AS 10 Property, Plant and Equipment | Advanced Accounting for CA Intermediate PDF Download

AS 10 Property, Plant and Equipment Overview

AS 10 Property, Plant and Equipment establishes guidelines for accounting treatment concerning properties, plant, and equipment. It ensures that financial statement users can discern and understand an enterprise's investments in these assets, along with any associated alterations.

Applicability of AS 10 Property, Plant and Equipment

The standard outlines the scope within which entities should apply accounting practices for property, plant, and equipment.

Recognition of Asset under AS 10 Property, Plant and Equipment

AS 10 defines how assets related to property, plant, and equipment should be identified and acknowledged in financial records.

Measurement of Cost of the Asset

An enterprise can choose either the revaluation model or the cost model as its accounting policy and apply it consistently across all its properties and plant and equipment (P&E). Under the cost model, once an asset is recognized as property or plant and equipment, it should be carried at its cost, minus accumulated depreciation and any accumulated impairment losses.

According to the revaluation model, once an asset is recognized and its fair value can be reliably measured, it should be carried at its revalued amount. This revalued amount is the fair value of the asset on the revaluation date, minus any subsequent accumulated depreciation and accumulated impairment losses. Revaluations must be conducted regularly to ensure that the carrying amount remains close to the fair value as of the balance sheet date.

Depreciation under AS 10 Property, Plant and Equipment

According to the standard, the depreciation charge for each period must be recognized in the profit and loss statement unless it is included in the carrying amount of another asset. The depreciable amount of an asset should be allocated systematically over its useful life.

Each part of property or plant and equipment (P&E) with a substantial cost relative to the overall cost of the item must be depreciated separately.

The standard also requires that the residual value and useful life of an asset be reviewed at the end of each financial year. If the expectations differ from previous estimates, changes must be accounted for as changes in accounting estimates in accordance with Accounting Standard 5 – Net Profit or Loss for the Period, Prior Period Items, and Changes in Accounting Policies.

The method of depreciation used must reflect the pattern of future economic benefits derived from the asset. Various methods can be employed to allocate the depreciable amount of an asset systematically over its useful life. These methods include the straight-line method (SLM), the diminishing balance method, and the units of production method.

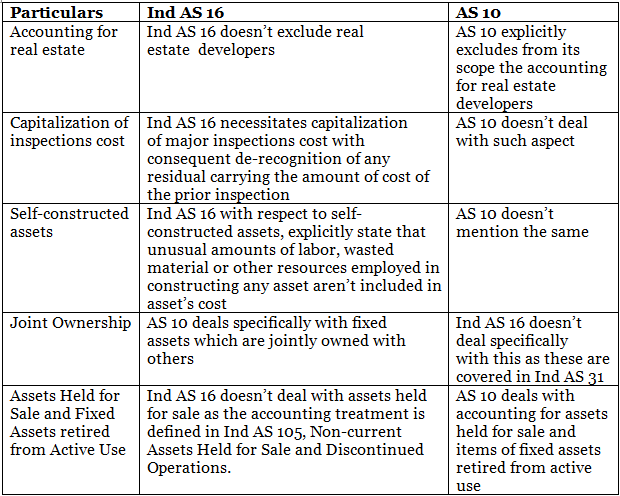

Major Differences Between AS 10 and Ind AS 16

Ind AS 16, Property, Plant, and Equipment, addresses the accounting for fixed assets, which is covered by AS 10. This standard also deals with the depreciation of property, plant, and equipment, previously covered by AS 6. The key differences between the existing AS 10 and Ind AS 16 are outlined below:

ICDS 5 vs AS 10

- The difference in recognizing materiality: AS does not allow treating an item as an expense based on materiality, whereas ICDS does.

- Treatment of Other Taxes: ICDS 5 excludes Other Taxes that are recoverable from the cost of a tangible fixed asset.

- Recognition of actual cost for assets acquired in exchange: ICDS 5 recognizes the actual cost for assets acquired in exchange for other assets, while AS 10 allows determining the cost based on the Fair Market Value (FMV) of the asset acquired or given up.

- Cost determination for assets acquired in exchange for shares or securities: ICDS 5 recognizes the actual cost for such assets, whereas AS 10 permits determining the cost based on the FMV of the asset acquired or the share or securities given up.

- Treatment of non-beneficial expenditure: ICDS does not define the treatment for expenditures that do not increase future benefits, whereas AS 10 requires such expenditures to be recognized as expenses in the Profit and Loss Statement.

- Additional disclosure requirements in ICDS: ICDS entails more disclosure requirements, including grants or subsidies received for tangible fixed assets and changes in currency exchange rates.

|

53 videos|134 docs|6 tests

|