Test: Bank Reconciliation Statement- Case Based Type Questions - SSC CGL MCQ

10 Questions MCQ Test SSC CGL Tier 2 - Study Material, Online Tests, Previous Year - Test: Bank Reconciliation Statement- Case Based Type Questions

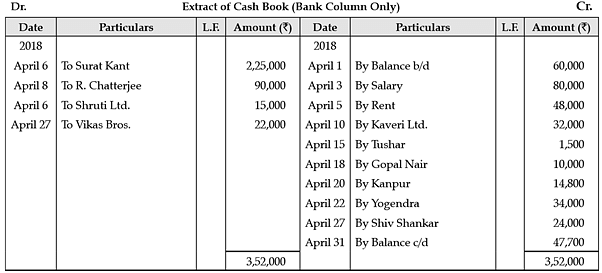

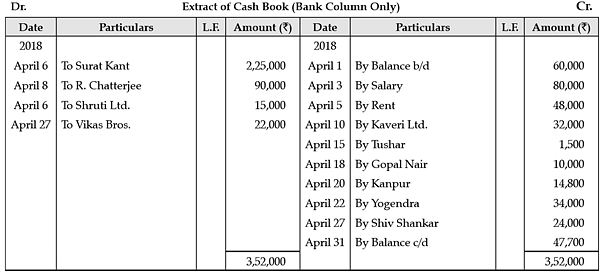

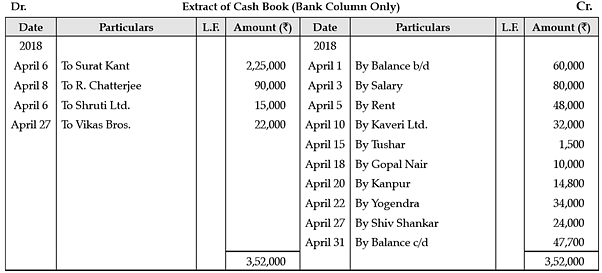

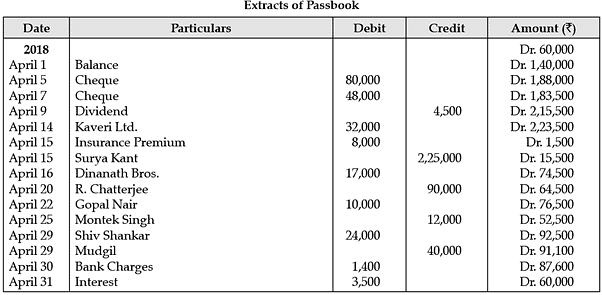

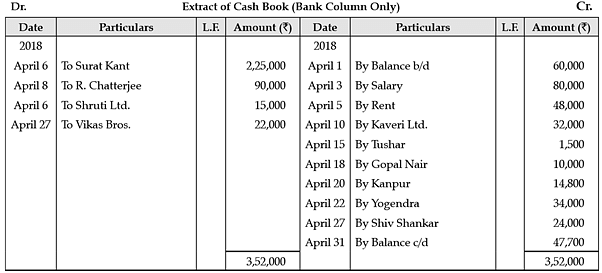

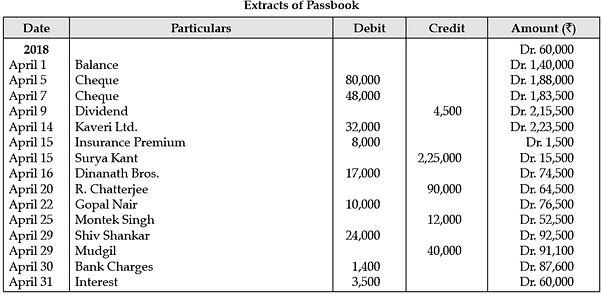

Read the following hypothetical Case Study and answer the given questions:

Given below is a hypothetical extract from the Cash Book and Pass Book of M/s Ganjan Traders.

The total amount of cheques paid into bank for collection but not yet credited by the bank is __________

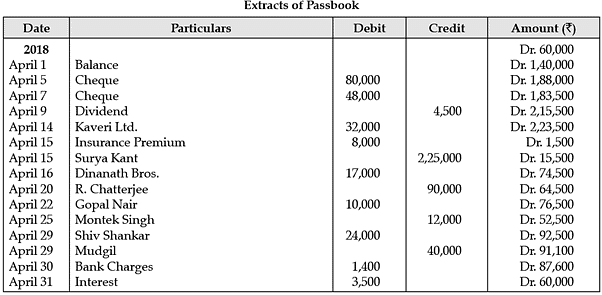

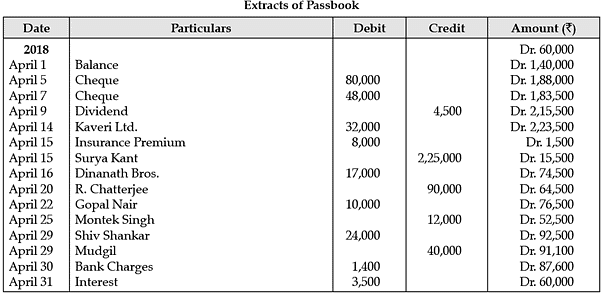

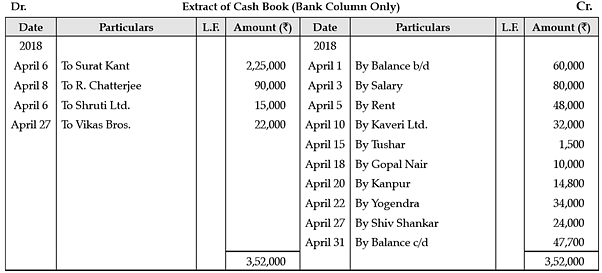

Read the following hypothetical Case Study and answer the given questions:

