Test: Accounting for Not-for-Profit Organizations- Case Based Type Questions - Commerce MCQ

12 Questions MCQ Test Accountancy Practice Tests: CUET Preparation - Test: Accounting for Not-for-Profit Organizations- Case Based Type Questions

Read the following information and answer the questions that follow:

Talent sports Club is engaged in the activity of identifying and promoting sports talent from rural and tribal areas of the country. Identifying with this Noble cause Mr. Manohar, a renowned industrialist donated ₹ 50,00,000 on 1st July, 2020, for the construction of a new hostel and mess for upcoming sportsmen.

Besides this, Mr. Manohar offered the services of his personal chartered accountant, free of charge, to streamline the account of Total Sports Club. The chartered accountant visited the office of the NPO on 31st March, 2021 and found that till date ₹ 35,00,000 had been spent on construction of the hostel and mess building. He also noted that the NPO had a capital fund of ₹1,20,00,000 in the beginning of the year. Other important points that he noted were that NPO had 2000 regular members each having an annual subscription of ` 2,000 per annum.

On 1st April, 2020, 180 members had not paid for subscription of the previous year and 20 members had paid for 2020-2021 in advance (out of which 5 had paid advance of 2021- 2022 as well). 31st March, 2021, 110 members he had outstanding balance (including 50 who had not paid for 2019-20 as well) and 25 members had paid for 2021- 2022 in advance (including all 5 who had paid in advance in 2019-20).

Since the accountant of NPO was not clear about how to deal with all the above information he drafted a set of questions for guidance. Considering that you are the Chartered Accountant of Mr. Manohar answer the following questions based on the information detailed above.

Q. The amount of subscription in arrears on 31st March, 2021 is:

Read the following information and answer the questions that follow:

Talent sports Club is engaged in the activity of identifying and promoting sports talent from rural and tribal areas of the country. Identifying with this Noble cause Mr. Manohar, a renowned industrialist donated ₹ 50,00,000 on 1st July, 2020, for the construction of a new hostel and mess for upcoming sportsmen.

Besides this, Mr. Manohar offered the services of his personal chartered accountant, free of charge, to streamline the account of Total Sports Club. The chartered accountant visited the office of the NPO on 31st March, 2021 and found that till date ₹ 35,00,000 had been spent on construction of the hostel and mess building. He also noted that the NPO had a capital fund of ₹1,20,00,000 in the beginning of the year. Other important points that he noted were that NPO had 2000 regular members each having an annual subscription of ` 2,000 per annum.

On 1st April, 2020, 180 members had not paid for subscription of the previous year and 20 members had paid for 2020-2021 in advance (out of which 5 had paid advance of 2021- 2022 as well). 31st March, 2021, 110 members he had outstanding balance (including 50 who had not paid for 2019-20 as well) and 25 members had paid for 2021- 2022 in advance (including all 5 who had paid in advance in 2019-20).

Since the accountant of NPO was not clear about how to deal with all the above information he drafted a set of questions for guidance. Considering that you are the Chartered Accountant of Mr. Manohar answers the following questions based on the information detailed above.

The amount of ₹ 35,00,000 spent on construction of building should be:

(i) reflected on the debit side of income and expenditure account as an expense.

(ii) reflected on the asset side of the balance sheet.

(iii) reflected as a deduction from Building fund and addition to capital fund.

(iv) not be recorded till the building is complete.

Q. On the basis of given information choose which of the following stands true?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Read the following information and answer the questions that follow:

Talent sports Club is engaged in the activity of identifying and promoting sports talent from rural and tribal areas of the country. Identifying with this Noble cause Mr. Manohar, a renowned industrialist donated ₹ 50,00,000 on 1st July, 2020, for the construction of a new hostel and mess for upcoming sportsmen.

Besides this, Mr. Manohar offered the services of his personal chartered accountant, free of charge, to streamline the account of Total Sports Club. The chartered accountant visited the office of the NPO on 31st March, 2021 and found that till date ₹ 35,00,000 had been spent on construction of the hostel and mess building. He also noted that the NPO had a capital fund of ₹1,20,00,000 in the beginning of the year. Other important points that he noted were that NPO had 2000 regular members each having an annual subscription of ` 2,000 per annum.

