Accounting for Bills of Exchange (Part - 2) | Accountancy Class 11 - Commerce PDF Download

Page No 16.36:

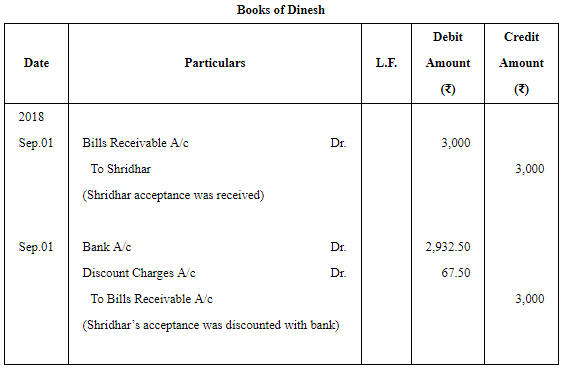

Question 6: Dinesh received from Shridhar an acceptance for ₹ 3,000 on 1st September, 2018 at 3 months. Dinesh got the acceptance discounted at 9% p.a. from his bank. On the due date, Shridhar paid the required amount.

Give the Journal entries in the books of Dinesh and Shridhar.

ANSWER:

Page No 16.36:

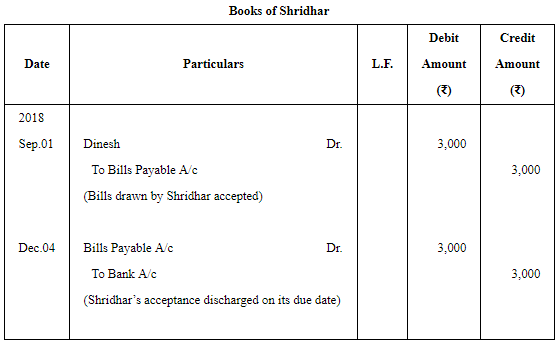

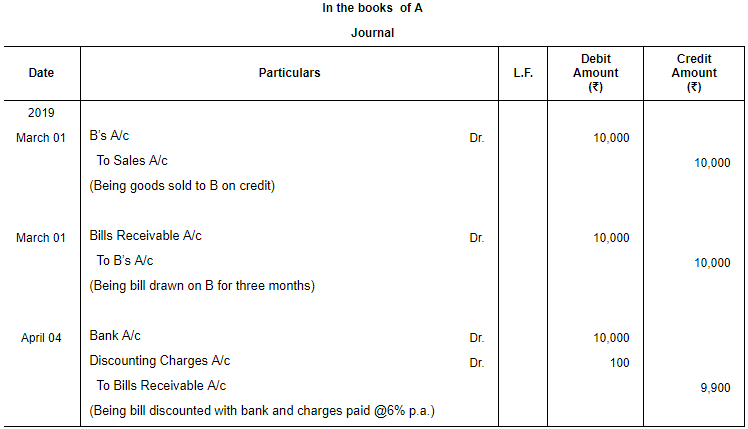

Question 7: A sells goods of ₹ 10,000 on 1st March, 2019 to B on credit. B accepts a bill on the same date for the amount payable three months after date. A discounts the bill at 6% p.a. from bank on 4th April. On maturity, the bill is met by B. Pass the necessary Journal entries in the books of both the parties.

ANSWER:

Working Notes:

Discounting Charges = ₹ (10,000 × 6/100 × 2/12) = ₹ 100

Page No 16.36:

