Test: Cash Flow Statements- Case Based Type Questions - Commerce MCQ

12 Questions MCQ Test Accountancy Practice Tests: CUET Preparation - Test: Cash Flow Statements- Case Based Type Questions

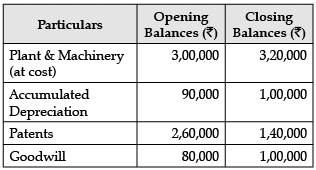

Read the following information and answer the questions that follow:

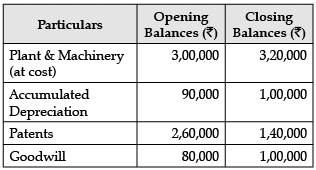

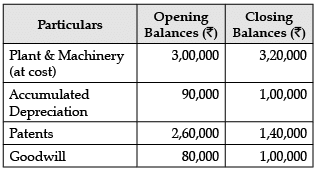

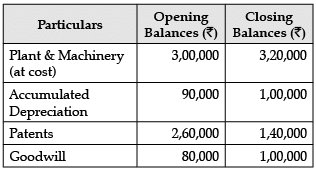

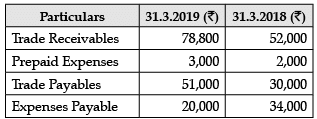

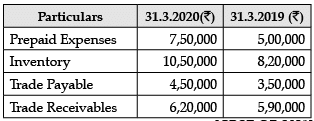

Following are the opening and closing balances of Jayesh Ltd.:

Additional information:

During the year :

(a) Depreciation charged on Plant and Machinery was ₹ 36,000.

(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.

(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.

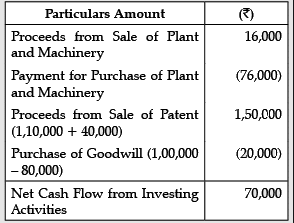

Q. What is the cash flow from investing activities?

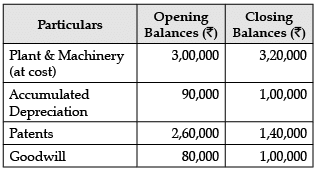

Read the following information and answer the questions that follow:

Following are the opening and closing balances of Jayesh Ltd.:

Additional information:

During the year :

(a) Depreciation charged on Plant and Machinery was ₹ 36,000.

(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.

(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.

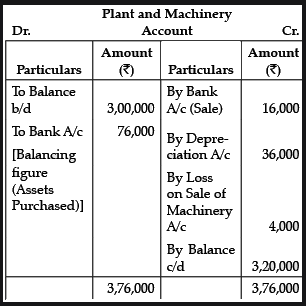

Q. What amount of machinery was purchased?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

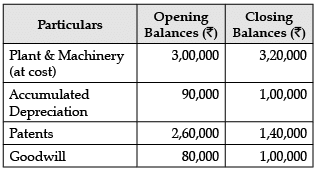

Read the following information and answer the questions that follow:

Following are the opening and closing balances of Jayesh Ltd.:

Additional information:

During the year :

(a) Depreciation charged on Plant and Machinery was ₹ 36,000.

(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.

(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.

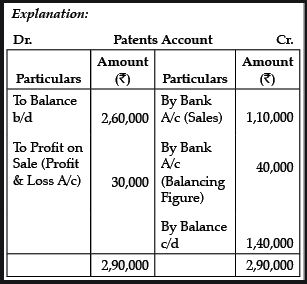

Q. What amount of Sales proceeds of Plant and Machinery will be added/subtracted?

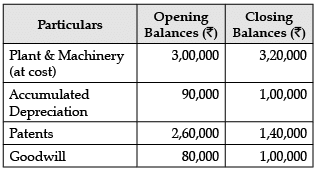

Read the following information and answer the questions that follow:

Following are the opening and closing balances of Jayesh Ltd.:

Additional information:

During the year :

(a) Depreciation charged on Plant and Machinery was ₹ 36,000.

(b) A machine having a book value of ₹ 20,000 was sold for ₹ 16,000.

