|

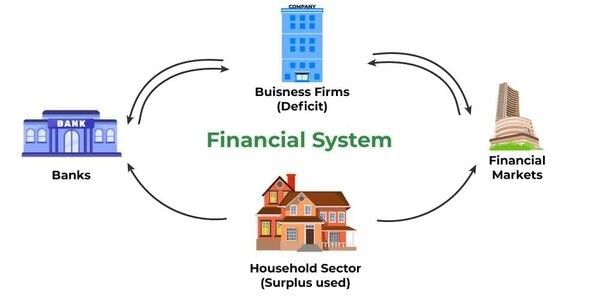

Financial markets facilitate the transfer of funds from savers to borrowers, supporting economic growth and development. |

Card: 2 / 48 |

|

Fill in the blanks: The financial market aids in mobilizing ___ from individuals and institutions and channels these savings into ___ investments. |

Card: 3 / 48 |

|

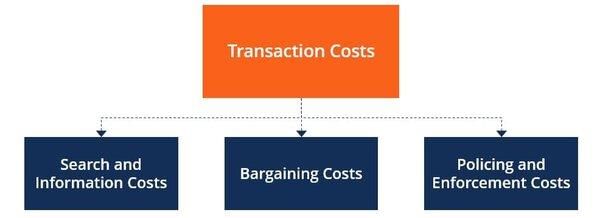

True or False: Financial markets increase transaction costs associated with trading securities. |

Card: 5 / 48 |

|

Price discovery refers to the process of determining the prices of financial assets through the forces of supply and demand, ensuring that prices reflect the true value based on market conditions. |

Card: 8 / 48 |

|

Riddle: I am a platform where assets are exchanged, helping to grow the economy without being a bank. What am I? |

Card: 9 / 48 |

|

Fill in the blank: Financial markets provide ___ to financial assets, allowing investors to easily buy and sell. |

Card: 11 / 48 |

|

Liquidity is important because it allows investors to quickly convert their assets into cash, providing flexibility and ease of trading. |

Card: 14 / 48 |

|

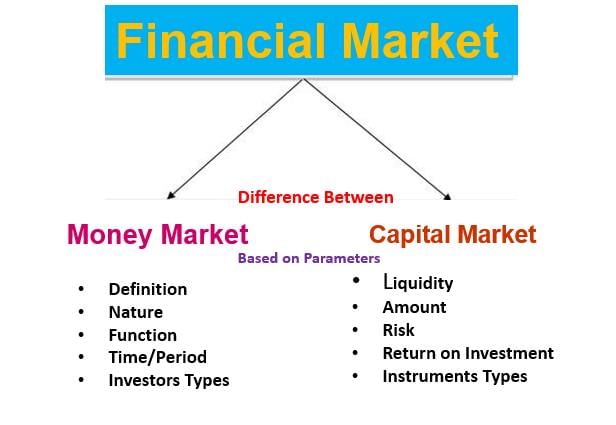

What is the primary difference between the money market and the capital market? |

Card: 15 / 48 |

|

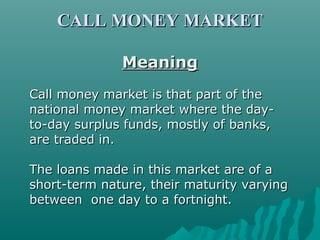

The money market deals with short-term funds with a maturity period of up to one year, while the capital market focuses on long-term funds, both debt and equity.  |

Card: 16 / 48 |

|

Treasury bills are also known as ___ and are issued for a maximum maturity of ___ year. |

Card: 17 / 48 |

|

True or False: Commercial papers are long-term secured promissory notes issued by companies. |

Card: 19 / 48 |

|

Fill in the blank: The major participants in the money market include the Reserve Bank of India, commercial banks, ___, and mutual funds. |

Card: 21 / 48 |

|

It is an unsecured, negotiable, short-term instrument issued by commercial banks and development financial institutions.  |

Card: 24 / 48 |

Unlock all Flashcards with EduRev Infinity Plan Starting from @ ₹99 only

|

|

Riddle: I am a short-term finance that is repayable on demand, and my maturity can range from one to fifteen days. What am I? |

Card: 25 / 48 |

|

Fill in the blank: Commercial bills are used to finance the ___ requirements of business firms. |

Card: 29 / 48 |

|

Commercial papers typically have a maturity period ranging from 15 days to one year. |

Card: 32 / 48 |

|

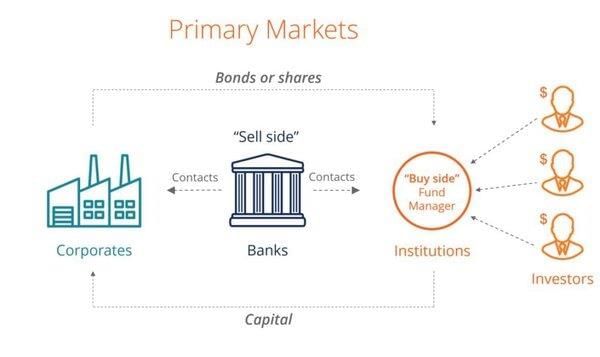

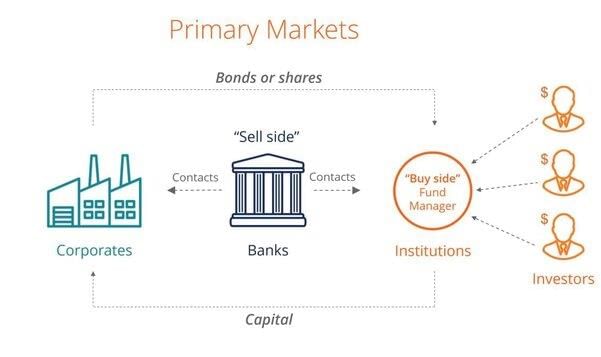

The primary market is where securities are sold for the first time to raise long-term capital.  |

Card: 36 / 48 |

|

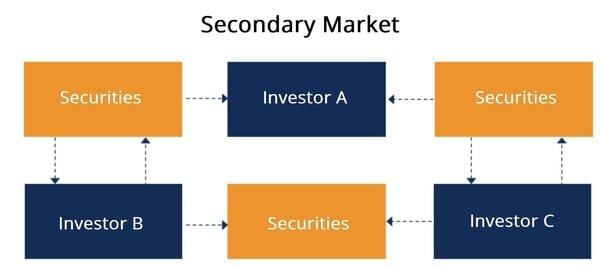

True or False: The secondary market allows companies to raise new capital through the sale of existing securities. |

Card: 37 / 48 |

|

False. The secondary market involves buying and selling existing securities without the issuing company's involvement.  |

Card: 38 / 48 |

|

A stock exchange assists in the buying and selling of securities, providing liquidity and marketability to existing securities. |

Card: 42 / 48 |

|

Riddle: I am a place where shares are bought and sold, my rules are strict and my prices unfold. What am I? |

Card: 43 / 48 |

|

The capital market is used for long-term securities and investments, while the money market is for short-term borrowing and lending, typically involving instruments with maturities of less than one year. |

Card: 46 / 48 |

|

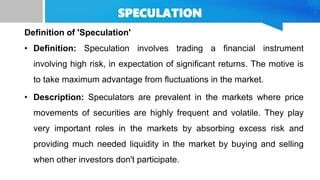

True or False: Speculation involves purchasing securities solely for the purpose of holding them long-term. |

Card: 47 / 48 |

|

False. Speculation is when securities are purchased with the expectation of profit from changes in their market price.  |

Card: 48 / 48 |