APSET Paper 2 Mock Test - 7 (Commerce) - AP TET MCQ

30 Questions MCQ Test APSET Mock Test Series 2025 - APSET Paper 2 Mock Test - 7 (Commerce)

The call-option value of a callable bond is likely to be high when :

In the line and staff form, the function of the marketing manager is to:

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Which of the following is the correct explanation of resource-based approach?

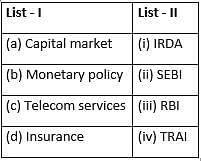

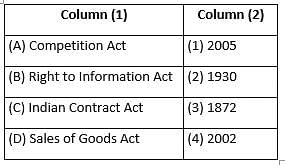

Match the columns and choose the correct pairs from the options.

Given below are two statements, one labelled as Assertion (A) and the other labeled as Reason (R). Read the statements and choose the correct answer using the code given below.

Assertion (A): Consumers need to be given legal protection against certain trade practices and business methods.

Reason (R): Protection as per market forces and 'Caveat Emptor' is not enough as perfectly competitive market is an economist's dream and consumer sovereignty is a myth.

Which of the following is/are the source(s) of short-term finance?

Consider the following conditions:

(a) An individual is in India for a period of 182 days in the financial year in which he is getting his salary income.

(b) An individual is in India for a period of 60 days or more during the financial year in which he gets his salary and 365 days or more during 4 years immediately preceding to that financial year.

If one of the above conditions is satisfied, as per the provisions of Income Tax Act, 1961, he is:

Which of the following is/are the characteristic(s) of Business Economics ?

i. Business economics is micro economic in character.

ii. It is positive in nature.

iii. It is both conceptual and metrical.

iv. Its contents are based mainly on the theory of firm.

The estimated requirement of total funds for working capital met from long-run sources is known as:

Choose the correct code for the following statements being correct or incorrect.

Statement I : Intellectual Property (IP) is a category of property that includes intangible creations of the human intellect.

Statement II : IPR does not include trade secrets and moral rights.

Reason: The absence of non-verbal cues in digital communication can lead to misinterpretations and misunderstandings.

Duties of bailor include

A. Take care of goods

B. Bear extraordinary expenses

C. Return accretion to the goods

D. Indemnify the bailee

E. Disclose known faults

Choose the correct answer from the options given below:

The Right to Information Act, 2005 makes the provision of _________________.

Adjusting Financial Statements of the company as per price indexes is a practice under:

Statement I: Data material held in any electronic form is 'information' under RTI Act, 2005.

Statement II: IT Act, 2000 came into force on 10th October, 2000.

Choose the correct code:

Which of the following relationships raise presumptions of undue influence?

A. Parent and child

B. Doctor and patient

C. Husband and wife

D. Fiance and fiancee

E. Creditor and debtor

Choose the correct answer from the options given below:

Which of the following is not the part of net invisibles of Balance of Payments Current Account?

|

60 tests

|