|

The primary objective of financial management is to maximize shareholder's wealth through optimal capital structure and proper utilization of funds. |

Card: 2 / 46 |

|

Fill in the blanks: Financial management is concerned with the planning, raising, controlling, and administering of funds used in the ___. |

Card: 3 / 46 |

|

True or False: The safety of funds in financial management refers to minimizing the chances of risk in investments. |

Card: 5 / 46 |

|

Riddle: I am essential for starting and running a business, ensuring smooth operations and maximizing wealth. What am I? |

Card: 7 / 46 |

|

Fill in the blank: A sound and economical combination of shares and debentures is necessary to maintain ___ capital structure. |

Card: 11 / 46 |

|

Which aspect of financial management ensures that funds are effectively utilized? |

Card: 13 / 46 |

|

Effective utilization of funds refers to using available resources in the most efficient way to achieve business goals. |

Card: 14 / 46 |

|

True or False: Short-term investment decisions, also known as capital budgeting decisions, are reversible at little cost. |

Card: 19 / 46 |

|

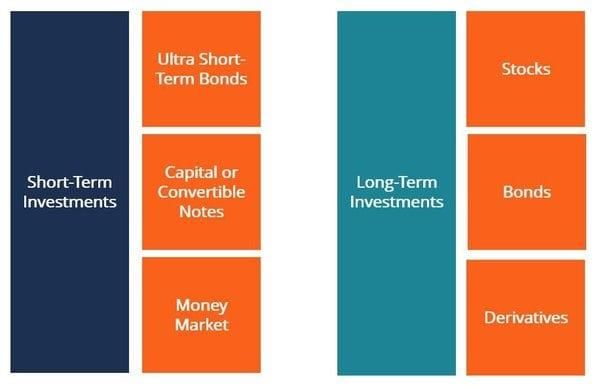

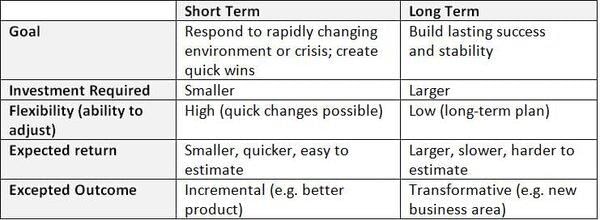

False. Short-term investment decisions are called working capital decisions, while long-term investment decisions are called capital budgeting decisions and are typically irreversible at little cost.  |

Card: 20 / 46 |

|

The series of cash flows, expected rate of return, and the associated risk of each proposal. |

Card: 22 / 46 |

|

Riddle: I am a financial decision that determines how a company raises funds. I can involve debt or equity. What am I? |

Card: 23 / 46 |

Unlock all Flashcards with EduRev Infinity Plan Starting from @ ₹99 only

|

|

Fill in the blank: The risk associated with borrowed funds is known as ___ risk. |

Card: 25 / 46 |

|

Owner’s funds have no fixed repayment commitment, while borrowed funds must be repaid at a fixed time and incur interest regardless of profit. |

Card: 28 / 46 |

|

Which type of investment decision involves high amounts of funds and is irreversible? |

Card: 29 / 46 |

|

The main factors include cost, risk, flotation costs, cash flow position, control considerations, state of capital markets, and the period of finance. |

Card: 32 / 46 |

|

True or False: Higher flotation costs make a source of finance more attractive. |

Card: 33 / 46 |

|

Fill in the blank: If existing shareholders want to retain complete control of the business, they should raise finance through ___ funds. |

Card: 35 / 46 |

|

Riddle: I can help you grow, but too much of me can lead to trouble. I have a cost, and I often need to be repaid. What am I? |

Card: 37 / 46 |

|

Short Answer: Why is it important to consider the cash flow position of a business when making financing decisions? |

Card: 39 / 46 |

|

Because a good cash flow position allows a company to use borrowed funds and pay interest on time.  |

Card: 40 / 46 |

|

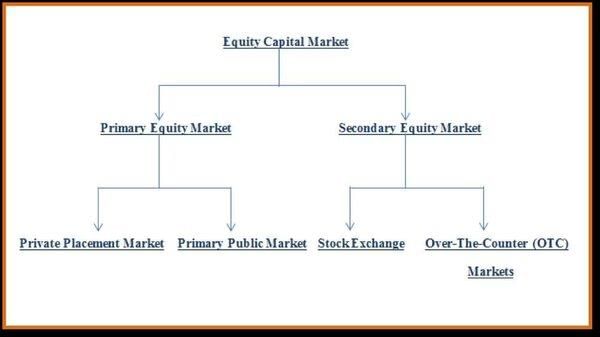

During a boom in the capital markets, which type of finance is easier to raise by issuing shares? |

Card: 41 / 46 |

|

What is the relationship between the state of capital markets and the ease of raising finance? |

Card: 43 / 46 |

|

During a boom, it is easier to raise finance through equity, while during a depression, it is easier to raise finance through debt. |

Card: 44 / 46 |

|

Fill in the blank: The decision regarding how much profit to distribute as dividends and how much to retain should focus on maximizing ___ wealth. |

Card: 45 / 46 |