Test: Accounting & Financial Management of Banking - 1 - Bank Exams MCQ

30 Questions MCQ Test Mock Test Series for JAIIB Exam 2025 - Test: Accounting & Financial Management of Banking - 1

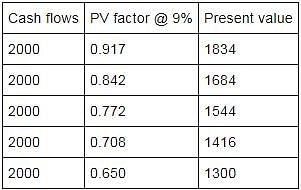

Mr X made an investment of ₹ 8,000 and expects a return of ₹2000 per annum for 5 years. What is the net present value of cash flow assuming the discount rate as 9%?

Which of the following scenarios will result in a higher profit as per absorption costing compared to the profit calculated by marginal costing approach?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Which of the following is a component of a standard costing system?

(l) Establishment of standard costs for materials, labor, and overheads for a particular production line

(ll) Developing a marketing plan for the products

(lll) Comparison of actual costs with the established standards to determine the variances

(lV) Analysis of the variances and initiation of corrective actions where necessary

(l) Establishment of standard costs for materials, labor, and overheads for a particular production line

(ll) Developing a marketing plan for the products

(lll) Comparison of actual costs with the established standards to determine the variances

(lV) Analysis of the variances and initiation of corrective actions where necessary

Marginal Cost of Capital is calculated using which of the following Formula?

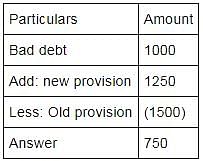

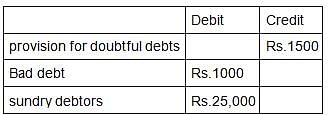

From the following information identify the total amount that should be debited to P&L account

Trial balance

Adjustment :

Maintain the provision at 5% on sundry debtors

Assertion: The current yield of a bond increases when the bond's market price decreases.

Reason: Current yield of bond is calculated by dividing the bond's annual interest payment by its current market price

Tax at source is not deductible under which of the following interest payable

I. National Development Bonds

II. 7-year National Savings Certificates (IV Issue)

III. Debentures issued by any institution or authority or any public sector company or any cooperative society

__________ helps in the review of the current trends and framing of future policies.

What is the purpose of preparing a bank reconciliation statement?

I. Detecting errors such as double payments, missed payments, calculation errors etc.

II. Tracking and adding bank fees and penalties in the books

III. Spot fraudulent transactions and theft

IV. Keeping track of accounts payable and receivables of the business

Given below is one of the features related to double entry system, the statement in incomplete, comprehend the feature of the following and complete the sentence.

Double Entry System does not record _______________aspects of the transaction.

Which of the following statement is correct regarding the approaches for determining the working capital mix

I. According to the hedging approach the permanent working capital requirements should be financed by long term funds while the temporary capital requirement should be financed out of a short term fund.

II. According to conservative approach all requirements of working capital fund should be met from the long term source

III. According to an aggressive approach the firm relies more on short term sources than long term sources to finance its current asset.

Match the examples with following types of profits and losses.

What are the benefits of GST compliance for businesses in India?

(l) Streamlining of the tax system

(ll) increased compliance burden

(lll) Increased tax revenue for the government

(lV) Reduction in tax evasion

Which of the following statement/s is/are correct regarding accounting ratio?

I. Accounting ratios are a group of metrics used to measure the efficiency and profitability of a company based on its financial reports.

II. An accounting ratio compares two line items in a company's financial statements

III. Accounting ratios are used by both the company itself to make improvements or monitor progress as well as by investors to determine the best investment option

IV. These ratios can be used to evaluate a company's fundamentals and provide information about the performance of the company over the last quarter or fiscal year.

Which of the following statement/s is/are correct regarding Accounting standards?

I. Accounting standards codified the generally accepted principle

II. Accounting standards are regulatory framework within which financial statements are prepared

III. The rule that ensure uniformity in preparation, presentation and reporting of accounting information

IV. It harmonize diverse accounting practice

A company reports a positive change in working capital and a negative change in long term investments. What can be inferred about the company's fund flow?

Which of the following statement/s is/are correct regarding equity share capital.

I. The dividend payable to equity shareholders is an appropriation of profit and not a charge against profit.

II. The dividend payable to equity shareholders is a charge against profit and not an appropriation of profit.

III. The company has no liability for cash outflows associated with the redemption of equity share capital.

IV. The company has liability for cash outflows associated with the redemption of equity share capital.

From the following balances, calculate the cost of goods sold during the year

Opening stock = 15000

Net purchase = 950000

Closing stock = 25000

Which of the following statement/s is/are correct regarding marginal costing and absorption costing?

I. In marginal costing only variable cost is allocated to a product

II. In absorption costing only fixed overhead cost is allocated to a product

III. In absorption costing variable cost and fixed overhead cost is allocated to a product

IV. In marginal costing variable cost and fixed overhead cost is allocated to a product

An entry made at the end of the financial year to record any unnoticed/unrecognized income or expenses of the period is known as___________.

Which of the following points is required for fund flow statement preparation ?

(I) Schedule of changes in working capital

(II) Statement of sources and application of fund

(III) Statement of fund from operations.

(IV) Statement of funds by other institutions.

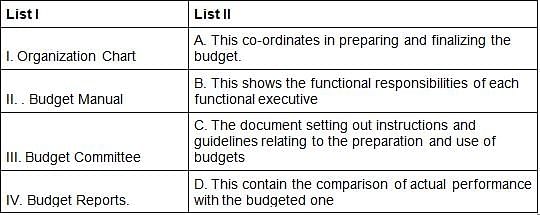

Match the following List I with List II

Which of the following statements are correct regarding the long term borrowings?

I. Where loans have been guaranteed by directors or others, the aggregate amount of such loans under each head shall be disclosed.

II. Period and amount of continuing default as on the balance sheet date in repayment of loans and interest, shall be specified separately in each case.

III. Where bonds/debentures are redeemable by installments, the date of maturity for this purpose must be reckoned as the date on which the first installment becomes due.

From the following statements choose the correct one.

From the following information find the amount of capital

Outsider's Claims - 170000

Bank - 42000

Stock - 30,000

Fixed asset - 500000

A firm produce 1000 units of TV, incurred fixed costs of 150000 and variable cost of 145 per unit. During the year, it sold all TV produced @ 450 per TV. What is the profit of the firm during the year?

Choose the correct statements.

I. A document used in job costing systems to record and track the direct and indirect costs associated with a particular job is known as a job cost card.

II. The method of costing in which the cost of production is calculated for each unit of product or services is known as product costing.

Equivalent production means converting incomplete production units into their equivalent completed units. Which of the following is true regarding the equivalent production concept applied in work in process?

From the following information calculate the quick ratio

Trade receivables= 7,00,000 Cash and cash equivalents = 2,50,000 Short term loans and advances = 45,000 Trade payables = 4,00,000, short term borrowings = 3,40,000, Inventories = 12,00,000. Tangible assets = 45,000,000, Share capital = 24,00,000, Reserve and surplus = 6,00,000

Which of the following statements are correct regarding the non-voting shares?

I. Such shareholders are entitled to all rights and bonus shares and enjoy voting rights.

II. Both private and public companies, limited by shares, can issue non-voting equity shares.

III. Only 25 per cent of the paid-up capital of the company can be issued as equity shares without voting rights.