|

Card: 1 / 40 |

True or False: The Payment of Wages Act applies to workers earning Rs. 24,000 or more per month. |

|

Card: 4 / 40 |

The main objective is to ensure timely payment of wages to certain workers and prevent unauthorized deductions. |

|

Card: 5 / 40 |

Fill in the blank: The Act applies to the whole of ___ and initially covers wage payments to persons employed in factories, on railways, and in specified industrial establishments. |

|

Card: 8 / 40 |

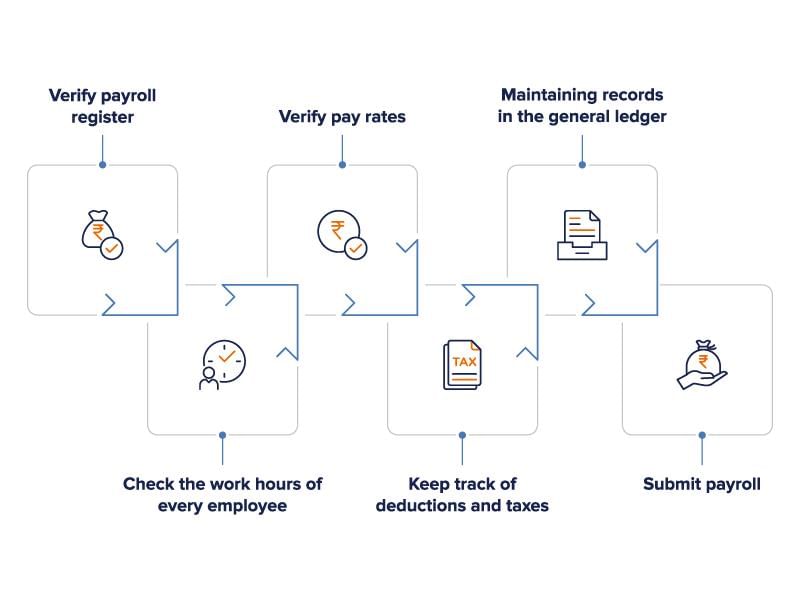

Employers are responsible for timely wage payments, adherence to wage periods, allowable payment methods, and ensuring no unauthorized deductions are made.  |

|

Card: 9 / 40 |

True or False: The legal representative of a deceased employed person is not included in the definition of an employed person under the Act. |

|

Card: 11 / 40 |

According to the Payment of Wages Act, wages include all remuneration expressed in ___ terms. |

|

Card: 13 / 40 |

Fill in the blank: The Act provides a mechanism for addressing complaints related to wage ___ and delays. |

|

Card: 16 / 40 |

Wages refer to all remuneration expressed in money terms, including salary, allowances, overtime pay, bonuses, and certain sums payable under law or contract, excluding specific items like non-remuneration bonuses and value of amenities. |

|

Card: 17 / 40 |

True or False: The State Government has the authority to extend the provisions of the Payment of Wages Act to other classes of workers. |

|

Card: 19 / 40 |

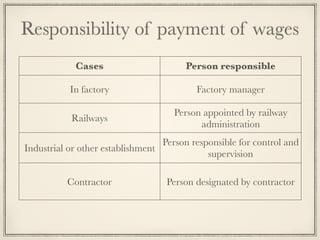

The responsibility for paying wages in a factory lies with the ___ of the factory. |

|

Card: 21 / 40 |

True or False: Wages in industrial establishments must be paid on a quarterly basis. |

|

Card: 22 / 40 |

False. Wages cannot be paid on a quarterly basis; they can be paid daily, weekly, fortnightly, or monthly. |

|

Card: 25 / 40 |

In establishments with more than 1000 employees, wages should be paid within ___ days after the wage period. |

|

Card: 27 / 40 |

True or False: Wages should be paid to terminated employees on any day of the week. |

|

Card: 28 / 40 |

False. Wages for terminated employees should be paid within 2 days of termination and only on working days. |

|

Card: 31 / 40 |

Wages for employees in port areas should be paid within ___ days after the wage period. |

|

Card: 33 / 40 |

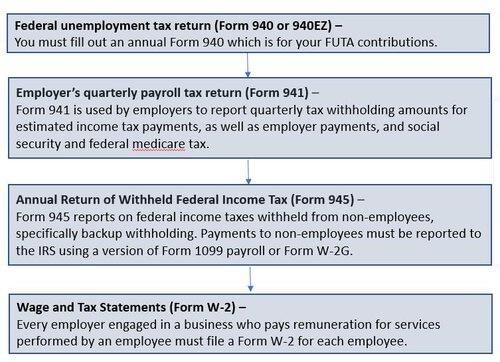

Employers can deduct up to ___% of wages for specified reasons as per the Act. |

|

Card: 34 / 40 |

50%. The total deductions should not exceed 50% of wages, except for payments to co-operative societies where it can be up to 75%. |

|

Card: 36 / 40 |

Deductions may include fines, absence from duty, damage or loss of goods, house accommodation, amenities, recovery of advances, loans, income tax, court orders, provident fund, and certain approved payments. |

|

Card: 37 / 40 |

True or False: Management can withhold full wages from employees if manufacturing activities are restricted due to health concerns. |

|

Card: 38 / 40 |

False. The court held that management must pay gross monthly wages to employees, except for conveyance and food allowances.  |

|

Card: 39 / 40 |

During the Covid-19 restrictions, management offered to pay workers ___% of gross wages or the minimum rates of wages, whichever is higher. |

|

Card: 40 / 40 |

50%. Management offered to pay 50% of gross wages or the minimum rates of wages prescribed under the Minimum Wages Act, whichever is higher. |