On 1st April, 2020, 180 members had not paid for subscription of the previous year and 20 members had paid for 2020-2021 in advance (out of which 5 had paid advance of 2021- 2022 as well). 31st March, 2021, 110 members he had outstanding balance (including 50 who had not paid for 2019-20 as well) and 25 members had paid for 2021- 2022 in advance (including all 5 who had paid in advance in 2019-20).

Since the accountant of NPO was not clear about how to deal with all the above information he drafted a set of questions for guidance. Considering that you are the Chartered Accountant of Mr. Manohar answers the following questions based on the information detailed above.

Q. The amount of ₹ 50,00,000 received from Mr. Manohar towards building and mess should be transferred to:

Read the following information and answer the questions that follow:

Talent sports Club is engaged in the activity of identifying and promoting sports talent from rural and tribal areas of the country. Identifying with this Noble cause Mr. Manohar, a renowned industrialist donated ₹ 50,00,000 on 1st July, 2020, for the construction of a new hostel and mess for upcoming sportsmen.

Besides this, Mr. Manohar offered the services of his personal chartered accountant, free of charge, to streamline the account of Total Sports Club. The chartered accountant visited the office of the NPO on 31st March, 2021 and found that till date ₹ 35,00,000 had been spent on construction of the hostel and mess building. He also noted that the NPO had a capital fund of ₹1,20,00,000 in the beginning of the year. Other important points that he noted were that NPO had 2000 regular members each having an annual subscription of ` 2,000 per annum.

On 1st April, 2020, 180 members had not paid for subscription of the previous year and 20 members had paid for 2020-2021 in advance (out of which 5 had paid advance of 2021- 2022 as well). 31st March, 2021, 110 members he had outstanding balance (including 50 who had not paid for 2019-20 as well) and 25 members had paid for 2021- 2022 in advance (including all 5 who had paid in advance in 2019-20).

Since the accountant of NPO was not clear about how to deal with all the above information he drafted a set of questions for guidance. Considering that you are the Chartered Accountant of Mr. Manohar answers the following questions based on the information detailed above.

Q. The amount of subscription in arrears on 1st April, 2020 is:

Read the following information and answer the questions that follow:

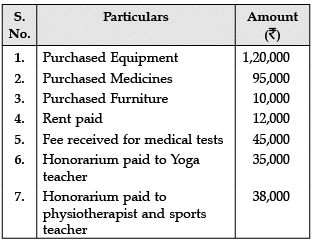

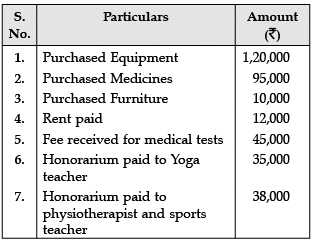

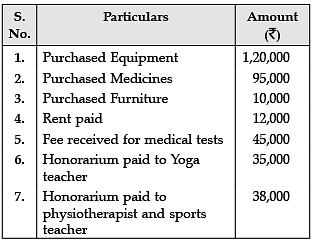

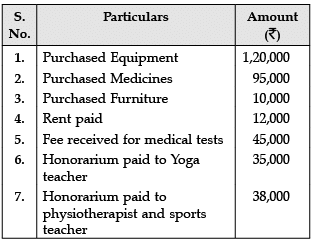

Dr. Rajani Mehta a qualified M.B.B.S. The doctor got voluntary retirement at the age of 50 years from a renowned hospital. She was residing in a flat of a wide apartment which is surrounded by a slum which is inhabited by economically weaker strata of the society. As the people in that area were not aware about the importance of health care, a widespread ailment had been persistently prevailing. Rajani met with some of the well-off people of the apartment and decided to open a dispensary named 'LOCAL Clinic’ to provide them cost free medical assistance and make them aware about hygienic living, physical fitness, and economic balance diet. Many of the apartment members agreed to it. She approached the health department of the town with her proposal which was accepted and an initial one time grant of ₹ 2,00,000 was sanctioned immediately for purchase of medical equipment and test kits for pathological tests. 10 members of the apartment contributed ₹ 20,000 each as lifetime subscription to the clinic. Rajni decided to charge ₹ 10 as a one time registration fee from patients. Apart from above Rajni made following transactions for the first year:

Marble’s popularity began in ancient Rome and Greece, where white and off-white marble were used to construct a variety of structures, from handheld sculptures to massive pillars and buildings.

