Test: Change In Profit Sharing Ratio - 2 - Commerce MCQ

20 Questions MCQ Test Accountancy Class 12 - Test: Change In Profit Sharing Ratio - 2

________ ratio in which the partners share all the accumulated profits, reserves, losses and fictitious assets in case of reconstitution of partnership firm

Why do existing partners change their profit sharing ratio:

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

In case of change in profit sharing ratio among the existing partners who will compensate the existing partners:

The significance of calculating sacrificing ratio:

Goodwill of the firm is 30,000. Gain of A is 1/6 and Sacrifice of B is 1/6. How will be adjust goodwill?

X, Y and Z are sharing profits and losses in the ratio of 5:3:2. Who will be debited and who will be credited, when they have decided to share profits equally in future?

A, B and C are sharing profits and losses in the ratio 10:6:4 with effect from 01/04/2013 they decide to share profit and losses equally. Which partner has to sacrifice

Vinod and Pandey are partners sharing profits in the ratio of 7:3 respectively. On 1.4.2015 they have decided to change their profit sharing ratio to 6:4. Calculate sacrifice/gain of Vinod.

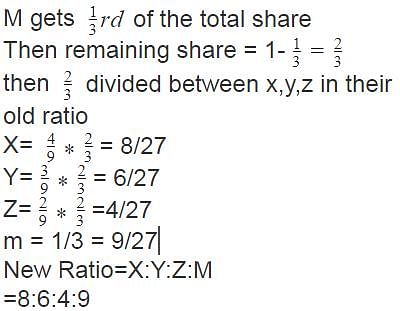

X, Y and Z are partners sharing profits in the ratio of 4:3:2. They admit a new partner M in the partnership firm for 1/3rd share in future profit. What will be the new ratio of all the partners?

VK, MK and JK are partners sharing profits equally. Now they have decided to share future profits in their capital ratio i.e. 5:3:2. Idenfity who two partners are sacrificing.

X, Y and Z are sharing profits in the ratio of 50%; 40% and 10% respectively. Now, they have decided to share future profits equally. Identify the gainer partner.

AK, BK and CK are sharing profits in the ratio of 2:1:1. They have decided to share future profits in the ratio of 3:2:1. Find out the gainer partner.

X, Y and Z are partners sharing profits in the ratio of 4:3:2. The partners have decided to share future profits in the ratio of 3:1:1. Find out the gainer partner.

P and Q are sharing profit and losses equally .With effects from current year they decided to share profits in the ratio of 4:3.Calculate individual partner’s gain and Sacrifice

A,B and C who are presently sharing profit and losses in the ratio of 5:3:2, decide to share future profits and losses in the ratio of 2:3:5 with effect from 1st April 2012.Balance sheet shown land building of 100000.What should be accounting g treatment if it decide it valued them at Rs.125000.By what amount revolution account should be credited in

P, Q and R who are presently sharing profits and losses in the ratio 5:3:2 decide to share future profits and losses in the ratio of 2:3:5 with effect from 1st April 2012. Balance sheet show Plant & Machinery of Rs.200000 and Provision for depreciation of Plant & Machinery Rs.10000.By what amount revaluation account should be debited if it is decided that Provision for depreciation be increased to Rs.19000.

X, Y and Z are partners sharing profits in the ratio of 8/14; 4/14 and 2/14. Profit and Loss account shows a loss of Rs.2,800. Now partners have decided to share future profits in the ratio of 4:2:2. Who is the gainer and with what amount?

Ram and Rohit shared profit and loss in the ratio of 3:2. With effect from 01/04/2012 they agreed to share profits equally. The goodwill of the firm was valued at 30000. Which partner account should be debited in this case for the adjustment

A, B and C are sharing profits and losses in the ratio 5:3:2 with effect from 01/04/2013 they decide to share profit and losses equally. Calculate B partner’s gain share

Geeta and Sita are partners in a firm sharing-profits in the ratio of 3 : 2. They decide to share future profits equally. For this purpose the goodwill of the firm has been valued at Rs. 50,000. Record necessary adjustment entry for the same.

|

47 videos|171 docs|56 tests

|

|

47 videos|171 docs|56 tests

|