Test: Rectification Of Errors - 3 - Commerce MCQ

25 Questions MCQ Test Accountancy Class 11 - Test: Rectification Of Errors - 3

Classify the errors : Goods taken away by the proprietor for personal use not recorded anywhere.

Which type of error occurs when credit sale is wrongly posted to purchases book?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Classify the errors : Repairs of newly purchased second hand machinery debited to repairs accounts.

Old office furniture sold to Sethi for Rs. 2,000 was entered in the Sales Book. The book value of furniture sold was Rs. 2,500. Rectification entry would be:

Goods worth Rs. 50 given as charity should be credited to

Rs. 200 received from Smith shoes account, was written off as a bad debt should be credited to :

Goods purchased from Keshav Rs. 13,500 has been recorded as Rs. 13,000 in Purchase Book. The error in this entry is:

Classify the errors :The total of sales book was not posted to the ledger.

Rectification entries are first recorded in __________

If purchase of goods amounting Rs. 500 has been wrongly posted to credit side of purchase account. The difference in the Trial Balance would be:

If One of the cars purchased by a car dealer is used for business purpose and has been debited to goods for resale A/c, then the rectification entry will be

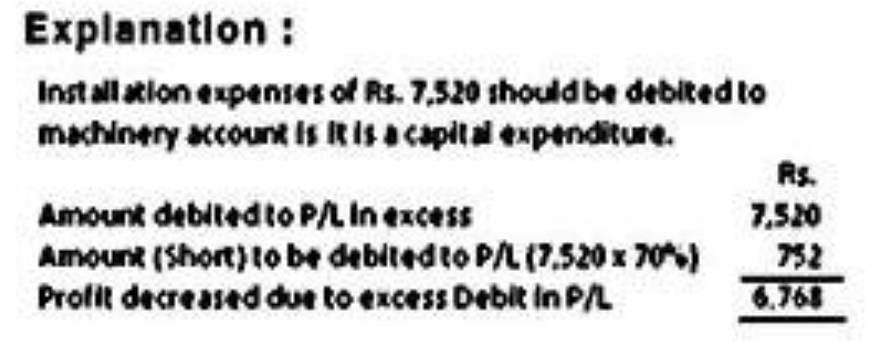

Hari charges 10% depreciation on plant and machinery. On 1st April 2011 he debited Rs. 7,520 paid on installation of plant and machinery to profit and loss account. At the time of preparing final accounts on 31st March, 2012 due to this error,

The following errors were detected in the books of Shreay Ltd. while preparing the final accounts:

1. A Cheque received for Rs. 3,100 from Franc & Co. was dishonoured and debited to discount account

2. The sales account has been totaled short by Rs. 23,000

3. Goods of Rs. 1,200 returned by Kumar & Sons were included in stock but no entry was made in the books.

After rectifying above mistakes, net profit will

Goods of Rs. 1,000 purchased from Mr. “A” were recorded in sales book, the rectification of this error will?

The goods sold for Rs. 900 but the amount was entered in the sales Account as Rs. 1080. On Rectification, suspense account will be:

Bill accepted by Govinda was discounted with the bank for Rs. 2000. On the due date the bill was dishonoured. However, there is error of Omission towards Bills dishonoured. Journal Entry for rectification will be:-

Goods purchased of Rs. 100 from N was not recorded at all. What will be its effect on the trial Balance?

Credit sale of Rs. 10,000 made to Sallu was passed through purchase book. The proper entry for rectification was the following :

Wages paid for the erection of a machine debited to Wages A/c is an example of :

Purchase of office furniture Rs. 1,200 has been debited to General Expense Account. It is:

Goods worth Rs. 750 were purchased from S & Co. but while posting wrong debut was given to R & Co. The total of credit side of the trial balance was Rs. 43,750. Assuming that this is the only error, the total of the debit side of the trial balance was:

Sale of old furniture is erraneously entered in sales book. Rectification entry will be:

If a purchase return of Rs. 1,000 has been wrongly posted to the debit of the sales returns account, but has been correctly entered in the suppliers’ account, the total of the

When the total of trial balance is not reconciled, the account opened at this juncture is :

|

64 videos|153 docs|35 tests

|

|

64 videos|153 docs|35 tests

|