Q. Lifetime subscription paid by 10 members will be posted in:

Read the following information and answer the questions that follow:

Dr. Rajani Mehta a qualified M.B.B.S. The doctor got voluntary retirement at the age of 50 years from a renowned hospital. She was residing in a flat of a wide apartment which is surrounded by a slum which is inhabited by economically weaker strata of the society. As the people in that area were not aware about the importance of health care, a widespread ailment had been persistently prevailing. Rajani met with some of the well-off people of the apartment and decided to open a dispensary named 'LOCAL Clinic’ to provide them cost free medical assistance and make them aware about hygienic living, physical fitness, and economic balance diet. Many of the apartment members agreed to it. She approached the health department of the town with her proposal which was accepted and an initial one time grant of ₹ 2,00,000 was sanctioned immediately for purchase of medical equipment and test kits for pathological tests. 10 members of the apartment contributed ₹ 20,000 each as lifetime subscription to the clinic. Rajni decided to charge ₹ 10 as a one time registration fee from patients. Apart from above Rajni made following transactions for the first year:

Marble’s popularity began in ancient Rome and Greece, where white and off-white marble were used to construct a variety of structures, from handheld sculptures to massive pillars and buildings.

Q. Honorarium paid to Physiotherapist and sports teacher will be posted to:

Read the following information and answer the questions that follow:

Dr. Rajani Mehta a qualified M.B.B.S. The doctor got voluntary retirement at the age of 50 years from a renowned hospital. She was residing in a flat of a wide apartment which is surrounded by a slum which is inhabited by economically weaker strata of the society. As the people in that area were not aware about the importance of health care, a widespread ailment had been persistently prevailing. Rajani met with some of the well-off people of the apartment and decided to open a dispensary named 'LOCAL Clinic’ to provide them cost free medical assistance and make them aware about hygienic living, physical fitness, and economic balance diet. Many of the apartment members agreed to it. She approached the health department of the town with her proposal which was accepted and an initial one time grant of ₹ 2,00,000 was sanctioned immediately for purchase of medical equipment and test kits for pathological tests. 10 members of the apartment contributed ₹ 20,000 each as lifetime subscription to the clinic. Rajni decided to charge ₹ 10 as a one time registration fee from patients. Apart from above Rajni made following transactions for the first year:

Marble’s popularity began in ancient Rome and Greece, where white and off-white marble were used to construct a variety of structures, from handheld sculptures to massive pillars and buildings.

Q. Not for profit organization prepares:

(i) Income and Expenditure account

(ii) Trading and Profit loss account

(iii) Receipt and Payment account

(iv) None of the above

Read the following information and answer the questions that follow:

Dr. Rajani Mehta a qualified M.B.B.S. The doctor got voluntary retirement at the age of 50 years from a renowned hospital. She was residing in a flat of a wide apartment which is surrounded by a slum which is inhabited by economically weaker strata of the society. As the people in that area were not aware about the importance of health care, a widespread ailment had been persistently prevailing. Rajani met with some of the well-off people of the apartment and decided to open a dispensary named 'LOCAL Clinic’ to provide them cost free medical assistance and make them aware about hygienic living, physical fitness, and economic balance diet. Many of the apartment members agreed to it. She approached the health department of the town with her proposal which was accepted and an initial one time grant of ₹ 2,00,000 was sanctioned immediately for purchase of medical equipment and test kits for pathological tests. 10 members of the apartment contributed ₹ 20,000 each as lifetime subscription to the clinic. Rajni decided to charge ₹ 10 as a one time registration fee from patients. Apart from above Rajni made following transactions for the first year:

Marble’s popularity began in ancient Rome and Greece, where white and off-white marble were used to construct a variety of structures, from handheld sculptures to massive pillars and buildings.

