Test: Introduction To Partnership Accounts - 2 - Commerce MCQ

30 Questions MCQ Test Accountancy Class 12 - Test: Introduction To Partnership Accounts - 2

Ram and Mohan, are partner’s. They draw for private use Rs. 6,000 and Rs. 4,000 respectively. Interest is changeable @ 6 percent per annum on drawings. What is the interest?

A and B are partners sharing profits and losses in the ratio of 4:1. C was a manager who received the salary of Rs. 2000 p.m. in addition to a commission of 5% on net profits after charging such commission. Profits for the year is Rs. 3,39,000 before charging salary. Find total remuneration of C:

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Ram is a partner. He made drawings as follows:

July 1 Rs. 200

August 1 Rs. 200

September 1 Rs. 300

November 1 Rs. 50

February 1 Rs. 100

If the rate of interest on drawings is 6% and accounts are closed on March 31 the interest on drawing is:

July 1 Rs. 200

August 1 Rs. 200

September 1 Rs. 300

November 1 Rs. 50

February 1 Rs. 100

Profit or loss on revaluation is shared among the old partners in _______ ratio.

Subject to contract between the partners, interest on capital is to be provided out of profits only. In case of insufficient profits (i.e. net profit less than the amount of interest on capital), the amount of profit is distributed:

On the death of a partner, public notice of death is not given and the firm continues the business, then for the acts of firm done after his death, the estate of the deceased partner is

Kapur and Sharma are partners in a partnership firm. Calculate the interest on drawings made by Kapur and Sharma @ 10% p.a. for the year ending 31st December 2013. If, Kapur withdrew Rs. 2,000 per month in the beginning whereas Sharma withdrew same amount at the end of every month.

In the absence of any agreement, partners are liable to receive interest on their Loans @:

Aryan and Gauri were partner in a firm sharing profits and losses in the ratio of 2:1. Their capital was R.s. 90,000 and Rs. 60,000 respectively. They were entitled for interest on capital @ 12% p.a. The firm earned a profit of Rs. 84,000 after allowing interest on capitals. Profits will be distributed among them will be:

Bill and Monica are partners sharing profits and losses in the ratio of 3:2 having the capital of Rs. 80,000 and Rs. 50,000 respectively. They are entitled to 9% p.a. interest on capital before distributing the profits. During the year firm earned Rs. 7,800 after allowing interest on capital. Profits apportioned among Bill and Monica is:

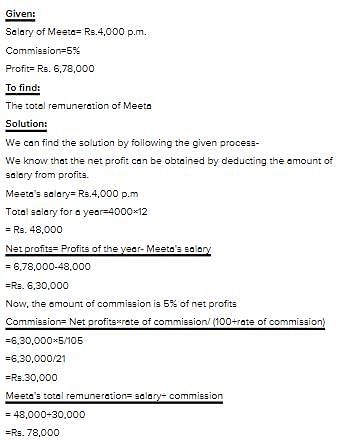

Seeta and Geeta are partners sharing profits and losses in the ratio 4:1. Meeta was manager who received the salary of Rs. 4,000 p.m. in addition to a commission of 5% on net profits after charging such commission. Profits for the year is Rs. 6,78,000 before charging salary. Find the total remuneration of Meeta

In absence of any agreement, partners are liable to receive interest on loans at the rate of :

If there is no partnership deed then interest on capital will be charged at ……….p.a.

Following is the difference between partnership deed and partnership agreement.

Match the following items from column A with column B

Partners are suppose to pay interest on drawings only when ……………..by the ………

X, Y and Z are partners in a firm. At the time of division of profit for the year there was dispute between the partners. Profits before interest on partner’s capital was Rs. 6,000 and X wanted interest on capital @ 20% as his capital contributions was Rs. 1,00,000 as compared to that of Y and Z which was Rs. 75,000 and Rs. 50,000 respectively.

Would interest on loan be allowed in the absence of any agreement or when partnership deed is silent?

In the absence of an agreement, partners are entitled to

X and Y sharing profits in the ratio of 7 : 3, admit Z for 3/7 share in the new firm in which he takes 2/7 from X and 1/7 from Y. The new ratio of X, Y and Z will be :

Bill and Monica are partners sharing profits and losses in the ratio of 3:2 having the capital of Rs. 80,000 and Rs. 50,000 respectively. They are entitled to 9% p.a. interest on capital before distributing the profits. During the year firm earned Rs. 7,800 after allowing interest on capital. Profits apportioned among Bill and Monica is:

Guarantee given to a partner ‘A’ by the other partners ‘B & C’ means

What balance does a Partner’s Current Account has?

What time would be taken into consideration if equal monthly amount is drawn as drawings at the beginning of each month?

Features of a partnership firm are:

How would you close the Partner’s Drawings Account?

Following are the differences between Partnership and Joint Venture except:

In the absence of any agreement, partners are liable to receive interest on their Loans @:

X, Y and Z are partners in a firm. At the time of division of profit for the year there was dispute between the partners. Profits before interest on partner’s capital was Rs. 6,000 and Z demanded minimum profit of Rs. 5,000 as his financial position was not good. However, there was no written agreement. Profit to be distributed to X, Y and Z will be

|

47 videos|180 docs|56 tests

|

|

47 videos|180 docs|56 tests

|