(c) Patents having a book value of ₹ 80,000 were sold for ₹ 1,10,000.

Q. What amount of patents will be added/subtracted to get the cash flow from investment?

Read the following information and answer the given questions:

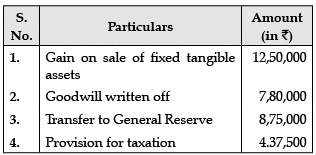

X Ltd. made a profit of ₹ 5,00,000 after consideration of the following items :

₹

(i) Goodwill written off 5,000

(ii) Depreciation on Fixed Tangible Assets 50,000

(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000

(iv) Provision for Doubtful Debts 10,000

(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500

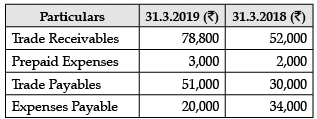

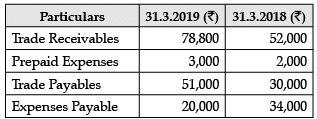

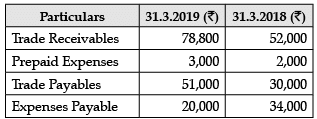

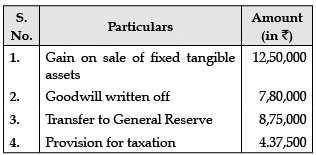

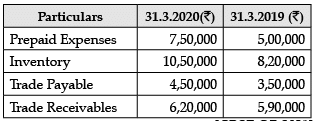

Additional information :

Q. Which of the following items will adjust to Net Profit before Tax?

Read the following information and answer the given questions:

X Ltd. made a profit of ₹ 5,00,000 after consideration of the following items :

₹

(i) Goodwill written off 5,000

(ii) Depreciation on Fixed Tangible Assets 50,000

(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000

(iv) Provision for Doubtful Debts 10,000

(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500

Additional information :

Q. What will be the amount of Trade payables added to get the Cash flow from operations?

Read the following information and answer the given questions:

X Ltd. made a profit of ₹5,00,000 after consideration of the following items :

₹

(i) Goodwill written off 5,000

(ii) Depreciation on Fixed Tangible Assets 50,000

(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000

(iv) Provision for Doubtful Debts 10,000

(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500

Additional information :

Q. How will goodwill written off be adjusted in the cash flow statement?

Read the following information and answer the given questions:

X Ltd. made a profit of ₹ 5,00,000 after consideration of the following items :

₹

(i) Goodwill written off 5,000

(ii) Depreciation on Fixed Tangible Assets 50,000

(iii) Loss on Sale of Fixed Tangible Assets (Machinery) 20,000

(iv) Provision for Doubtful Debts 10,000

(v) Gain on Sale of Fixed Tangible Assets (Land) 7,500

Additional information :

Q. What amount of Trade Receivables will be subtracted from the Cash flow Statement to get Cash flow from operations?

Read the following information and answer the given questions:

Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items:

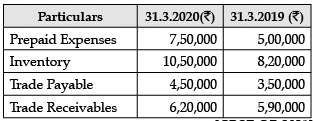

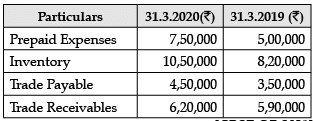

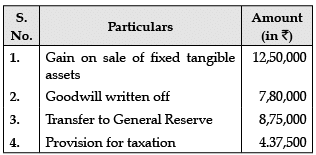

Additional information :

Q. Operating profit before working capital changes will be ₹ _______ .

Read the following information and answer the given questions:

Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items:

Additional information :

Q. Cash flow from Operating Activities will be ₹ ___________.

Read the following information and answer the given questions:

Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items:

Additional information :

Q. Net Profit before Tax will be ₹ ____________.

Read the following information and answer the given questions:

Krishika an alumni of IIM Ahmedabad initiated her startup Krishika Ltd. in 2018. The profits of Krishika Ltd. in the year 2019-20 after all appropriations was ₹ 31,25,000. This profit was arrived after taking into consideration the following items:

Additional information :

Q. Cash from operating activities before tax will be ₹__________.