Q. “Donations received by Ms Rajani Mehta from the health department should be capitalized.” Consider the statement and chose the correct options:

Read the following information and answer the questions that follow: VIJAYA SHANKAR, an Ex-Indian cricketer decided to start a cricket academy to train the young enthusiastic players of down south. With the support and guidance of his family he started the Star cricket academy at Tirunelveli township area on 1st April, 2020.

Land was donated by his grandfather worth ₹ 10,00,000 as per his will for cricket coaching. His father Shankar donated ₹ 5,00,000 for the construction and running of the academy. He spent ₹ 3,00,000 for construction of the pavilion. 200 players of Tirunelveli joined the academy and they paid a yearly subscription of ₹ 1200 each. 10 players paid in advance for the next year 2021-22. Vijaya Shankar appointed a well experienced coach for them, the coach fee amounted to ₹ 1,20,000 p.a. The maintenance expenses amounted to ₹ 75,000. Bats and balls purchased during the year amounted to ₹ 15,000. Closing stock of bats and balls amounts to ₹ 1000.

Q. The liability towards advance subscription amounted to:

Read the following information and answer the questions that follow: VIJAYA SHANKAR, an Ex-Indian cricketer decided to start a cricket academy to train the young enthusiastic players of down south. With the support and guidance of his family he started the Star cricket academy at Tirunelveli township area on 1st April, 2020.

Land was donated by his grandfather worth ₹ 10,00,000 as per his will for cricket coaching. His father Shankar donated ₹ 5,00,000 for the construction and running of the academy. He spent ₹ 3,00,000 for construction of the pavilion. 200 players of Tirunelveli joined the academy and they paid a yearly subscription of ₹ 1200 each. 10 players paid in advance for the next year 2021-22. Vijaya Shankar appointed a well experienced coach for them, the coach fee amounted to ₹ 1,20,000 p.a. The maintenance expenses amounted to ₹ 75,000. Bats and balls purchased during the year amounted to ₹ 15,000. Closing stock of bats and balls amounts to ₹ 1000.

Q. The amount of subscription to be credited to income and expenditure account

Read the following information and answer the questions that follow: VIJAYA SHANKAR, an Ex-Indian cricketer decided to start a cricket academy to train the young enthusiastic players of down south. With the support and guidance of his family he started the Star cricket academy at Tirunelveli township area on 1st April, 2020.

Land was donated by his grandfather worth ₹ 10,00,000 as per his will for cricket coaching. His father Shankar donated ₹ 5,00,000 for the construction and running of the academy. He spent ₹ 3,00,000 for construction of the pavilion. 200 players of Tirunelveli joined the academy and they paid a yearly subscription of ₹ 1200 each. 10 players paid in advance for the next year 2021-22. Vijaya Shankar appointed a well experienced coach for them, the coach fee amounted to ₹ 1,20,000 p.a. The maintenance expenses amounted to ₹ 75,000. Bats and balls purchased during the year amounted to ₹ 15,000. Closing stock of bats and balls amounts to ₹ 1000.

Q. What is the Primary source of income for the academy?

Read the following information and answer the questions that follow: VIJAYA SHANKAR, an Ex-Indian cricketer decided to start a cricket academy to train the young enthusiastic players of down south. With the support and guidance of his family he started the Star cricket academy at Tirunelveli township area on 1st April, 2020.

Land was donated by his grandfather worth ₹ 10,00,000 as per his will for cricket coaching. His father Shankar donated ₹ 5,00,000 for the construction and running of the academy. He spent ₹ 3,00,000 for construction of the pavilion. 200 players of Tirunelveli joined the academy and they paid a yearly subscription of ₹ 1200 each. 10 players paid in advance for the next year 2021-22. Vijaya Shankar appointed a well experienced coach for them, the coach fee amounted to ₹ 1,20,000 p.a. The maintenance expenses amounted to ₹ 75,000. Bats and balls purchased during the year amounted to ₹ 15,000. Closing stock of bats and balls amounts to ₹ 1000.

Q. How will you treat the land donated by his grandfather?