Test: Accounting Ratios- Case Based Type Questions - Commerce MCQ

12 Questions MCQ Test Online MCQ Tests for Commerce - Test: Accounting Ratios- Case Based Type Questions

Read the following hypothetical extract of ABC Ltd. and answer the questions that follow: The following information are given:

Trade Receivables Turnover Ratio 4 times

Current Liabilities ₹ 5,000

Average Debtors ₹ 1,80,000

Working Capital Turnover Ratio 8 times

Cash Revenue from Operations 25% of Revenue from Operations

Gross Profit Ratio

What will be the value of current assets?

Read the following hypothetical extract of ABC Ltd. and answer the questions that follow: The following information are given:

Trade Receivables Turnover Ratio 4 times

Current Liabilities ₹ 5,000

Average Debtors ₹ 1,80,000

Working Capital Turnover Ratio 8 times

Cash Revenue from Operations 25% of Revenue from Operations

Gross Profit Ratio

What is the revenue from operations?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Read the following hypothetical extract of ABC Ltd. and answer the questions that follow: The following information are given:

Trade Receivables Turnover Ratio 4 times

Current Liabilities ₹ 5,000

Average Debtors ₹ 1,80,000

Working Capital Turnover Ratio 8 times

Cash Revenue from Operations 25% of Revenue from Operations

Gross Profit Ratio

What is the working Capital?

Read the following hypothetical extract of ABC Ltd. and answer the questions that follow: The following information are given:

Trade Receivables Turnover Ratio 4 times

Current Liabilities ₹ 5,000

Average Debtors ₹ 1,80,000

Working Capital Turnover Ratio 8 times

Cash Revenue from Operations 25% of Revenue from Operations

Gross Profit Ratio ![]()

What is the Gross Profit?

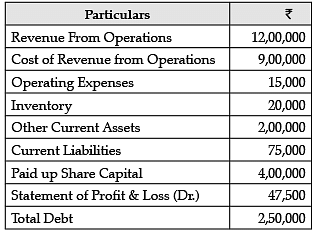

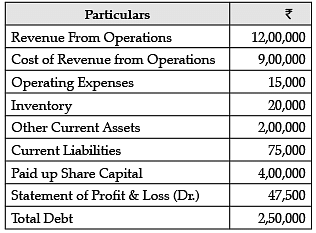

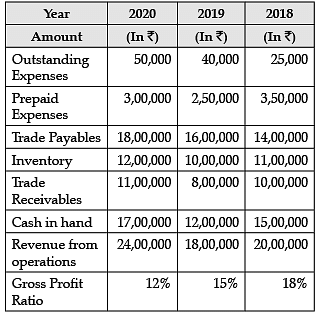

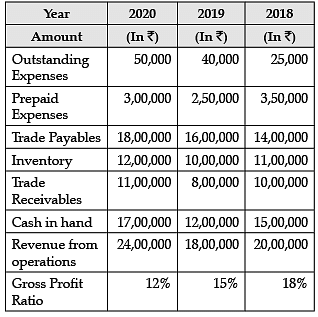

Consider the following data and answer the questions that follow:

What is the working capital turnover ratio?

Consider the following data and answer the questions that follow:

What is the Operating ratio?

Consider the following data and answer the questions that follow:

What is the Debt to Equity Ratio?

Consider the following data and answer the questions that follow:

What is the quick ratio?

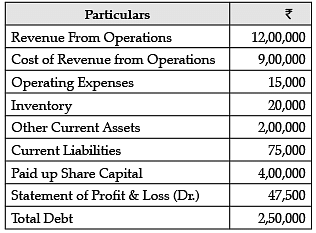

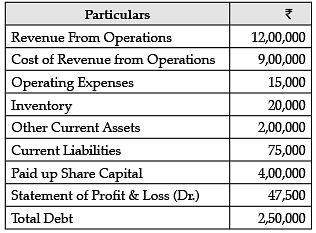

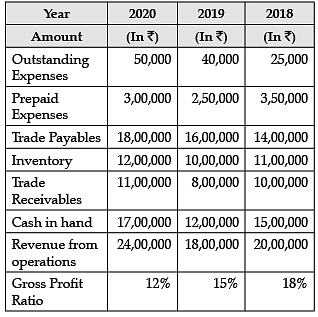

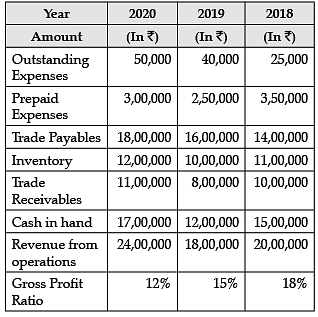

Read the following information and answer the given questions:

Cost of Revenue from Operations for the year 2020 would be ______________.

Read the following information and answer the given questions:

Current Ratio for the year 2020 will be_____. (Choose the correct alternative)

Read the following information and answer the given questions:

Inventory turnover ratio for the year 2020 will be______.(Choose the correct alternative)

Read the following information and answer the given questions:

Quick Ratio for the year 2018 will be_____________. (Choose the correct alternative)

|

705 tests

|