Test: National Income Accounting- Case Based Type Questions - Commerce MCQ

12 Questions MCQ Test Economics Class 12 - Test: National Income Accounting- Case Based Type Questions

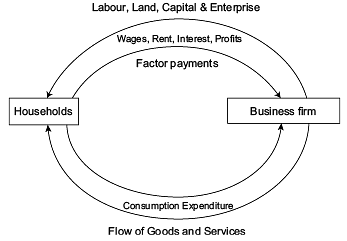

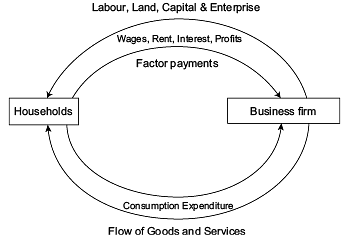

Direction: Read the below case and answer the questions that follow:

Circular Income Flow in a Two Sector Economy: In the figure given we can see that upper loop shows the resources such as land, capital and entrepreneurial ability flow from households to firms in the direction shown by the arrow direction.

The money flows from firms to the households as factor payments in the form of wages, rent, interest and profits, shown by the arrow direction.

The lower part of the figure shows the flow of money from households to firms in the form of consumption expenditure done by the households to purchase the goods and services produced by the firms, making the flow of goods and services from firms to households.

Thus, we see that money flows from business firms to households as factor payments and then it flows from households to firms. Thus, there is, in fact, a circular flow of money or income. This is how the economy functions.

Which of the following is not an assumption of a two sector model of Circular Flow of Income?

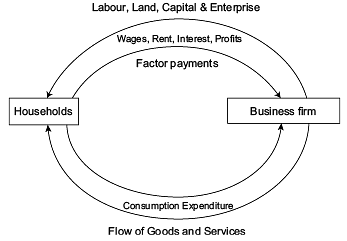

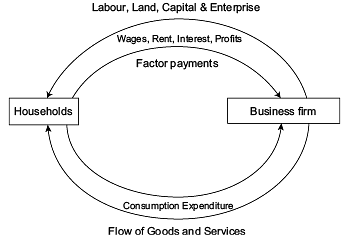

Direction: Read the below case and answer the questions that follow:

Circular Income Flow in a Two Sector Economy: In the figure given we can see that upper loop shows the resources such as land, capital and entrepreneurial ability flow from households to firms in the direction shown by the arrow direction.

The money flows from firms to the households as factor payments in the form of wages, rent, interest and profits, shown by the arrow direction.

The lower part of the figure shows the flow of money from households to firms in the form of consumption expenditure done by the households to purchase the goods and services produced by the firms, making the flow of goods and services from firms to households.

Thus, we see that money flows from business firms to households as factor payments and then it flows from households to firms. Thus, there is, in fact, a circular flow of money or income. This is how the economy functions.

Circular flow of income refers to the flow of activities of production, income generation and expenditure involving different ___________ of the economy.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

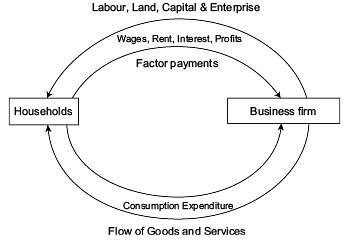

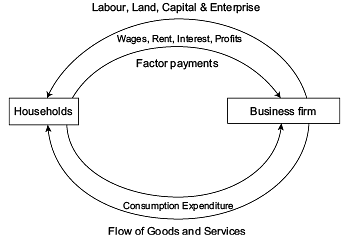

Direction: Read the below case and answer the questions that follow:

Circular Income Flow in a Two Sector Economy: In the figure given we can see that upper loop shows the resources such as land, capital and entrepreneurial ability flow from households to firms in the direction shown by the arrow direction.

The money flows from firms to the households as factor payments in the form of wages, rent, interest and profits, shown by the arrow direction.

The lower part of the figure shows the flow of money from households to firms in the form of consumption expenditure done by the households to purchase the goods and services produced by the firms, making the flow of goods and services from firms to households.

Thus, we see that money flows from business firms to households as factor payments and then it flows from households to firms. Thus, there is, in fact, a circular flow of money or income. This is how the economy functions.

