Test: Admission Of New Partner - 1 - Commerce MCQ

30 Questions MCQ Test Accountancy Class 12 - Test: Admission Of New Partner - 1

Reserve appearing in the Balance sheet will be divided among partners during admission in _________ ratio.

X and Y are partners sharing profits in the ratio of 3:1. They admit Z as a partner who pays Rs. 4000 as goodwill, the new profit sharing ratio being 2:1:1 among X, Y, Z. The amount of goodwill will be credited to :

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

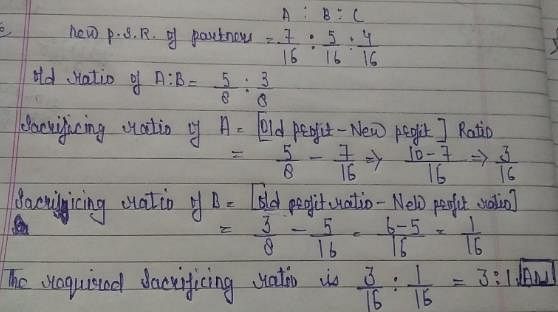

A and B are partner sharing profits and losses in the ration 5 : 3. On admission, C brings Rs. 70,000 cash and Rs. 48,000 against goodwill. New profit sharing ratio between A, B, C is 7:5:4. The sacrificing ratio among A and B is :

The opening balance of Partner’s Capital Account is credited with:

A, B, C, D are partners sharing their profits and losses equally. They change their profit sharing ratio to 2:2:1:1. How much will C sacrifice?

A and B are partners, sharing profits in the ratio of 5:3. They admit C with 1/5 share in profits, which he acquires equally from both 1/10 from A and 1/10 from B. New profit sharing ratio will be:

The balance of memorandum revaluation account (second part), is transferred to the capital accounts of the partners in :

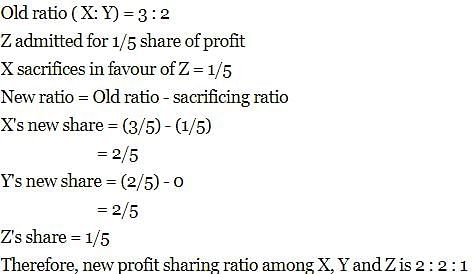

X and Y are sharing profits and losses in the ratio of 3 :2. Z is admitted with 1/5th share in profits of the firm which he gets from X. Now the new profit sharing ratio among X, Y and Z will be _________.

A, B, C are partners sharing profits in ratio of 3:2:1. They agree to admit D into the firm. A, B, and C agreed to give 1/3rd , 1/6th, 1/9th share of their profit. The share of profit of d will be:

A and B are partners C is admitted with 1/5th share C brings Rs. 1,20,000 as his share towards capital. The total net worth of the firm is :

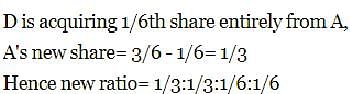

A, B, and C share profits and Losses in the ratio, of 3:2:1. D is admitted with 1/6 share which he gets entirely from A. New ratio will be:

Three partners shared the profit in a business in the ratio 5 : 7 : 8. They had partnered for 14 months, 8 months and 7 months respectively. What was the ratio of their investments?

R and S are partners sharing profits in the ratio of 5:3. T joins the firm. R gives 1/4th of his share and S gives, 1/5th of his share to the new partner. Find out new ratio:

General Revenue at time of admission of a new partner is transferred to:

A and B carry on business and share profits and losses in the ratio of 3:2. Their respective capital are Rs. 1,20,000 and Rs. 54,000. C is admitted for 1/3rd share in profit and brings Rs. 75,000 as his share of capital. Capitals of A and B to be adjusted according to C’s share. Calculate the amount refunded to A.

X and Y are partners sharing profits in the ratio 5:3. They admitted Z for 1/5th share of profits, for which he paid Rs. 1,20,000 against capital and Rs. 60,000 against goodwill. Find the capital balances for each partner taking Z’s capital as base capital.

General Reserve at the time of admission of a partner is transferred to ____________ .

A and B having shares capital of Rs.20,000 each, share profit and losses equally. They admit C as an equal partner and goodwill was valued as Rs. 30,000 (book value NIL). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill Account will not remain in the books. If profit on revaluation is Rs. 13,000, find the closing balance of the capital account

Which account will be prepared at the time of admission of a new partner for giving effect of revaluation of assets and liabilities without changing the value of assets and liabilities of old Balances Sheet?

X and Y are partners sharing profits in the ratio of 3:1. They admit Z as a partner who pays Rs. 4,000 as Goodwill the new profit sharing ratio being 2:1:1 among X, Y and Z respectively. The amount of goodwill will be credited to:

A and B are partners sharing the profit the ratio of 3:2. They take C as the new partner, who brings in Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. In what ratio will this amount will be shared among the old partners A & B.

C was admitted in a firm with 1/4th share of the profits of the firm. C contributes Rs. 15,000 as his capital, A and B are other partners with the profit sharing ratio as 3:2. Find the required capital of A and B, if capital should be in profit sharing ratio taking C’s as base capital:

Profit or loss on revaluation is shared among the partners in …………..ratio.

P and Q are partners sharing Profits in the ratio of 2:1. R is admitted to the partnership with effect from 1st April on the term that he will bring Rs. 20,000 as his capital for 1/4th share and pays Rs. 9,000 for goodwill, half of which is to be withdrawn by P and Q. How much cash can P & Q withdraw from the firm (if any).

A and B are partners sharing profits and losses in the proportion of 7 : 5. They agree to admit C, their manager, into partnership who is to get 1 / 6th share in the profit. He acquires this share as 1 / 24th from A and 1 / 8th from B. Calculate new profit-sharing ratio.

A and B shares profit and losses equally. They admit C as an equal partner and assets were revalued as follow: Goodwill at Rs. 30,000 (book value NIL). Stock at Rs. 20,000 (book value Rs. 12,000); Machinery at Rs. 60,000 (book value Rs. 55,000). C is to bring in Rs. 20,000 as his capital and the necessary cash towards his share of Goodwill. Goodwill account will not remain in the books. Find the profit/loss on revaluation to be shared among A, B and C.

A and B are partners sharing the profit in the ratio of 3:2. They take C as the new partner, who is supposed to bring Rs. 25,000 against capital and Rs. 10,000 against goodwill. New profit sharing ratio is 1:1:1. C is able to bring only his share of Capital. How this will be treated in the books of the firm

A and B are partners sharing profits and losses in the ratio 5:3. They admitted C and agreed to give him 3/10th of the profit. What is the new ratio after C’s admission?

Adam, Brain and Chris were equal partners of a firm with goodwill Rs. 1,20,000 shown in the balance sheet and they agreed to take Daniel as an equal partner on the term that he should bring Rs. 1,60,000 as his capital and goodwill, his share of goodwill was evaluated at Rs. 60,000 and the goodwill account is to be written off before admission. What will be the treatment for goodwill?

A and B are partners sharing profits in the ratio of 3 : 2. C is admitted into the firm for 1 / 5th share in the profit which he acquires equally from A and B. The new profit sharing ratio will be ________.

|

47 videos|180 docs|56 tests

|

|

47 videos|180 docs|56 tests

|