AS 19 – Leases | Advanced Accounting for CA Intermediate PDF Download

Introduction

AS-19 outlines the accounting principles that apply to most lease agreements, excluding specific types. A lease involves an arrangement where the lessor allows the lessee to utilize an asset in exchange for payment(s) over an agreed-upon period.

What kind of leases are not covered under this standard

This standard does not apply to:

- Lease agreements related to the exploration or utilization of natural resources such as oil, gas, timber, metals, and other mineral rights.

- Licensing agreements including motion picture films, video recordings, plays, manuscripts, patents, and copyrights.

- Lease agreements for land use.

There are two types of leases:

- Finance Lease

- Operating Lease

Finance Lease

A finance lease involves the transfer of all risks and rewards to the asset owner. The ownership title may or may not ultimately be transferred.

Examples of finance leases include:

- Leases where the asset is transferred to the lessee at the end of the lease term.

- Lease terms where the lessee has the option to purchase the asset from the lessor at a price lower than the fair market value at the exercisable option date.

- Lease terms that cover the entire economic life of the asset, even if the title is not transferred.

- Lease terms where the present value of minimum lease payments equals or substantially covers the fair value of the leased asset.

- Leased assets of a specialized nature, such as an ambulance that can be used without significant modifications.

Operating Lease

- Any lease that is not classified as a finance lease falls under the category of an operating lease.

Accounting in the books of Lessee in case of Finance Lease

- When a finance lease begins, the lessee records the lease as an asset or liability, reflecting the fair value of the leased asset.

- Lease payments are divided into finance charges and reductions in outstanding liabilities.

- The finance charge is allocated over the lease term.

- Journal entries for depreciation are made as required.

Disclosure in case of Finance Lease

- Assets obtained through leasing should be presented separately.

- The net carrying amount of each leased asset should be evident on the balance sheet date.

- A reconciliation between Minimum Lease Payments and their present value at the balance sheet date must be provided.

- Total minimum lease payments at the balance sheet date and their present value need to be disclosed based on time periods:

- Not later than one year

- Later than one year but not later than five years

- Later than five years

- Future minimum sublease payments expected to be received at the balance sheet date should be mentioned.

- A general description of significant leasing arrangements by the lessee is necessary.

Accounting in the books of Lessee in case of Operating Lease

- Lease payments are treated as expenses in the profit and loss account for operating leases.

Disclosure in case of Operating Lease

Future lease payments for upcoming periods need to be disclosed.

Time Periods for Lease Classification:

- Within one year

- Between one and five years

- Beyond five years

Key Financial Aspects of Leases:

- Total anticipated lease payments

- Lease payments reflected in the Profit and Loss statement

- Overview of significant leasing agreements for the lessee

Lessor Accounting for Finance Lease

When dealing with a finance lease, the lessor must adhere to specific accounting practices:

- Recording assets in the accounting books at the net investment in the lease

- Recognizing finance income based on a consistent periodic rate of return

- Estimating the unguaranteed residual value for calculating the lessor's gross investment

- Adjusting income allocation if there's a reduction in the estimated unguaranteed residual value

- Immediately recognizing initial direct costs associated with the lease in the profit and loss account

Disclosure Requirements for Finance Lease

In the context of a finance lease, disclosure obligations include:

- Providing a reconciliation between the gross investment in the lease and the present value of minimum lease payments

- Detailing unearned finance income, unguaranteed residual value, and accumulated provisions for uncollectible minimum lease payments

- Reporting contingent rent in the profit and loss statement

- Outlining the accounting policy regarding initial direct costs

Accounting in the books of Lessor in case of Operating Lease

- Lessor must list assets on the balance sheet under fixed assets.

- Lease income should be acknowledged in the statement of profit and loss account.

- Costs incurred, including depreciation, need to be recognized in the statement of profit and loss account.

- Assess for impairment and make provisions for it in the books according to GAAP.

Disclosure in case of Operating Lease

- Provide details for each class of assets including accumulated depreciation, accumulated impairment, and carrying amount at the balance sheet date.

- Show depreciation recognized in the statement of profit and loss account.

- Display impairment losses recognized in the statement of profit and loss account.

- Present impairment loss reversals in the statement of profit and loss account.

- List future minimum lease payments for different periods:

- Not later than one year

- Later than one year but not later than five years

- Later than five years

- Total contingent recognized in the statement of profit and loss account.

- Provide a general description of the leasing arrangement.

