AS 5 Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies | Advanced Accounting for CA Intermediate PDF Download

| Table of contents |

|

| Introduction |

|

| Application |

|

| Net Profit or Loss for the Period |

|

| Prior Period Items |

|

| Changes in Accounting Estimates |

|

| Changes in Accounting Policies |

|

| Comparison with Ind AS (IAS) |

|

Introduction

AS 5 outlines the method for categorizing and revealing the following elements:

- Prior period items

- Extraordinary items

- Specific items related to profit and loss from ordinary activities

The standard also explains how changes in accounting estimates should be handled and the disclosures required due to such changes. It does not cover the tax implications resulting from these changes.

Application

- Utilization of the Standard

- Applying this criterion aids in comparing financial statements across different enterprises. It facilitates a comparative analysis of financial statements over time when consistently applied.

Insight Into the Standard Guidelines

- Overview of the Standard

- The standard specifically focuses on four key areas:

Net Profit or Loss for the Period

Categories of Profit or Loss

- The net profit or loss for a period is divided into two main categories: Profit or loss from ordinary activities and Profit or loss from extraordinary activities.

Profit or Loss from Ordinary Activities

Definition and Examples:

- Profit or loss from ordinary activities encompasses transactions that occur in the regular course of business operations. These activities are routine and integral to the business. Examples include profit/loss from the sale of goods and services.

Reporting in Financial Statements:

- Transactions falling under this category are presented as standard items in financial statements for the accounting period.

Profit or Loss from Extraordinary Activities

- Definition and Examples

- Profit or loss from extraordinary activities comprises events that are outside the normal course of business operations. These activities are non-routine and irregular. Examples include profit from the sale of fixed assets and losses due to theft.

- Disclosure Requirements

- These transactions should be separately disclosed in financial statements to clearly demonstrate their impact on overall profits or losses. Significant activities that substantially affect the enterprise's performance should be highlighted separately, such as fixed assets disposal, restructuring of activities, or settlement of litigations.

Prior Period Items

- When creating financial statements, some items relate to previous accounting periods. These items result from errors or omissions in past financial statements. They are infrequent and easily recognizable.

- The financial statements of the current period must clearly display the impact of these prior period items.

Changes in Accounting Estimates

Accounting estimates, such as the useful life of machinery or the realizable value of inventory items, are crucial in financial statement preparation.

Revisions in estimates may occur due to:

- Changes in circumstances

- New information

- Subsequent developments

- Experience

Any effects resulting from changes in estimates should be reflected in financial statements. If the change impacts regular operations, it is disclosed as part of ordinary activities rather than extraordinary activities.

Changes in Accounting Policies

Accounting policies are the accounting principles and the methods used to apply those principles in preparing financial statements. Changes in accounting policy should only be made in two situations:

- When required by law or accounting standards; or

- When the change results in a better presentation of financial statements.

Any change in an accounting policy that has a substantial or material effect must be disclosed. The impact of such a change should also be reflected in the financial statements. If the impact cannot be assessed, this fact should also be disclosed.

Illustration of AS 5

There was a theft of goods in the warehouse of ABC Pvt. Ltd. in the previous year (2016-17) amounting to Rs. 50 Lakhs. The same was detected in the current year (2017-18) at the time of physical verification of inventory. How do we account for this theft and its discovery in the financial statements of 2017-18? The theft is not expected to take place on a frequent or regular basis and is not in a normal course of business of ABC Pvt. Ltd. Thus, the same qualifies to be an extraordinary item. Also, the theft took place in the financial year 2016-17 but was discovered in 2017-18. This suggests that although the loss related to 2016-17, it was not shown and the profit was overstated by such amount i.e. Rs. 50 Lakhs. While taking the effect of such loss in the current year (2017-18), this is a prior period item. Thus, the disclosures for the same should be given in the financial statements that due to a theft in 2016-17, goods worth Rs. 50 Lakhs were lost and discovered only in the current year. The value of inventory should be adjusted for such loss (both opening and closing inventory).

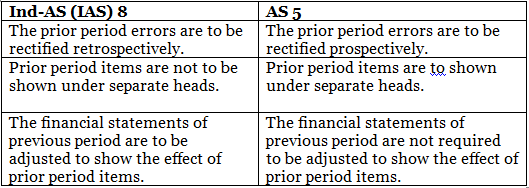

Comparison with Ind AS (IAS)

The following points are of importance in comparing AS 5 with Ind-AS 8:

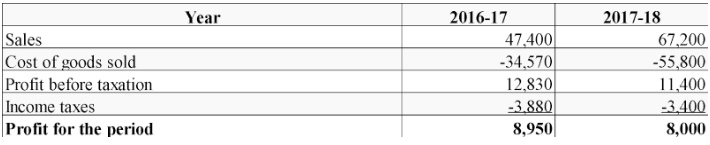

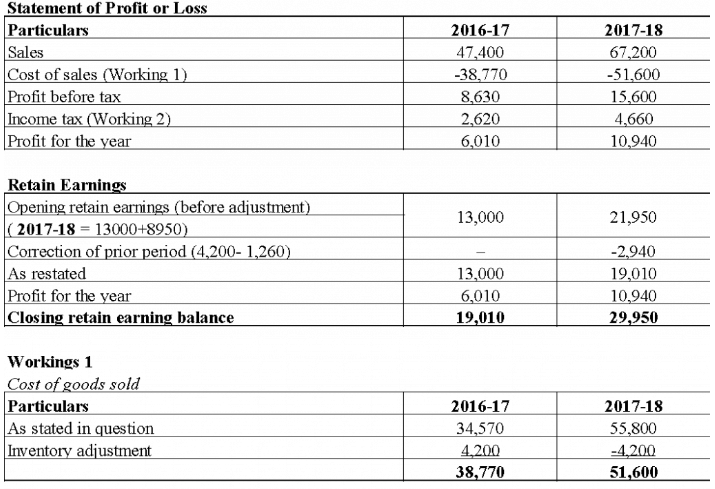

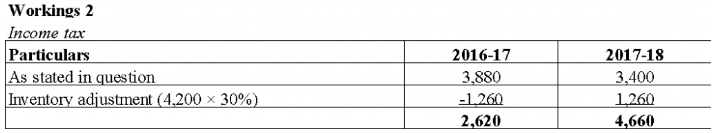

Case Study on Ind-AS 8 with regards to disclosure of prior period items

In September 2017, ABC Limited found that goods amounting to Rs. 42,000 which were included in the inventory as on 31 Mar 2017, were actually sold before 31 March 2017. The following figures for 2016-17 (reported) and 2017-18 (draft) are available.

Retained earnings on 1 Apr 2016 were Rs. 13,000. The cost of goods sold for 2017-18 includes Rs. 42,000 errors in opening inventory. The income tax rate was 30% for 2016-17 and 2017-18. No dividends have been declared or paid.

Required: Show the statement of profit or loss for 2017-18, with the 2016-17 comparative, and retained earnings.

|

53 videos|134 docs|6 tests

|

FAQs on AS 5 Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies - Advanced Accounting for CA Intermediate

| 1. What is the purpose of AS 5 Net Profit or Loss for the Period? |  |

| 2. What are Prior Period Items in the context of AS 5? |  |

| 3. How does AS 5 address Changes in Accounting Estimates? |  |

| 4. What is the significance of Changes in Accounting Policies according to AS 5? |  |

| 5. How can AS 5 Net Profit or Loss for the Period impact income tax calculations? |  |