|

To manage public finances by allocating resources for various sectors such as health, infrastructure, and technology to promote economic growth and social welfare. |

Card: 2 / 48 |

|

Fill in the blank: The government budget aims to reduce disparities in ___ and ___ among different sections of society. |

Card: 3 / 48 |

|

True or False: Non-tax revenue is derived solely from taxes imposed by the government. |

Card: 5 / 48 |

|

Riddle: I am a payment made to the government, but I can be direct or indirect. What am I? |

Card: 9 / 48 |

|

Fill in the blank: The government encourages the setting up of production units in economically backward regions by providing ___ and other benefits. |

Card: 11 / 48 |

|

It encourages economic development in backward regions by providing financial assistance and incentives, thereby promoting regional equality. |

Card: 14 / 48 |

|

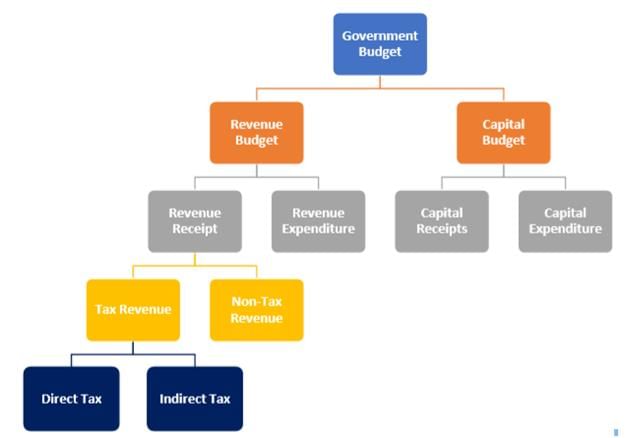

Government budget receipts are categorized into Revenue Receipts and Capital Receipts.  |

Card: 16 / 48 |

|

Profits and dividends from public sector investments, fines and penalties for law enforcement, service fees, license fees, gifts and grants from foreign governments, borrowings, and recovery of loans. |

Card: 18 / 48 |

|

Fill in the blank: Recovery of a loan by the state and union territory to the government is classified as a ___ receipt. |

Card: 19 / 48 |

|

Riddle: I am a fee charged to grant permission, often required for business activities. What am I? |

Card: 23 / 48 |

Unlock all Flashcards with EduRev Infinity Plan Starting from @ ₹99 only

|

|

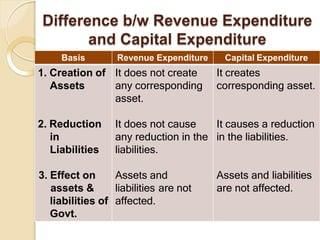

What distinguishes capital expenditure from revenue expenditure in government budgeting? |

Card: 25 / 48 |

|

Capital expenditure creates assets or reduces liabilities, while revenue expenditure does neither. |

Card: 26 / 48 |

|

Multiple Choice: Which of the following is considered a source of non-tax revenue? A) Income Tax B) License Fee C) Corporate Tax D) Sales Tax |

Card: 27 / 48 |

|

True or False: A Fiscal Deficit indicates that the government is spending within its means. |

Card: 31 / 48 |

|

False. A Fiscal Deficit indicates that the government is spending beyond its means. |

Card: 32 / 48 |

|

Fill in the blank: The Revenue Deficit shows that the government is using ___ to meet its expenditures. |

Card: 33 / 48 |

|

The government should reduce its expenditures and increase revenue receipts while controlling tax evasion. |

Card: 36 / 48 |

|

Riddle: I represent the excess of total expenditure over total receipts excluding borrowings. What am I? |

Card: 37 / 48 |

|

It signifies that the government will have to meet its deficit from capital receipts, which can reduce assets or increase liabilities.  |

Card: 40 / 48 |

|

Fill in the blank: Capital expenditure either creates assets or reduces the ___ of the government. |

Card: 41 / 48 |

|

What does a government experiencing a Revenue Deficit imply about its earnings? |

Card: 43 / 48 |

|

It implies that the government's own earnings are insufficient to cover the day-to-day operations of its departments. |

Card: 44 / 48 |

|

The process of borrowing by the government to meet fiscal deficit is referred to as ___ financing. |

Card: 45 / 48 |

|

True or False: An increase in interest payments due to government borrowing can lead to a revenue surplus. |

Card: 47 / 48 |