TS SET Paper 2 Mock Test - 7 (Commerce) - TS TET MCQ

30 Questions MCQ Test TS SET Mock Test Series 2024 - TS SET Paper 2 Mock Test - 7 (Commerce)

Direction: For the Assertion (A) and Reason (R) given below, choose the correct alternative.

Assertion (A): Most of the development banks in India have set up private commercial banks after the introduction of capital adequacy norms.

Reason (R): Development banks in India have not adhered to their basic objectives.

In the case of a Giffen good, a fall in its price tends to

In rounding of the income under Section 288 A of the Income Tax Act, the rounding off is done:

Given below are two statements, one labelled as Assertion (A) and the other labeled as Reason (R). Read the statements and choose the correct answer using the code given below.

Assertion (A): Consumers need to be given legal protection against certain trade practices and business methods.

Reason (R): Protection as per market forces and 'Caveat Emptor' is not enough as perfectly competitive market is an economist's dream and consumer sovereignty is a myth.

Which of the following is/are the characteristic(s) of Business Economics ?

i. Business economics is micro economic in character.

ii. It is positive in nature.

iii. It is both conceptual and metrical.

iv. Its contents are based mainly on the theory of firm.

The process of gathering, sorting, analyzing, and disseminating marketing information for businesses to make daily business decisions is called?

Direction: Given below are two statements, one labeled as Assertion (A) and the other labeled as Reason (R). Choose which of the following alternatives is correct.

Assertion (A): Family pension is not taxable.

Reason (R): The person who receives the family pension was not an employee but despendent of the employee.

Direction In the question given below are two statements labelled as Assertion (A) and Reason (R). In the context of the two statements, which one of the following is correct?

Assertion (A) SEBI has power to compel listing of securities by public companies.

Reason (R) SEBI has power to regulate insider trading or can regulate the functions of merchant bankers.

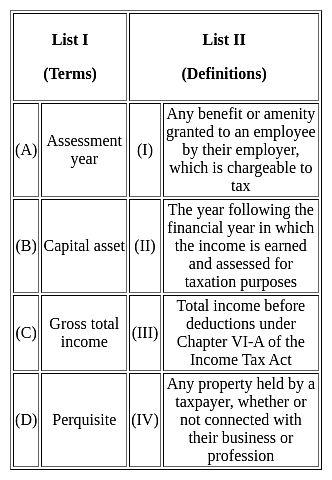

Match the following terms used in the Income Tax Act 1961 with their respective definitions:

Investment in which of the following is most risky?

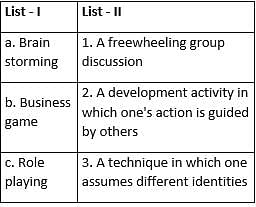

Match the items in List I with the items in List II.

A list of all the units of population and their description understudy is called?

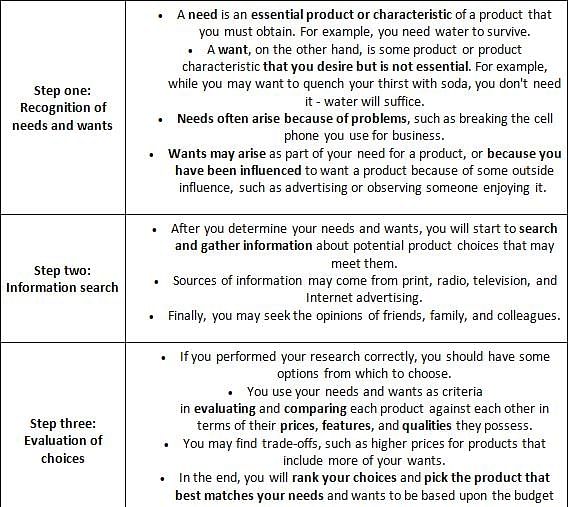

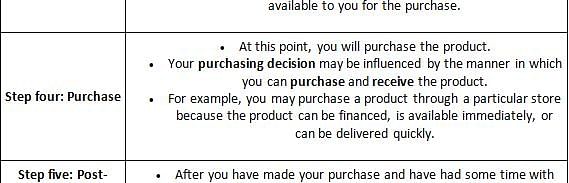

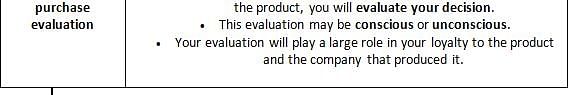

Which of the following is the last stage in consumer decision process?

Reason: The absence of non-verbal cues in digital communication can lead to misinterpretations and misunderstandings.

Direction: For the following two statements of Assertion (A) and Reason (R), indicate the correct code:

Assertion (A): The quantity of a commodity demanded invariably changes inversely to changes in its price.

Reason (R): The price effect is the net result of the positive substitution effect and a negative income effect.

Which of the following motives were articulated by J. M. Keynes for holding cash?

A. Precautionary

B. Return generation

C. Speculative

D. Investment

E. Transaction

Choose the correct answer from the options given below:

Adjusting Financial Statements of the company as per price indexes is a practice under:

|

60 tests

|