Money Flows from __________ to ____________ as factor payments.

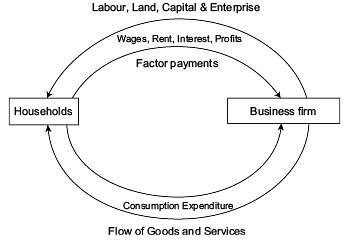

Direction: Read the below case and answer the questions that follow:

Circular Income Flow in a Two Sector Economy: In the figure given we can see that upper loop shows the resources such as land, capital and entrepreneurial ability flow from households to firms in the direction shown by the arrow direction.

The money flows from firms to the households as factor payments in the form of wages, rent, interest and profits, shown by the arrow direction.

The lower part of the figure shows the flow of money from households to firms in the form of consumption expenditure done by the households to purchase the goods and services produced by the firms, making the flow of goods and services from firms to households.

Thus, we see that money flows from business firms to households as factor payments and then it flows from households to firms. Thus, there is, in fact, a circular flow of money or income. This is how the economy functions.

Which of the following is not the significance of Circular Flow of Income?

Direction: Read the below case and answer the questions that follow:

The Centre on Saturday increased the budgetary allocation for the environment ministry from last fiscal by nearly five percent for 2020-21 with no change in the amount allotted to pollution abatement and climate change action plan.

Union Finance Minister, Nirmala Sitharaman, allocated ₹ 3,100 crore for the ministry out of which ₹ 460 crore were allotted to control pollution, which is the same as the money it received in the last budget.

Control of pollution has been conceptualized to provide financial assistance to Pollution Control Boards/Committees and funding to National Clean Air Programme (NCAP).

Similarly, budget for pollution abatement, which was cut by 50 percent last year from 2018-19, remained unchanged at ₹ 10 crore.

The minister also announced that states, which are formulating and implementing plans for ensuring cleaner air in cities above one million population should be encouraged.

Why is the policy implemented?

Direction: Read the below case and answer the questions that follow:

The Centre on Saturday increased the budgetary allocation for the environment ministry from last fiscal by nearly five percent for 2020-21 with no change in the amount allotted to pollution abatement and climate change action plan.

Union Finance Minister, Nirmala Sitharaman, allocated ₹ 3,100 crore for the ministry out of which ₹ 460 crore were allotted to control pollution, which is the same as the money it received in the last budget.

Control of pollution has been conceptualized to provide financial assistance to Pollution Control Boards/Committees and funding to National Clean Air Programme (NCAP).

Similarly, budget for pollution abatement, which was cut by 50 percent last year from 2018-19, remained unchanged at ₹ 10 crore.

The minister also announced that states, which are formulating and implementing plans for ensuring cleaner air in cities above one million population should be encouraged.

___________ means material well-being of the people.

Direction: Read the below case and answer the questions that follow:

The Centre on Saturday increased the budgetary allocation for the environment ministry from last fiscal by nearly five percent for 2020-21 with no change in the amount allotted to pollution abatement and climate change action plan.

Union Finance Minister, Nirmala Sitharaman, allocated ₹ 3,100 crore for the ministry out of which ₹ 460 crore were allotted to control pollution, which is the same as the money it received in the last budget.

Control of pollution has been conceptualized to provide financial assistance to Pollution Control Boards/Committees and funding to National Clean Air Programme (NCAP).

Similarly, budget for pollution abatement, which was cut by 50 percent last year from 2018-19, remained unchanged at ₹ 10 crore.

The minister also announced that states, which are formulating and implementing plans for ensuring cleaner air in cities above one million population should be encouraged.

What type of externality will the increase in budget allocation create?

Direction: Read the below case and answer the questions that follow:

The Centre on Saturday increased the budgetary allocation for the environment ministry from last fiscal by nearly five percent for 2020-21 with no change in the amount allotted to pollution abatement and climate change action plan.

Union Finance Minister, Nirmala Sitharaman, allocated ₹ 3,100 crore for the ministry out of which ₹ 460 crore were allotted to control pollution, which is the same as the money it received in the last budget.

Control of pollution has been conceptualized to provide financial assistance to Pollution Control Boards/Committees and funding to National Clean Air Programme (NCAP).