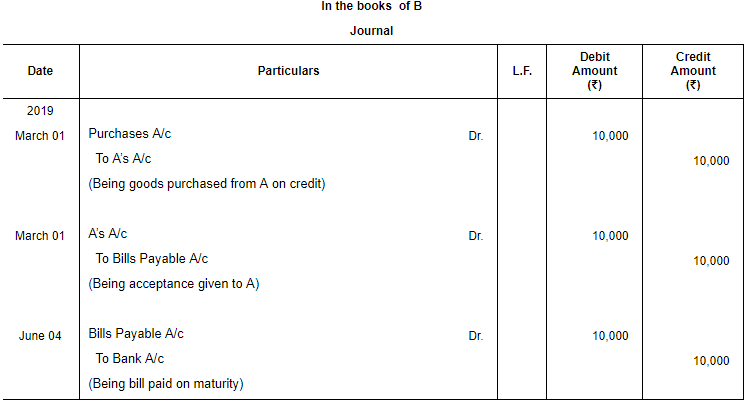

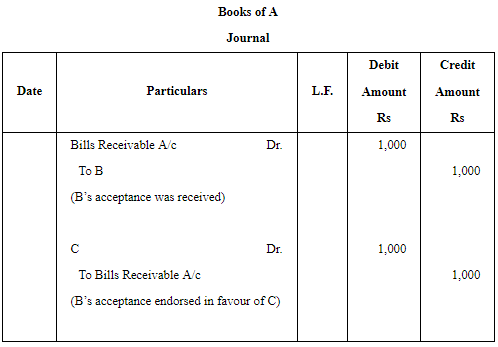

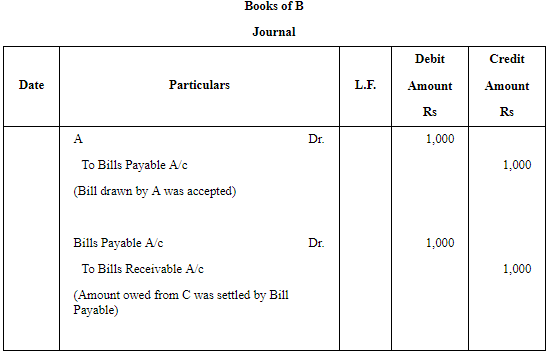

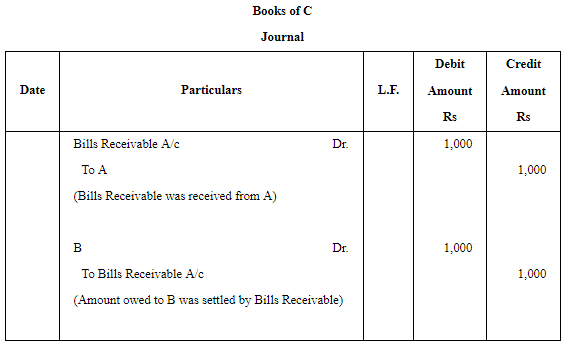

Question 8: A drew a bill of ₹ 1,000 on B for 3 months which was duly accepted by the latter. A endorsed the bill to C in full payment of his own acceptance to C for a like amount. C endorsed the bill to B.

Pass the Journal entries in the books of A, B and C.

ANSWER:

Page No 16.36:

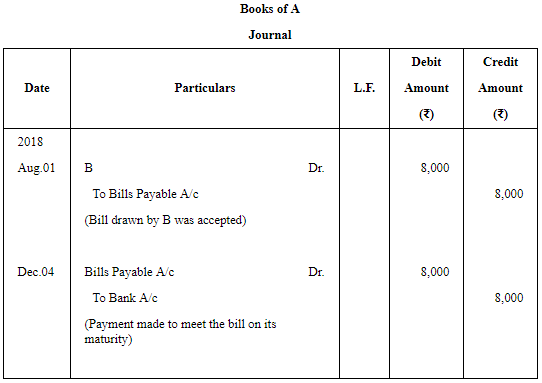

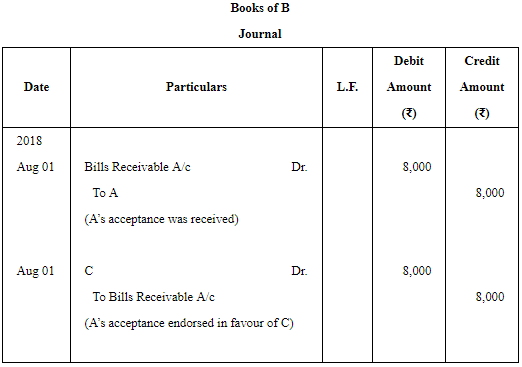

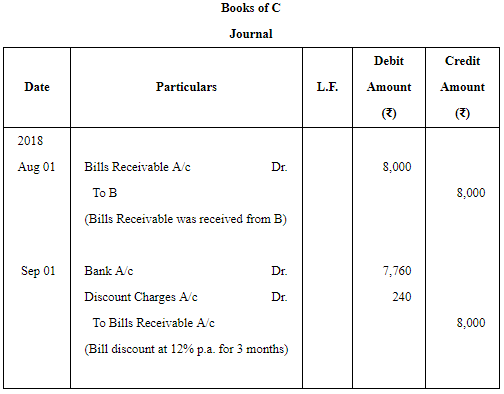

Question 9: A owed B ₹ 8,000. He gave a bill for the same on 1st August, 2018 payable after 4 months at the Bank of India, Chandni Chowk, Delhi. Immediately after receiving the bill, B endorsed it to C in payment of his debt. On 1st September, C discounted the bill at 12% p.a. The bill is met on due date.

Pass the necessary Journal entries in the books of A, B and C.

ANSWER:

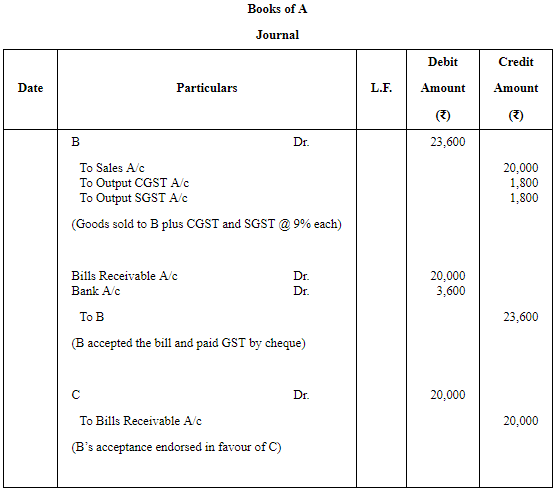

Working Note:

Page No 16.36:

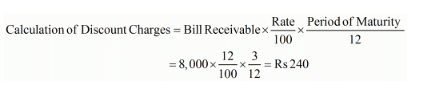

Question 10: A sold goods to B for ₹ 20,000 plus CGST and SGST @ 9% each on credit 3 months. B paid A ₹ 3,600 by cheque and accepted a draft for the balance amount. The draft was endorsed in favour of C, who got the payment on maturity.

Give Journal entries in the books of A.

ANSWER:

Page No 16.36:

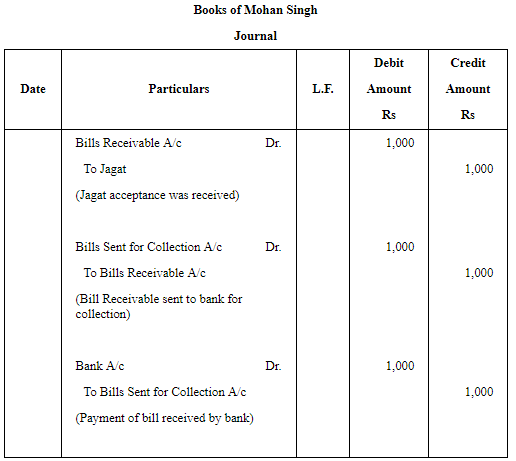

Question 11: Mohan Singh draws a bill on Jagat for ₹ 1,000 payable 2 months after date. Immediately after its acceptance, Mohan Singh sends the bill to his bank for collection. On due date, bank gets the payment. Make the entries in the books of all the parties.