Given below is a hypothetical extract from the Cash Book and Pass Book of M/s Ganjan Traders.

The bank charges of ₹1,400 shown in the Pass book and not the cash book will come in the ___________ column of the amended Cash Book.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

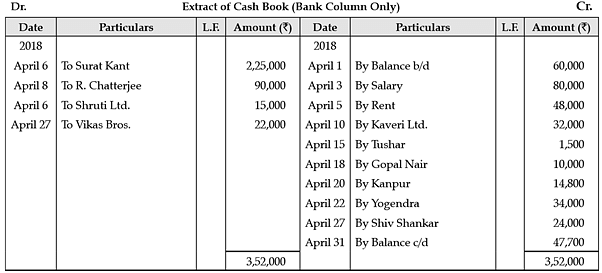

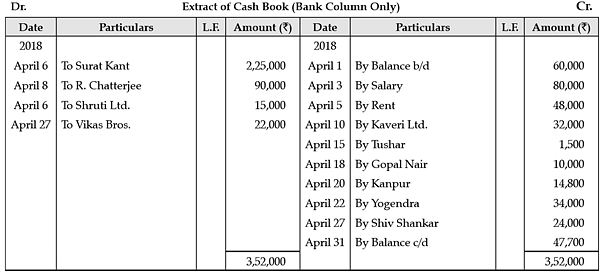

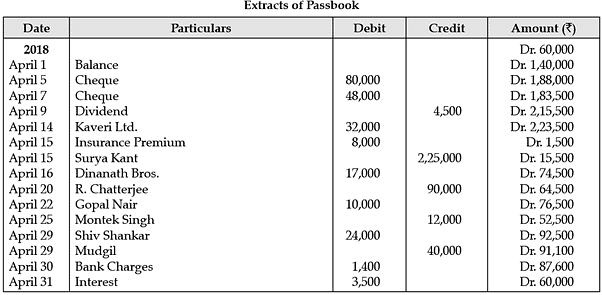

Read the following hypothetical Case Study and answer the given questions:

Given below is a hypothetical extract from the Cash Book and Pass Book of M/s Ganjan Traders.

Which of the following statement is not correct?

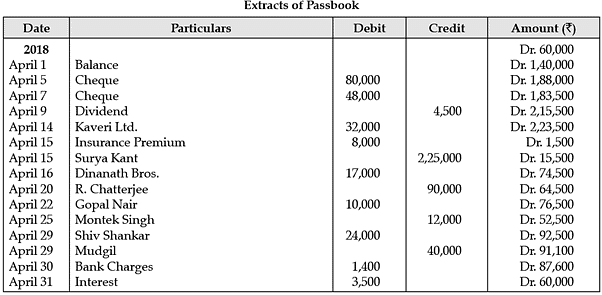

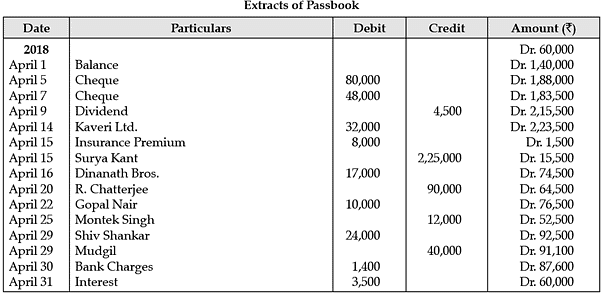

Read the following hypothetical Case Study and answer the given questions:

Given below is a hypothetical extract from the Cash Book and Pass Book of M/s Ganjan Traders.

Study the following hypothetical transactional detail of Mr. Keshav and answer the given questions:

On 31st March, 2019 the bank column of the Cash Book of Mr. Keshav disclosed an overdraft balance of ₹8,300. On examining the cash book and bank statement you find that:

• Cheques were deposited into the bank for ₹16,000 but of these cheques for ₹4,600 were cleared and credited in April 2015.

• Cheques were issued for ₹7,500 out of which cheques for ₹6,000 had been presented for payment in March 2019.

• In March Mr. Keshav had discounted with a bank a bill of exchange for ₹10,000 and had entered this amount in the Cash Book, but the proceeds credited as shown by the Passbook, amounted to ₹9,600.

• No entry is made in the Cash Book of an amount of ₹6,100 directly deposited by a customer in the bank accounts.

• Bank Column of the payment side of the Cash Book was undercast by ₹1,000.

