Accountancy: CUET Mock Test - 1 - CUET MCQ

30 Questions MCQ Test CUET Mock Test Series - Accountancy: CUET Mock Test - 1

In the absence of partnership deed or the partnership being silent, the Partnership Act, 1932 provides for no interest on

In absence of partnership deed, ______ partner gets more share of profit.

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Salary to a partner is _____ with respect to profit.

If a fixed amount is withdrawn on the last day of every quarter of a calendar year, the interest on the total amount of drawings will be calculated for __________.

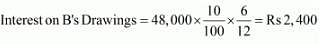

B and M are partners in a firm. They withdrew ₹ 48,000 and ₹ 36,000 respectively during the year evenly in the middle of every month. According to the partnership agreement, interest on drawings is to be charged @ 10% p.a.

Calculate interest on drawings of the partners using the appropriate formula.Calculate B interest

Interest on partner’s loan will be ______ to ______ account.

No interest is to be charged on drawings from the partners in case of ______.

Ram, Raghav and Raghu are partners in a firm sharing profits in the ratio of 5 : 3 : 2. As per partnership deed, Raghu is to get a minimum amount of ₹ 10,000 as profit. Net profit for the year is ₹ 40,000. Calculate deficiency (if any) to Raghu.

I f a partner withdraws equal am ount at end of each quarter, then _____ are to be considered for interest on total drawings.

Moin and Azam are partners in a firm with capital ₹ 20,000 and ₹ 40,000 respectively. Profit for FY 21 are ₹ 60,000 . Who will get how much share?

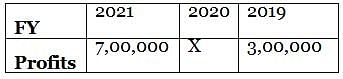

Goodwill of Indian bears, a partnership firm, is ₹ 10,00,000 calculated on 2.5 years’ purchase of average profits of last 3 years.

What is value of X?

Competency of management does not affect goodwill.

For valuation of goodwill, normal profit is calculated by ______ abnormal gains and ______ abnormal losses.

Goodwill calculated by one method is equal to goodwill calculated by any other method.

As per AS-26, self-generated goodwill is recorded in the books.

Non-business incomes are added while calculating average profits.

Assertion(A): The factors which affect profits, also affect goodwill.

Reason(R): Profits are directly related to goodwill.

Read the following case study and answer question on the basis of the same.

Tony and Rony started a partnership firm, TR CDs to manufacture music CDs way back in 1990. Now since the music CDs are out of business, they plan to sell the business to one of the major content production houses in Mumbai. For the purpose of selling business, they reached to their accountant to calculate the goodwill and other financial advice. He suggested that since the CDs are very less in demand, their goodwill value will be hampered. Nonetheless, the framework for goodwill calculation was decided as follows

‘The goodwill be valued at 4 years’ purchase of super profits.’ The following financial information was obtained at the end of this transaction

Assets

- ₹ 8,000

- Creditors ₹ 1,000

- Normal rate of return 10%

- Goodwill of the firm ₹ 1,000

. What is the super profit of business?

Which of these ways lead to reconstitution of partnership firm?

|

8 docs|148 tests

|