Test: Indian Economy and Indian Financial System - 2 - Bank Exams MCQ

30 Questions MCQ Test - Test: Indian Economy and Indian Financial System - 2

If the consumption expenditure increases to Rs. 35,000, gross investment increases to Rs. 45,000, government spending remains at Rs. 20,000, exports remain at Rs. 68,000 and imports increase to Rs. 65,000, what would be the new GDP using the expenditure approach?

What is the impact of determining GDP at the production stage, income generation stage, or final use stage on its valuation?

What is the correlation between volatility and risk in the context of price discovery?

What does the "New Age 24×7 banking" theme of EASE 4.0 aspire to achieve?

Among the following options what was the primary concern of Adam Smith in his work "The Wealth of Nations"?

Which one of the following statements about the Special Drawing Facility (SDF) is inaccurate?

Which regulatory authority is empowered to call for periodical returns and inspect books and accounts of a bank under the Banking Regulation Act, 1949?

What amount of funds were allocated to the first presidency bank of India, the Bank of Calcutta, during its inception?

Which of the following is the purported role of the National Asset Reconstruction Company (NARCL)?

Which of the following are the primary methods of implementing protectionist policies?

In India, which legal statute is not-permissible for the registration of not-for-profit microfinance institutions (MFIs)?

The Prime Minister dedicated Digital Banking Units (DBU) across districts to the nation. These DBU will further financial inclusion and enhance banking experience for citizens. The government aims to provide maximum services with minimum infrastructure, and all of this will happen digitally without involving any paperwork. It will also simplify the banking procedure while also providing a robust and secure banking system. Recently, the Reserve Bank of India (RBI) also issued guidelines on ‘Establishment of DBUs

How is the Digital Assistance Zone in a DBU serving as a novel approach to providing customer support and enhancing the overall banking experience?

The Prime Minister dedicated Digital Banking Units (DBU) across districts to the nation. These DBU will further financial inclusion and enhance banking experience for citizens. The government aims to provide maximum services with minimum infrastructure, and all of this will happen digitally without involving any paperwork. It will also simplify the banking procedure while also providing a robust and secure banking system. Recently, the Reserve Bank of India (RBI) also issued guidelines on ‘Establishment of DBUs

Which of the following entities are not eligible to set up a DBU as per the RBI guidelines?

Which individual among the following choices is credited with characterizing Economics as a discipline that focuses on human welfare?

Which of the following is not a factor limiting the role of the bank rate as an instrument of monetary policy in India?

What is the most significant difference between a forward contract and a futures contract in the domain of derivatives?

Within the framework of the Indradhanush Plan, which sought to restructure public sector banks (PSBs), what does the fifth component "E" in the acronym ABCDEFG stand for?

Which of the following continue to remain the outstanding or emerging apprehensions related to non-performing assets (NPA)?

Which terminology is used to denote the rise and fall of the macroeconomic performance of a nation over the course of several months or years?

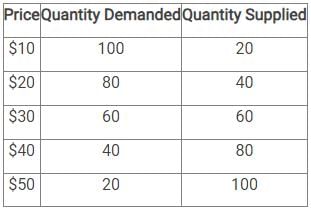

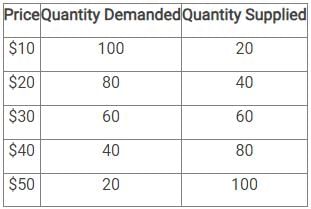

If the price is $45, what is the quantity demanded in the market?

If the price is $50, what is the excess supply in the market?

What was the recommendation of the Narasimhan Committee with regard to interest rates as per Narasimhan Committee-I?

What is the principal objective of reinsurance?

The Reserve Bank of India (RBI) has issued a note on Central Bank Digital Currency (CBDC). CBDC pilot launched by the RBI in retail segment has components based on blockchain technology. RBI has identified 9 banks for phase-wise participation in the retail pilot project. Like cash, the CBDC will not earn any interest and can be converted to other forms of money, like deposits with banks. Other steps being taken by RBI for full operationalisation of CBDC include expanding the scope of the pilots gradually to include more banks, users and locations based on feedback received during the pilots.

Among the following options, which country was the first or pioneer in launching a CBDC?

The Reserve Bank of India (RBI) has issued a note on Central Bank Digital Currency (CBDC). CBDC pilot launched by the RBI in retail segment has components based on blockchain technology. RBI has identified 9 banks for phase-wise participation in the retail pilot project. Like cash, the CBDC will not earn any interest and can be converted to other forms of money, like deposits with banks. Other steps being taken by RBI for full operationalisation of CBDC include expanding the scope of the pilots gradually to include more banks, users and locations based on feedback received during the pilots.

What constitutes a Central Bank Digital Currency (CBDC)?

Among the following options, which is the distinguishing feature between a tri-party repo and a market repo?

What are the activities that Merchant Banks extended their operations to, in addition to syndication of long-term/short-term finance?

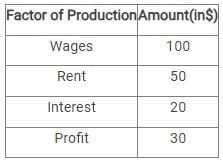

The table below provides information on the economy of a country. Use the income approach to calculate the GDP for this country.

Which of the following types of NBFCs are excluded under the Ombudsman Scheme?

Recently, World Bank postulated that Digital markets work differently than traditional physical markets. The winner-take-all markets of the digital economy prompt 'winners' to resort to certain actions that discourage competition, the Standing Committee on Finance, chaired by Jayant Sinha, said in its report. The committee interacted with Indian representatives of foreign big tech companies like Amazon, Apple, Facebook, Google, Netflix, Twitter, and Uber, as well as representatives of domestic companies like PayTM, MakeMyTrip, Zomato, Ola, Swiggy, Flipkart, etc., to identify competition concerns.

According to economic theory, Oligopolistic competition refers to a certain type of market structure. Which feature is not a defining characteristic of this structure?