Test: Applications of Computer in Accounting- Case Based Type Questions - SSC CGL MCQ

10 Questions MCQ Test SSC CGL Tier 2 - Study Material, Online Tests, Previous Year - Test: Applications of Computer in Accounting- Case Based Type Questions

Read the following hypothetical case study and answer the question that follows:

Mr. Nahin Ahmed keeps his book on Single Entry. From the following information given by him, ascertain his profit or loss for the year ending 31st March 2019 and prepare the final statement affairs.

His position on 1st April 2018 were as follows: Plant and Machinery ₹30,000; Stock ₹5,000; Cash in hand ₹100; Debtors ₹17,000; Loan from Mr. Bishal Podiyal ₹1,000 at 4% p.a. interest; Bank Overdraft ₹1,100 and Creditors ₹12,120.

On 31st March 2019, he owed his creditors ₹9,170 and had paid Mr. Bishal ₹500 in lieu of his loan on 1st October 2018 and paid no interest. He had bought additional Plant and Machinery @ ₹13,000. Debtors were ₹23,000 out of which ₹900 would not be able to connect. The Cash and Bank Balance was ₹4,100. Stock at the end was valued at ₹4,500.

Mr. Ahmed withdrew ₹8,300 for domestic purposes. He introduced a further capital of ₹10,000 during this year.

Q. The total amount of Plant and Machinery to be put in the Final Statement of Affairs is _________.

Read the following hypothetical case study and answer the question that follows:

Mr. Nahin Ahmed keeps his book on Single Entry. From the following information given by him, ascertain his profit or loss for the year ending 31st March 2019 and prepare the final statement affairs.

His position on 1st April 2018 were as follows: Plant and Machinery ₹30,000; Stock ₹5,000; Cash in hand ₹100; Debtors ₹17,000; Loan from Mr. Bishal Podiyal ₹1,000 at 4% p.a. interest; Bank Overdraft ₹1,100 and Creditors ₹12,120.

On 31st March 2019, he owed his creditors ₹9,170 and had paid Mr. Bishal ₹500 in lieu of his loan on 1st October 2018 and paid no interest. He had bought additional Plant and Machinery @ ₹13,000. Debtors were ₹23,000 out of which ₹900 would not be able to connect. The Cash and Bank Balance was ₹4,100. Stock at the end was valued at ₹4,500.

Mr. Ahmed withdrew ₹8,300 for domestic purposes. He introduced a further capital of ₹10,000 during this year.

Q. How will the amount of capital at the beginning be ascertained by Mr. Nahin Ahmed?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

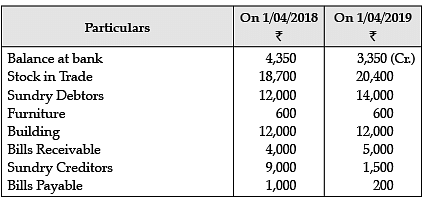

Study the following hypothetical case study and answer the given questions: Rohit, the accountant of M/s Ravi Kanth Emporium who keep their books by Single Entry System, has accumulated the following information:

He also knows the following information that has been in the company:

(i) A provision of ₹1,450 is required for bad and doubtful debts.

(ii) Depreciation @5% is to be written off on Building and Furniture.

(iii) Wages outstanding ₹3,000; salaries outstanding ₹1,200.

(iv) Insurance has been prepaid to the extent of ₹250

(v) Legal Expenses outstanding ₹700 (f) Drawings of ₹7,520 were made.

Q. The amount of Profit after adjustment that needs to be added to the capital shown in the final statement of affairs is _____________.

Study the following hypothetical case study and answer the given questions: Rohit, the accountant of M/s Ravi Kanth Emporium who keep their books by Single Entry System, has accumulated the following information:

He also knows the following information that has been in the company:

(i) A provision of ₹1,450 is required for bad and doubtful debts.

(ii) Depreciation @5% is to be written off on Building and Furniture.

(iii) Wages outstanding ₹3,000; salaries outstanding ₹1,200.

(iv) Insurance has been prepaid to the extent of ₹250

(v) Legal Expenses outstanding ₹700 (f) Drawings of ₹7,520 were made.

Q. What will be the treatment of outstanding wages and salaries?

Consider the following statements with regard to the objectives of Accounting Reports:

(i) The objective needs to be defined clearly specifying the user type.

(ii) The report can be incomplete and of rigid style.

(iii) It should provide the relevant information to manipulate the database.

(iv) Its needs have analysed the ending and suggestions.

Q. Identify the correct statement/statements:

Pick the odd one out:

Pick the odd one out:

Consider the following statements with respect to the features of Accounting Information System:

(i) The accounting and financial transactions are handled and manipulated.

(ii) It generates reports for the Outsiders and Internal Reports.

(iii) Futuristic data can be produced in the form of Budget forecasts.

Q. Identify the correct statement/statements:

Which of the following is the purpose of the Accounting Information System?

Examples of Transaction Processing System are:

|

1365 videos|1312 docs|1010 tests

|

|

1365 videos|1312 docs|1010 tests

|