Sale and Leaseback Transaction

If a sale and leaseback transaction leads to a finance lease:

- Any surplus or shortfall over the carrying amount needs to be deferred and spread out over the lease term in proportion to the depreciation of the leased assets.

If a sale and leaseback transaction results in an operating lease:

Any surplus or shortfall over the carrying amount should be immediately recorded in the books:

- If the sale price is lower than the fair value, any loss is offset by future lease payments at a price below the market rate. This loss should be deferred and amortized in line with the lease payments over the asset's expected usage period.

- If the sale price exceeds the fair value, the surplus over fair value should be deferred and amortized over the asset's expected usage period.

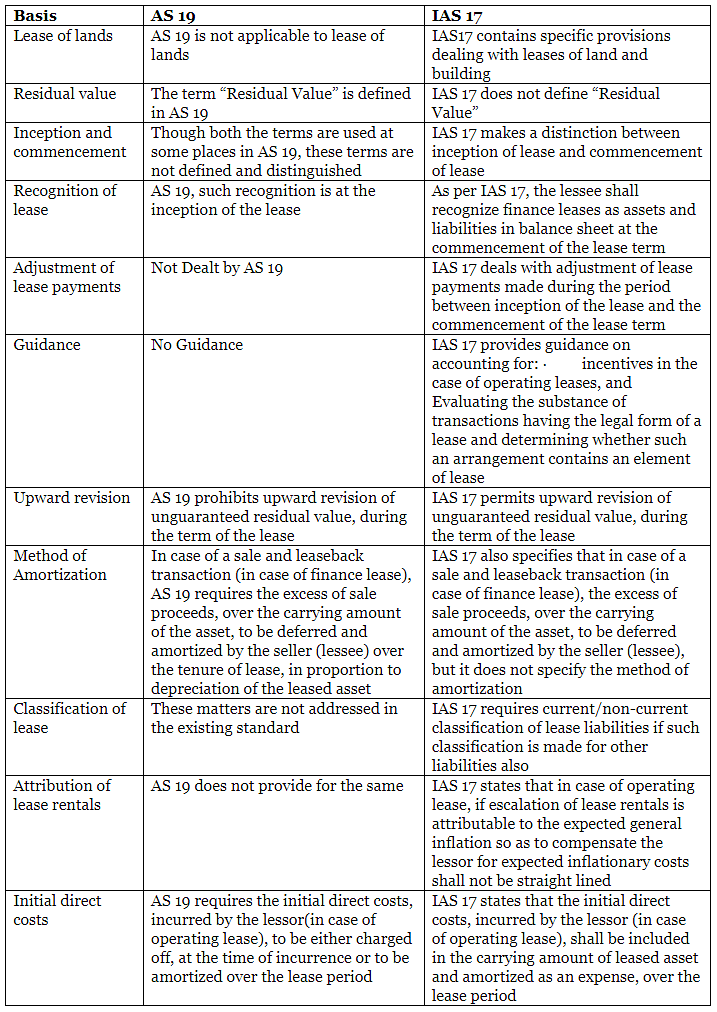

Difference between AS19 and IAS17

Difference between IAS 17 and IFRS 16

IAS 17:

- In IAS 17, all lease rentals are required to be expensed on a straight-line basis for operating leases, unless another systematic basis is more suitable. If payments to the lessor do not follow a straight-line pattern, adjustments are necessary.

IFRS 16:

- Under IFRS 16, lease rentals for operating leases should be expensed based on the terms of the lease agreement. If payments to the lessor increase in line with expected general inflation to offset the lessor's inflationary costs, they are recognized accordingly. However, if payment variations are due to factors beyond general inflation, this condition is not met.

Conclusion:

- When dealing with lease rentals that include an inflation component according to IAS 17, all expected rentals must be calculated. These rentals should then be evenly charged to the profit and loss statement over the lease term. Any excess or deficiency should be transferred to a lease equalization account.

|

53 videos|134 docs|6 tests

|

FAQs on AS 19 – Leases - Advanced Accounting for CA Intermediate

| 1. What types of leases are not covered under AS 19 – Leases CA Intermediate? |  |

| 2. How should a lessee account for a finance lease in their books under AS 19 – Leases CA Intermediate? |  |

| 3. What disclosure requirements are there for a finance lease under AS 19 – Leases CA Intermediate? |  |

| 4. How should a lessor account for an operating lease in their books under AS 19 – Leases CA Intermediate? |  |

| 5. What disclosure requirements are there for an operating lease under AS 19 – Leases CA Intermediate? |  |