AS 13 Accounting for Investments | Advanced Accounting for CA Intermediate PDF Download

Introduction

AS 13 Accounting for Investments is widely used and deals with accounting for investments in financial statements prepared by a Company and prescribes various disclosure requirements.

Applicability of AS 13 Accounting for Investments

AS 13 Accounting for Investments does not cover the following:

- The criteria for recognizing dividends, interest, and rentals earned on investments under AS 9.

- Finance or operating leases as addressed in AS 19.

- Investments in retirement benefit plans and life insurance enterprises as per AS 15.

- Entities established under government acts or the Companies Act, 2013.

- Mutual Funds

- Venture Capital Funds and associated Asset Management Companies

- Banks and public financial institutions

Criteria Not Covered by AS 13 Accounting for Investments:

- The guidelines for recognizing income such as dividends, interest, and rentals related to investments, which are specified in AS 9.

- Finance and operating lease considerations outlined in AS 19.

- Procedures concerning investments in retirement plans and life insurance companies, as detailed in AS 15.

- Entities falling under government regulations or the Companies Act, 2013.

- Types of financial institutions like Mutual Funds, Venture Capital Funds, Banks, and public financial institutions.

Classification of Investments

- Current Investments: Current investments are those that are easily convertible into cash and are expected to be held for less than a year from the time of investment.

- Long-Term Investments: Long-term investments are assets that are held for a longer period, typically more than a year, and are not intended for immediate sale.

Cost of Investments

- Broker, Duties, and Fees: This includes expenses related to brokerage, duties, and fees incurred during the acquisition of investments.

- Non-cash Consideration: When investments are acquired using non-monetary assets like shares, securities, or other assets, the cost of acquisition is determined by the fair value of the assets exchanged.

- For example, if a company acquires another firm by issuing its own shares, the cost of acquisition would be based on the fair value of the shares issued, not their nominal value.

Interest, Dividend, or Other Receivables

- Interest, dividend, or other receivables - These typically represent income related to investments, contributing to the Return on Investment (ROI).

- Interest, dividend, or other receivables

However, in certain scenarios, these inflows may indicate a recovery of costs and not count as income. When allocation becomes challenging, the cost of investment is often reduced by the dividends receivable, if they clearly signify a cost recovery.

Right Shares

- Right Shares - If subscribed for, the cost of these additional shares is added to the original holding amount.

- Right Shares

If the rights are not subscribed but sold, the proceeds are reflected in the Profit and Loss statement. However, in cases where an investment's market value drops below its acquisition cost after becoming ex-right, it could be wise to use the sale proceeds to adjust the investment's carrying amount to its market value.

Carrying Amount of Investments

- Current investments should be recorded in financial statements at the lower of cost and fair value. This determination is usually made based on the category of investment or on an individual investment basis, and not on an overall basis.

- Long-term investments are to be stated in financial statements at their original cost. However, if there is a non-temporary decline in value, the carrying amount of the long-term investment needs to be reduced to reflect this decline.

Investment Property

- Investment property refers to investments in land or buildings that are not intended for significant use in the operations of the investing company.

Investment Treatment on Disposal

When you sell or dispose of an investment, the profit or loss is calculated as the the selling price minus the carrying value of the investment, taking into account any selling expenses. This difference is then reflected in the Profit and Loss statement.

Reclassification of Investments

When a long-term investment is reclassified as a current investment, it is transferred at its carrying amount or the lower of its cost at the time of reclassification. Similarly, if an investment moves from being a current investment to a long-term one, the transfer is made at the lower of its original cost or the fair value at the time of reclassification.

Disclosures in the Financial Statements

The following disclosures in the financial statements are required under AS 13 Accounting for Investments:

(a) The accounting policies used to determine the carrying amount of investments.

(b) The amounts included in the profit and loss statement for:

- Dividends, interest, and rentals on investments, showing income from long-term and current investments separately. Gross income must be stated, with the amount of TDS (tax deducted at source) included under Advance Taxes Paid.

- Profits and losses on the disposal of current investments and changes in their carrying amount.

- Profits and losses on the disposal of long-term investments and changes in their carrying amount.

(c) Any significant restrictions on ownership rights, realizability of investments, or remittance of income and proceeds from disposals.

(d) The total amount of both quoted and unquoted investments, including the total market value of quoted investments.

(e) Any other disclosures explicitly required by the relevant statute governing the company.

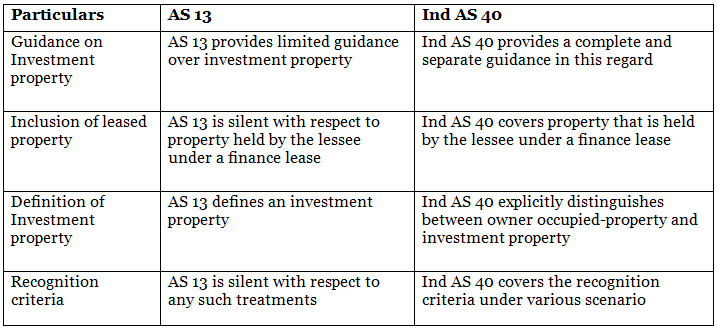

Major differences between AS 13 and Ind AS 40

|

52 videos|121 docs|6 tests

|

FAQs on AS 13 Accounting for Investments - Advanced Accounting for CA Intermediate

| 1. How does AS 13 Accounting for Investments apply to companies? |  |

| 2. What are the different classifications of investments as per AS 13? |  |

| 3. How is the cost of investments determined under AS 13? |  |

| 4. What is the carrying amount of investments and how is it calculated under AS 13? |  |

| 5. What disclosures are required in the financial statements under AS 13 Accounting for Investments? |  |

|

52 videos|121 docs|6 tests

|

|

Explore Courses for CA Intermediate exam

|

|