ANSWER:

Page No 16.36:

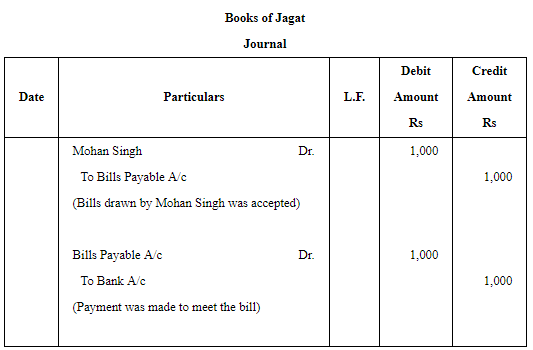

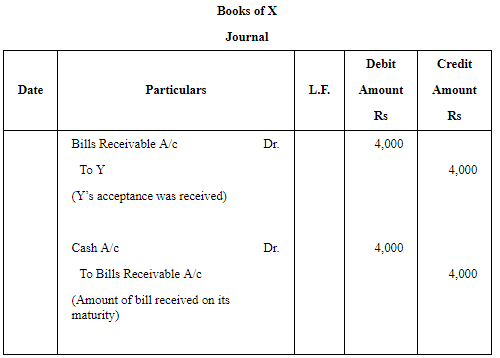

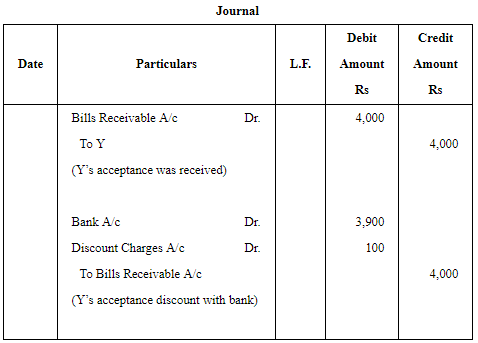

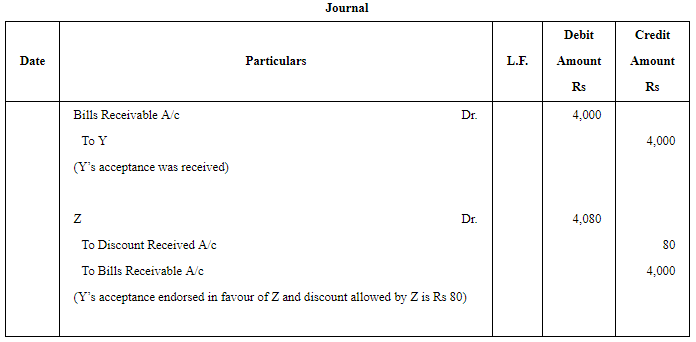

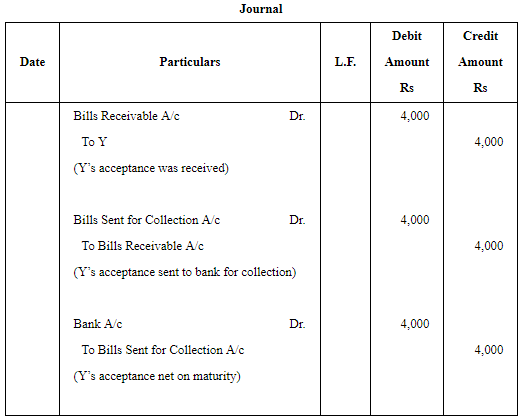

Question 12: X draws on Y a bill for ₹ 4,000 which was duly accepted by Y. Y meets the bill on its due date. Show what entries would be passed in the books of X under each of the following circumstances:

(a) If X retains the bill till due date.

(b) If X discounts the same with his banker paying ₹ 100 for discount.

(c) If X endorses the same to his creditor Z in full settlement of his debt of ₹ 4,080.

(d) If X sends the bill to his banker for collection the next day.

ANSWER:

Case (a)

Case (b)

Case (c)

Case (d)

|

64 videos|152 docs|35 tests

|

FAQs on Accounting for Bills of Exchange (Part - 2) - Accountancy Class 11 - Commerce

| 1. What is a bill of exchange in accounting? |  |

| 2. How does accounting for bills of exchange work? |  |

| 3. What are the accounting entries for a bill of exchange? |  |

| 4. How is interest calculated for bills of exchange in accounting? |  |

| 5. What are the advantages of using bills of exchange in accounting? |  |

|

Explore Courses for Commerce exam

|

|