Test: Financial Market & Money Market - 2 - Bank Exams MCQ

10 Questions MCQ Test SBI PO Prelims & Mains Preparation - Test: Financial Market & Money Market - 2

______________ are financial instruments in which an investor lends money to a corporation or government for a specific length of time in exchange for regular interest payments.

Which among the following is defined as an Initial Public Offering?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Which of the following is the purpose of the Money Market?

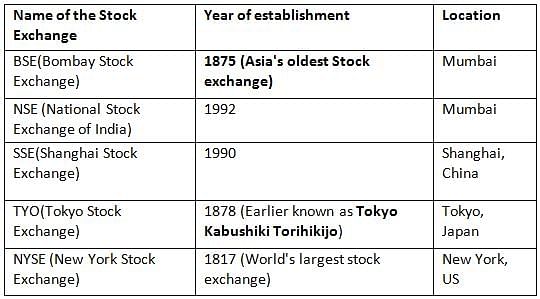

Which of the following is the oldest stock exchange in Asia?

Which among the following is the tenure of the Treasury Bills issued by the Government of India?

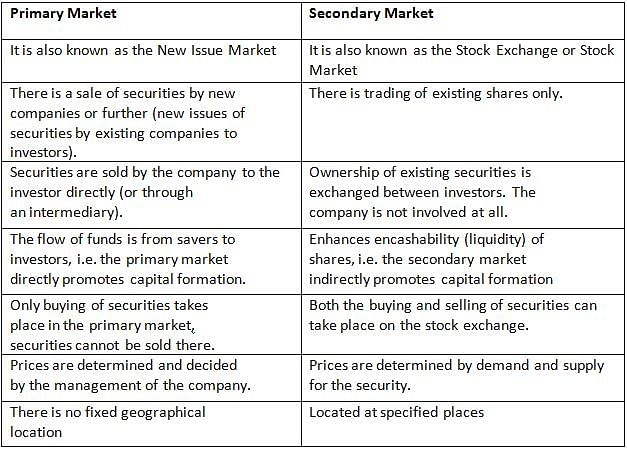

In which of the markets securities cannot be sold?

Call money rate is the rate at which short-term funds are borrowed and lent in the money market overnight. When the money is borrowed or lent for exceeding 14 days to 365 days, then it is called ______________.

Certificate of Deposit or CD is a fixed-income financial instrument governed under the Reserve Bank and India (RBI) issued in a dematerialized form. What is the minimum denomination of Certificate of Deposits?

Which of the following is not a Money Market Instrument?

|

628 videos|824 docs|280 tests

|

|

628 videos|824 docs|280 tests

|