Central Bank Apprentice Mock Test - 8 - Bank Exams MCQ

30 Questions MCQ Test Mock Test Series for Central Bank Apprentice Exam 2024 - Central Bank Apprentice Mock Test - 8

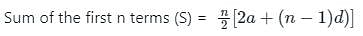

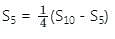

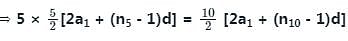

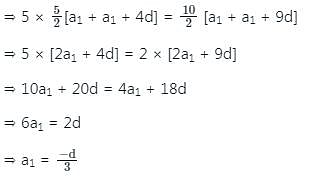

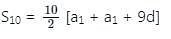

If the first term of an AP is 2 and the sum of the first five terms is equal to one-fourth of the sum of the next five terms, then what is the sum of the first ten terms?

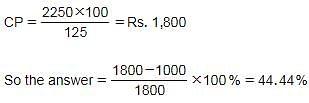

A shopkeeper sold an article for Rs. 2,250 and made a profit of 25%. Find his profit/loss percent if he had sold his article for Rs. 1,000.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

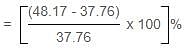

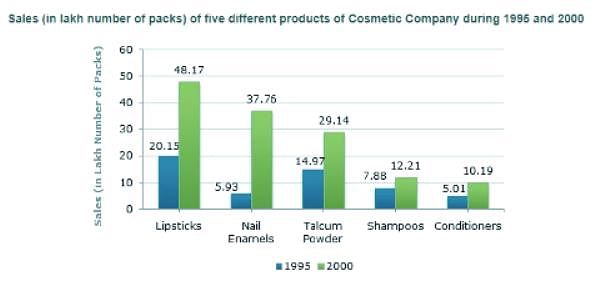

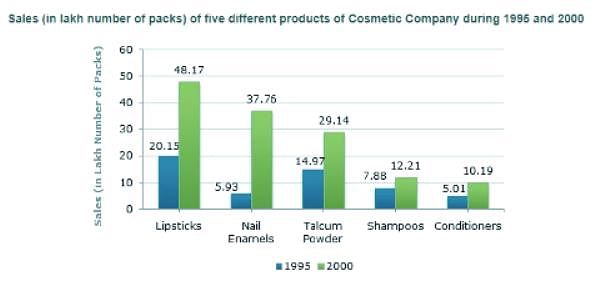

Direction: A cosmetic company provides five different products. The sales of these five products (in lakh number of packs) during 1995 and 2000 are shown in the following bar graph.

Q. The sales of lipsticks in 2000 was by what percent more than the sales of nail enamels in 2000? (rounded off to nearest integer)

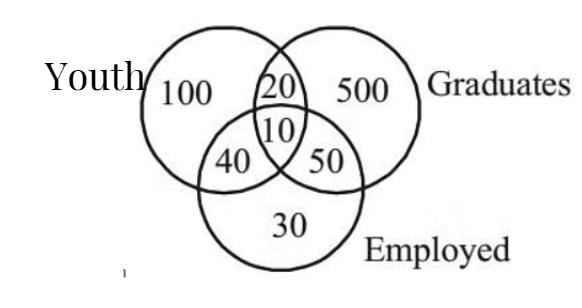

If the number indicates the number of persons, then how many youth graduates are there?

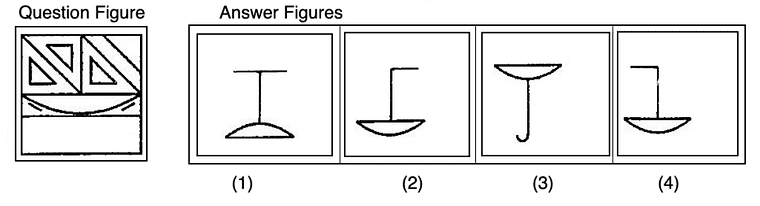

Choose the answer figure which is embedded in the question figure.

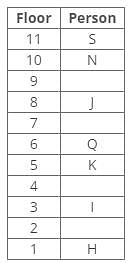

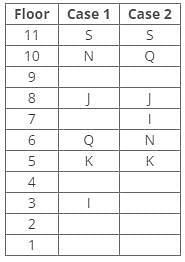

Direction: Study the following information and answer the given questions carefully.

A certain number of people live on different floors of a building, where the bottommost floor is numbered 1 and the floor above it is 2 and so on. There is no vacant floor in the building.

J lives three floors above K. One person lives between J and N. The number of persons living between Q and K is equal to the number of persons living between N and S. The number of persons living below H is equal to the number of persons living above S. Q lives three floors above I. The number of persons living between I and N is one less than the number of persons living below J. K lives on the 5th floor. S doesn’t live on a perfect square-numbered floor. One person lives between I and H. One person lives between Q and J.

Q. How many persons live above N?

Direction: Read the following passage carefully and answer the questions. Your answer to these questions should be based on passage only.

As concern about radiation from phones and base stations continues to grow, health experts advice a change of habits-spending less time on the phone, using landline, and texting rather than calling-to cut the risk. The risk of brain cancer as a result of excessive use of phones cannot be ruled out. Reduced use of mobile phones is advised, Cancer is an extreme example. We get many cases of parents complaining that their children lack concentration, get headache and have behavioral problems. This cannot be proved, though. A scientist with ICMR said exposure to radio frequency radiation has a thermal effects, caused by holding a phone close to the body, and also a non-thermal effect which can be attributed to the induced electromagnetic effects inside biological cells. The non-thermal effect is possibly more harmful. People who are chronically exposed to low level wireless antenna emissions and users of mobile phone handsets have reported feeling several unspecific symptoms.

Q. How can the chances of brain cancer be reduced?

Direction: Read the following passage carefully and answer the questions. Your answer to these questions should be based on passage only.

As concern about radiation from phones and base stations continues to grow, health experts advice a change of habits-spending less time on the phone, using landline, and texting rather than calling-to cut the risk. The risk of brain cancer as a result of excessive use of phones cannot be ruled out. Reduced use of mobile phones is advised, Cancer is an extreme example. We get many cases of parents complaining that their children lack concentration, get headache and have behavioral problems. This cannot be proved, though. A scientist with ICMR said exposure to radio frequency radiation has a thermal effects, caused by holding a phone close to the body, and also a non-thermal effect which can be attributed to the induced electromagnetic effects inside biological cells. The non-thermal effect is possibly more harmful. People who are chronically exposed to low level wireless antenna emissions and users of mobile phone handsets have reported feeling several unspecific symptoms.

Q. Which is more harmful out of the given below?

What document must be submitted to determine the financial standing of a company?

What is one key feature that distinguishes debit cards from credit cards ?

What is the primary benefit of using the Real-Time Gross Settlement (RTGS) system for fund transfers ?

What type of transactions are free of charge in the RTGS system ?