• Payment of Insurance premium of ₹2,000 and receipt of insurance claim of ₹8,000 appear in the Passbook but not entered in the Cash Book.

• A cheque for ₹3,500 issued to Mr. Kapil was omitted to be recorded in the Cash Book.

• A cheque for ₹2,800 issued to Mr. Darshan was entered in the cash column of the Cash Book.

The amount of cheque not credited until April 2015 will be recorded as a _______ item in the bank reconciliation statement.

Study the following hypothetical transactional detail of Mr. Keshav and answer the given questions:

On 31st March, 2019 the bank column of the Cash Book of Mr. Keshav disclosed an overdraft balance of ₹8,300. On examining the cash book and bank statement you find that:

• Cheques were deposited into the bank for ₹16,000 but of these cheques for ₹4,600 were cleared and credited in April 2015.

• Cheques were issued for ₹7,500 out of which cheques for ₹6,000 had been presented for payment in March 2019.

• In March Mr. Keshav had discounted with a bank a bill of exchange for ₹10,000 and had entered this amount in the Cash Book, but the proceeds credited as shown by the Passbook, amounted to ₹9,600.

• No entry is made in the Cash Book of an amount of ₹6,100 directly deposited by a customer in the bank accounts.

• Bank Column of the payment side of the Cash Book was undercast by ₹1,000.

• Payment of Insurance premium of ₹2,000 and receipt of insurance claim of ₹8,000 appear in the Passbook but not entered in the Cash Book.

• A cheque for ₹3,500 issued to Mr. Kapil was omitted to be recorded in the Cash Book.

• A cheque for ₹2,800 issued to Mr. Darshan was entered in the cash column of the Cash Book.

Which of the following amount will be shown in the plus item column of the bank reconciliation statement with regard to the cheques that were issued but not presented to the bank?

Study the following hypothetical transactional detail of Mr. Keshav and answer the given questions:

On 31st March, 2019 the bank column of the Cash Book of Mr. Keshav disclosed an overdraft balance of ₹8,300. On examining the cash book and bank statement you find that:

• Cheques were deposited into the bank for ₹16,000 but of these cheques for ₹4,600 were cleared and credited in April 2015.

• Cheques were issued for ₹7,500 out of which cheques for ₹6,000 had been presented for payment in March 2019.

• In March Mr. Keshav had discounted with a bank a bill of exchange for ₹10,000 and had entered this amount in the Cash Book, but the proceeds credited as shown by the Passbook, amounted to ₹9,600.

• No entry is made in the Cash Book of an amount of ₹6,100 directly deposited by a customer in the bank accounts.

• Bank Column of the payment side of the Cash Book was undercast by ₹1,000.

• Payment of Insurance premium of ₹2,000 and receipt of insurance claim of ₹8,000 appear in the Passbook but not entered in the Cash Book.

• A cheque for ₹3,500 issued to Mr. Kapil was omitted to be recorded in the Cash Book.

• A cheque for ₹2,800 issued to Mr. Darshan was entered in the cash column of the Cash Book.

The amount not entered in the cash book as it was directly deposited in the bank by a customer will be recorded as a ________ item in the bank reconciliation statement.

Study the following hypothetical transactional detail of Mr. Keshav and answer the given questions:

On 31st March, 2019 the bank column of the Cash Book of Mr. Keshav disclosed an overdraft balance of ₹8,300. On examining the cash book and bank statement you find that:

• Cheques were deposited into the bank for ₹16,000 but of these cheques for ₹4,600 were cleared and credited in April 2015.

• Cheques were issued for ₹7,500 out of which cheques for ₹6,000 had been presented for payment in March 2019.

• In March Mr. Keshav had discounted with a bank a bill of exchange for ₹10,000 and had entered this amount in the Cash Book, but the proceeds credited as shown by the Passbook, amounted to ₹9,600.

• No entry is made in the Cash Book of an amount of ₹6,100 directly deposited by a customer in the bank accounts.

• Bank Column of the payment side of the Cash Book was undercast by ₹1,000.

• Payment of Insurance premium of ₹2,000 and receipt of insurance claim of ₹8,000 appear in the Passbook but not entered in the Cash Book.

• A cheque for ₹3,500 issued to Mr. Kapil was omitted to be recorded in the Cash Book.

• A cheque for ₹2,800 issued to Mr. Darshan was entered in the cash column of the Cash Book.

Where will the payment of insurance premium be recorded?

Consider the following statements with respect to the transactions shown only in the cash book:

(i) Cheques issued but not yet presented in the bank for payment.

(ii) Cheques deposited into the bank but not yet credited or collected.

(iii) Cheques deposited into the bank but dishonoured.

Identify the correct statement/statements:

Consider the following statements with regard to the need for preparing the Bank Reconciliation Statement:

(i) It helps the management in checking the accuracy of entries recorded in Cash Book.

(ii) It helps in keeping the track of cheques etc., sent to the bank for collection. Any undue delay in the clearance of cheques can be noticed.

(iii) It helps in bringing out any errors that may have been committed either in cash book or in the pass book.

Identify the correct statement/statements:

|

1365 videos|1312 docs|1010 tests

|

|

1365 videos|1312 docs|1010 tests

|