Similarly, budget for pollution abatement, which was cut by 50 percent last year from 2018-19, remained unchanged at ₹ 10 crore.

The minister also announced that states, which are formulating and implementing plans for ensuring cleaner air in cities above one million population should be encouraged.

Real GDP and Welfare are ___________ related with each other.

Direction: Read the below case and answer the questions that follow:

The country’s real gross domestic product (GDP) is likely to expand by 11 percent in the next financial year due to a faster economic recovery and on a low base, says a report. The report by domestic rating agency Brickwork Ratings said economic activities are slowly reaching Pre-COVID levels following the relaxation of the lockdown, except in sectors that remain affected by social distancing norms.

“With progress in developing an effective vaccine for COVID-19 and signals of faster-than-expected recovery in the domestic economy, and also supported by a low base, we expect the real GDP to grow at 11 percent in F/Y 22, from the estimated contraction of 7 percent to 7.5 percent in F/Y 21,” the agency said.

According to the first advance estimates of national income released by the National Statistical Office (NSO), the country’s GDP is estimated to contract by a record 7.7 percent during the current financial year.

Assertion (A): Real GDP is the true indicator of the growth of the economy.

Reason (R): Real GDP is nominal GDP adjusted for inflation used to measure the actual growth of production.

Select the correct alternative from the following:

Direction: Read the below case and answer the questions that follow:

The country’s real gross domestic product (GDP) is likely to expand by 11 percent in the next financial year due to a faster economic recovery and on a low base, says a report. The report by domestic rating agency Brickwork Ratings said economic activities are slowly reaching Pre-COVID levels following the relaxation of the lockdown, except in sectors that remain affected by social distancing norms.

“With progress in developing an effective vaccine for COVID-19 and signals of faster-than-expected recovery in the domestic economy, and also supported by a low base, we expect the real GDP to grow at 11 percent in F/Y 22, from the estimated contraction of 7 percent to 7.5 percent in F/Y 21,” the agency said.

According to the first advance estimates of national income released by the National Statistical Office (NSO), the country’s GDP is estimated to contract by a record 7.7 percent during the current financial year.

Choose one of the correct alternatives given below:

Assertion (A): The country's real gross domestic product is likely to expand.

Reason (R): Some sectors remain affected by social distancing norms.

Direction: Read the below case and answer the questions that follow:

The country’s real gross domestic product (GDP) is likely to expand by 11 percent in the next financial year due to a faster economic recovery and on a low base, says a report. The report by domestic rating agency Brickwork Ratings said economic activities are slowly reaching Pre-COVID levels following the relaxation of the lockdown, except in sectors that remain affected by social distancing norms.

“With progress in developing an effective vaccine for COVID-19 and signals of faster-than-expected recovery in the domestic economy, and also supported by a low base, we expect the real GDP to grow at 11 percent in F/Y 22, from the estimated contraction of 7 percent to 7.5 percent in F/Y 21,” the agency said.

According to the first advance estimates of national income released by the National Statistical Office (NSO), the country’s GDP is estimated to contract by a record 7.7 percent during the current financial year.

Real GDP is when the goods and services are produced by all producing units in the domestic territory of a country during an accounting year and valued at ___________ prices or constant price.

Direction: Read the below case and answer the questions that follow:

The country’s real gross domestic product (GDP) is likely to expand by 11 percent in the next financial year due to a faster economic recovery and on a low base, says a report. The report by domestic rating agency Brickwork Ratings said economic activities are slowly reaching Pre-COVID levels following the relaxation of the lockdown, except in sectors that remain affected by social distancing norms.

“With progress in developing an effective vaccine for COVID-19 and signals of faster-than-expected recovery in the domestic economy, and also supported by a low base, we expect the real GDP to grow at 11 percent in F/Y 22, from the estimated contraction of 7 percent to 7.5 percent in F/Y 21,” the agency said.

According to the first advance estimates of national income released by the National Statistical Office (NSO), the country’s GDP is estimated to contract by a record 7.7 percent during the current financial year.

What will be the growth rate of GDP according to the NSO?

|

86 videos|335 docs|54 tests

|