Test: Principles and Practices of Banking - 2 - Bank Exams MCQ

30 Questions MCQ Test Mock Test Series for JAIIB Exam 2025 - Test: Principles and Practices of Banking - 2

Mr. Patnaik, who is the founder of Alpha deal Associates, asked his operation team and planning team for preparing a business plan for next year on the basis of the analysis and the scenario of market risk. Mr. Mishra who is Chief planning officers calls a general meeting and asked the team for analysing the market risk. For deeply analysing the market risk, the team must keep focus on certain variables defined by RBI. Among the below given risks which of the following parameter the team can ignore in preparing the market risk progression?

Mr. Shukla, who is the branch manager of a Maharashtra Grameen bank, trying to ensure that the funds are utilised for the sanctioned purposes and at the same time complying with all sanction terms and conditions, so that he can avoid the time lag and cost overruns and easily detect the early signals of incipient sickness in the units financed by banks and to initiate timely action for recovery or rehabilitation. Under the credit monitoring arrangements, he should ensure which of the following?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Central Vigilance Commission (CVC) is an apex Indian governmental body created in 1964 to address ______________.

Which of the following complaints will be entertained by consumer disputes redressal commission?

Among the given, which of the following is not included in the general details of the partnership deed in case of opening a partnership firm account?

Mrs. Dindekar, always gives importance to the quality of good as well as it should take rules and preferences in the account of morality, on the basis of which of the accounts, she is a standpoint?

For the funds availed under the Pradhan Mantri Rozgar Yojana in India. The repayments done in EMIs. What is the repayment schedule of the PMRY?

Under the prime minister rozgar yojana, preference is given to weaker sections including women. The scheme envisages __________ percent reservation for SC/ST and ____ percent for the other backward classes.

Which of the following is/are correct about the financing of self-help groups under PMRY?

I. The loan may be provided as per individual eligibility taking into account the requirement of the project

II. The upper ceiling on loan

III. Required margin money contribution (i.e., subsidy and margin to be equal to 20 percent of the project cost) should be brought in by the SHG collectively

IV. Required margin money contribution (i.e., subsidy and margin to be equal to 15 percent of the project cost) should be brought in by the SHG collectively

V. The exemption limit for obtaining collateral security will be Rs 5 lakh per borrower account for the project under the industry sector

Branch representatives should visit the village after ___________ of the second session to make sure that the residents received their cards.

Among the given, which of the following is not correctly matched?

Among the given, which of the following is/are the advantages of using a centralised data processing system?

For communication between the computers, the data has to travel through some medium during its transmission. Which of the following is/are the prevalent technology/technologies for data communication media?

I. Terrestrial

II. Microwave

III. Satellites

IV. Multiplexers

Which of the following was commenced by the RBI in 1991 and is a packet-switched X.25 based network with nodes at Mumbai, Delhi, Chennai and Kolkata, and a switching Centre at Nagpur?

The concept of good as opposed to evil helps us define the banking business from the point of view of ethics, and is known as ____________.

Among the given, which of the following statements is not correct in context to LAN?

_________ investigates whether morality exists.

Loan up-to how much rupees is given per borrower to dealers/ sellers of fertilizers, pesticides, seeds, cattle feed poultry feed, agricultural implements and other inputs?

Read the following statement and choose the correct option as per Importance of Ethics in Business.

Statement I: Accounting Ethics is primarily a field of applied ethics, the study of moral values and judgements as these apply to accountancy.

Statement II: First introduced by Florina Edward, the 15th century Mathematician and later expanded by governments, Professional organizations and independent companies.

_______ complaints will not be covered under the Scheme and such complaints will not be entertained.

Among the given under which of the following cases the automatic right of set off is not arises without any notice?

In the case of a personal loan, the eligibility of the amount is what percent of gross loan?

RTGS offers the following advantage(s) over the other modes of funds transfer _____.

Which of the following is false about Rangarajan Committee recommendations on computerisation in banking?

Among the given, which of the following is an advantage of update driven methodology?

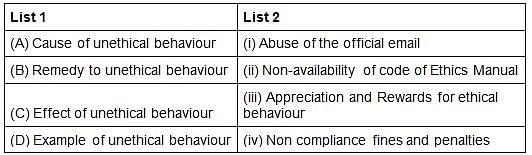

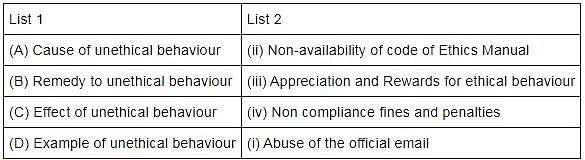

Among the below given matches, which of the following is correctly matched on the basis of the business ethics and business values?

Smart card with an embedded Microchip, provides multiple options _____. Which of the following is/are Smart Card (s) ?

Among the given which of the following are the initiatives taken by BCSBI for spreading awareness of the codes amongst customers and banks?

Which of the following are correct as regards to time deposits?

I. Repaid after the expiry of the Deposit Period.

II. High-interest rates, which vary according to period.

III. Time deposits from 7 days to 120 months period with or without reinvestment plans.