Test: Inventories - 1 - CA Foundation MCQ

30 Questions MCQ Test Accounting for CA Foundation - Test: Inventories - 1

A businessman purchased goods for Rs. 25,00,000 and sold 70% of such goods during the accounting year ended 31stMarch, 2005. The market value of remaining goods was Rs. 5,00,000. He valued the Closing stock at Rs. 5,00,000 and not at Rs. 7,50,000 due to :

Purchases = Rs. 1,10,000, Return outward Rs. 10,000. Goods given away as charity = Rs. 1,500. Goods distributed as sample = Rs. 1,000. What is the amount of net purchases ?

What is the amount of purchase when opening stock = Rs. 3,500 closing stock = Rs. 1,500, Cost of goods sold = Rs. 22,000.

If average stock is Rs. 20,000. Closing stock is Rs. 4,000 more than value of opening stock. Closing stock will be :

AS – 2 Prescribes the use of which method of stock valuation?

What are the consequences of undervaluation of closing stock ?

When closing inventory will be overstated it will result in :

Opening Stock Rs. 40,000

Closing Stock Rs. 50,000

Purchases Rs. 5,50,000

Return outward Rs. 5,000

Return inward Rs. 20,000

Carriage inward Rs. 5,000

If gross profit is 20% of sales, the gross sales will be:

Find out value of Closing Stock :

Opening Stock Rs. 70,000

Purchase Rs. 4,16,000

Sales Rs. 5,22,000

Gross profit earned 25% of cost

Opening stock Rs. 10,000

Purchases Rs. 1,10,000

Closing Stock Rs. 20,000

Find out total sales if profit margin is 30% on cost of sales :

The revised Accounting Standard-2 (Valuation of Inventories) permits which of the following method for computation of cost of Inventory?

Opening Stock = Rs. 6,000

Closing Stock = Rs. 8,000

Cost of Goods Sold = Rs. 87,000

Calculate the value of Purchases ?

If cost of goods sold is Rs. 80,700, opening stock Rs.5,800 and closing stock Rs. 6,000, then the amount of purchase will be :-

The books of T Ltd. revealed the following information:

Opening inventory Rs.6,00,000

Purchases during the year 2010-2011 Rs.34,00,000

Sales during the year 2010-2011 Rs.48,00,000

On March 31, 2011, the value of inventory as per physical Inventory-taking was Rs. 3,25,000. The company’s gross profit on sales has remained constant at 25%. The management of the company suspects that some inventory might have been pilfered by a new employee. What is the estimated cost of missing inventory?

The total cost of gods available for sale with a company during the current years is Rs. 12,00,000 and the total sales during the period are Rs. 13,00,000. If the gross profit margin of the company is 331 /3% on cost, the closing inventory during the current year is

Goods purchased Rs. 1,00,000. Sales Rs. 90,000. Margin 20% on cost. Closing Inventory =?

On April 07,2011, i.e., a week after the end of the accounting year 2010-11, a company undertook physical Inventory verification. The value of Inventory as per physical Inventory verification was found to be Rs. 35,000.

The following details pertaining to the period April 01, 2011 to April 07,2011 are given:

I. Goods costing Rs. 5,000 were sold during the week.

II.Goods received from consignor amounting to Rs. 4,000 included in the value of Inventory.

III.Goods earlier purchased but returned during the period amounted to Rs. 1,000..

IV.Goods earlier purchased and accounted but not received Rs. 6,000.

After considering the above, the value of Inventories held as on March 31,2011 was

Consider the following information pertaining to G & Sons as on March 31, 2011:

Opening inventory Rs.15,00,000

Purchases during the year 2010-11 Rs.45,00,000

Sales during the year 2010-11 Rs.50,00,000

As per physical inventory taken on March 31, 2011 the closing inventory was Rs.20,90,000. Gross profit on sales has remained constant at 25%. The management of the firm suspects that some inventory might have been taken away by a new employee. The estimated cost of missing inventory on the close of the financial year and the cost of goods sold during the year, respectively are

C Ltd. recorded the following information as on March 31,2011:

Stock as on April 01, 2010 Rs. 80,000

Purchases Rs.1,60,000

Sales Rs.2,00,000

It is noticed that goods worth Rs.30,000 were destroyed due to fire. Against this, the insurance company accepted a claim of Rs. 20,000.

The company sells goods at cost plus 33 1/3%. The value of closing inventory, after taking into account the above transactions is,

Calculate the value of purchase through following details :

Opening Stock Rs. 20,000

Sales Rs. 1,50,000

Gross profit Margin Rs. 20% of sales

Closing Stock Rs. 30,000

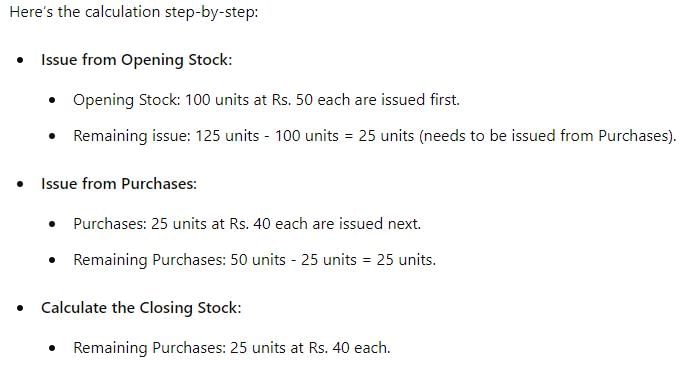

D Company, a dealer in cosmetics, records its inventory under first-in-first-out method, so as to minimize accumulation of outdated Inventory. The opening stock as on September 01, 2011 is 150 units at the rate of Rs. 20 per unit. The purchases and sales made during the month are:

Purchases:

Sales:

With effect from September 01,2011, the company decided to change the method of inventory valuation from the FIFO method to LIFO method. The change in the value of inventory as on September 30,2011 consequent upon the change in the method of valuation is

Average Inventory = Rs. 12,000. Closing stock is Rs. 3,000 more than opening stock. The value of closing Inventory = _________.

X & Company, a furniture dealer, due to some business problem could take physical stock taking on April 20 and arrived at the cost at Rs.5,25,000. Between April 01 and April 20 firm even though purchased goods worth Rs. 3,25,000 including credit purchases of Rs. 75,000 only goods costing Rs. 50,000 was not actually received before April 20. Cost of goods held at godown on March 31 was:

Four Washing Machines are in stock with a dealer

Find out the value of stock for balance sheet as per AS-2

|

68 videos|160 docs|83 tests

|