TS SET Paper 2 Mock Test - 10 (Commerce) - TS TET MCQ

30 Questions MCQ Test TS SET Mock Test Series 2024 - TS SET Paper 2 Mock Test - 10 (Commerce)

Who among the following has never been a Governor for Reserve Bank of India?

Which of the following is a supply strategy?

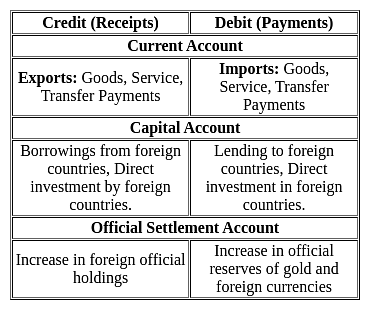

In the balance of payment account, the transfer payments are included in which one of the following?

Which of the following are true about conditions according to the Sale of Goods Act?

a) Title

b) Description

c) Quite possession

d) Encumbrances

Choose the correct answer from the following options

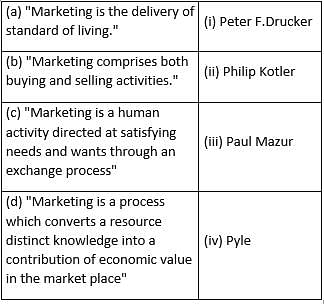

Match the following statements with their authors.

Which of the following is not an example of probability sampling?

Which of the following is correct with respect to GST in India?

I. GST The Act was passed by the Parliament in 2016.

II. GST The law came into force from July 2016.

With reference to the Exim policy of India, which of the following is not true?

Which of the following tests are not recommended for the top-level positions?

Which of the following incomes are exempt from tax?

1. Dividend received from the foreign company.

2. Agricultural income.

3. Remuneration received by an individual who is not a citizen of India

4. Long term Capital gain income (Below 1 lakh).

5. Dividend received from an Indian company.

6. Rental income of house property.

Codes:

Arrange the following in descending order of importance

A. Free Trade Area

B. Customs union

C. Economic cooperation

D. Economic union

E. Common markets

Choose the correct answer from the options given below:

Assertion: 'Positioning' involves creating a distinct market space that differentiates the product from competitors.

Reason: Positioning aligns the business’s offering with the needs of the targeted segments by developing a unique selling proposition.

Which of the following was the battle cry of the American Revolution?

Which of the following tells why the nobles revolted against King John?

Direction: The following are the two statements regarding elasticity of demand and its measurement.

Statement I: On every point on the straight line demand curve, the point elasticities are all equal

Statement II: On every point on the rectangular hyperbola shaped demand curve, the point elasticities are not equal

Select the correct option for those below:

|

60 tests

|