Test: Final Accounts Of Manufacturing Entities - 1 - CA Foundation MCQ

30 Questions MCQ Test Accounting for CA Foundation - Test: Final Accounts Of Manufacturing Entities - 1

Pick up the correct answer from the given choices(only one correct answer):

Q. The balance of the petty cash is

Pick up the correct answer from the given choices(only one correct answer):

Q. Fixed assets are

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Pick up the correct answer from the given choices(only one correct answer):

Q. Goodwill is

Pick up the correct answer from the given choices(only one correct answer):

Q. Stock is

Pick up the correct answer from the given choices(only one correct answer):

Q. The manufacturing account is prepared:

A new firm commenced business on 1st January, 2006 and purchased goods costing Rs. 90,000 during the year. A sum of Rs. 6,000 was spent on freight inwards. At the end of the year the cost of goods still unsold was Rs. 12,000. Sales during the year Rs. 1,20,000. What is the gross profit earned by the firm?

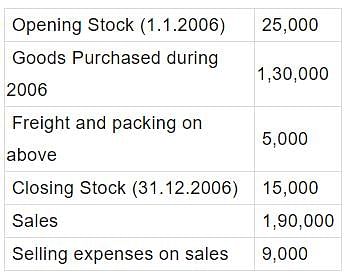

From the following figures ascertain the gross profit:

Rs.

A prepayment of insurance premium will appear in the Balance Sheet and in the Insurance Account respectively as:

Under-statement of closing work in progress in the period will

If sales revenues are Rs. 4,00,000; cost of goods sold is Rs. 3,10,000 and operating expenses are Rs. 60,000, the gross profit is

A Company wishes to earn a 20% profit margin on selling price. Which of the following is the profit mark up on cost, which will achieve the required profit margin?

If sales are Rs. 2,000 and the rate of gross profit on cost of goods sold is 25%, then the cost of goods sold will be

Sales for the year ended 31st March, 2005 amounted to Rs. 10,00,000. Sales included goods sold to Mr. A for Rs. 50,000 at a profit of 20% on cost. Such goods are still lying in the godown at the buyer’s risk. Therefore, such goods should be treated as part of

The capital of a sole trader would change as a result of:

Rent paid on 1 October, 2004 for the year to 30 September, 2005 was Rs. 1,200 andrent paid on 1 October, 2005 for the year to 30 September, 2006 was Rs. 1,600. Rent payable, as shown in the profit and loss account for the year ended 31 December 2005, would be:

A decrease in the provision for doubtful debts would result in:

Profit is the difference between?

The cost of goods sold for the month of June, 2006 is:

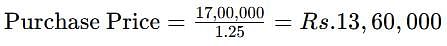

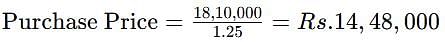

Stock purchased in July, 2006 is:

The cost of raw materials consumed, issued and used were:

The manufacturing cost of finished goods produced were:

The manufacturing cost of finished goods sold was:

What does the "cost of goods manufactured" include in the final accounts of a manufacturing entity?

|

68 videos|186 docs|83 tests

|

|

68 videos|186 docs|83 tests

|