2003-04 Profits Rs. 98,000 & 2004-05 Profits Rs. 76,000. The average capital employed in the business is Rs. 2,00,000. The rate of interest expected form capital invested is 12%. The remuneration of partners is estimated to be Rs. 1,000 per month. Calculate the value of goodwill on the basis of four years purchase of super profit based on the annuity of four years. Take discounting rate as 10%.

In the absence of any provision in the partnership agreement, profits and losses are shared

Goodwill brought in by incoming partner in cash for joining in a partnership firm is taken away by the old partners in their …………ratio.

The following particulars are available in respect of the business carried on by a partnership firm:

Trading Results:

2001 Loss Rs. 5,000

2002 Loss Rs. 10,000

2003 Profit Rs. 75,000

2004 Profit Rs. 60,000

You are required to compute the value of goodwill on the basis of 5 year’s purchase of average profit of the business.

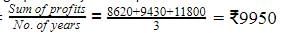

On the admission of a new partner, it is decided that goodwill of the firm be valued at 2 years purchase of average which amounted to Rs. 8,620, Rs. 9,430 and Rs. 11,800 respectively. The value of goodwill is:

Under average profit basis goodwill is calculated by:

A and B are partners with capitals of Rs. 10,000 and Rs. 20,000 respectively and sharing profits equally. They admitted C as their third partner with one-fourth profits of the firm on the payment of Rs. 12,000. The amount of hidden goodwill is:

Goodwill brought in by incoming partner in cash for joining in a partnership firm is taken away by the old partners in their ____________ratio.

In a firm John’s capital being &40,000 and Harry’s $60,000. Micheal purchased john’s interest for $50,000, the amount of goodwill paid to John will be:

Match the following items from column A with column B

Following are the factors affecting goodwill except:

The profits for the last three years are 2002-03 Rs. 42,500; 2003-04 Profits Rs. 56,000 & 2004-05 Profits Rs. 68,000. The total assets of the firm are Rs. 11,52,500 and the total liabilities of the firm are Rs. 10,00,000 of which outsiders liabilities is Rs. 5,00,000. The rate of interest expected from capital invested is 10%. Calculate the value of goodwill on capitalization basis.

A, B and C are equal partners. D is admitted to the firm for one-fourth share. D brings Rs. 20,000 capital and R.s 5,000 being half of the premium for goodwill. The value of goodwill of the firm is

Under annuity basis goodwill is calculated by:

What does not affect the goodwill of the firm?

Goodwill=9950*2=₹19900

Goodwill=9950*2=₹19900