Accounting for Bills of Exchange (Part - 3) | Accountancy Class 11 - Commerce PDF Download

Page No 16.36:

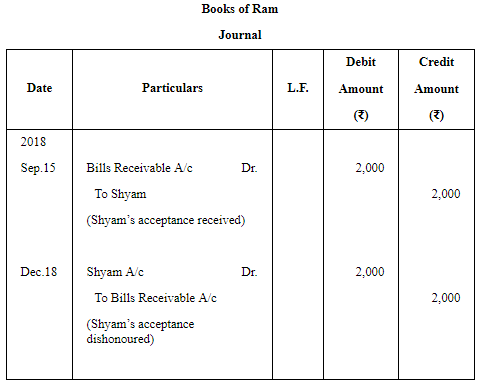

Question 13: Ram draws a bill for ₹ 2,000 on Shyam on 15th September, 2018 for 3 months. On maturity, Shyam failed to honour th bill.

Pass the necessary Journal entries in the books of Ram and Shyam.

ANSWER:

Page No 16.37:

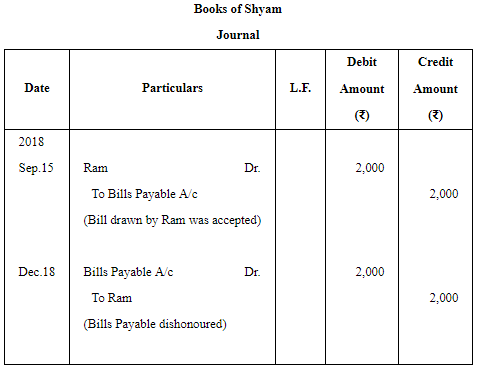

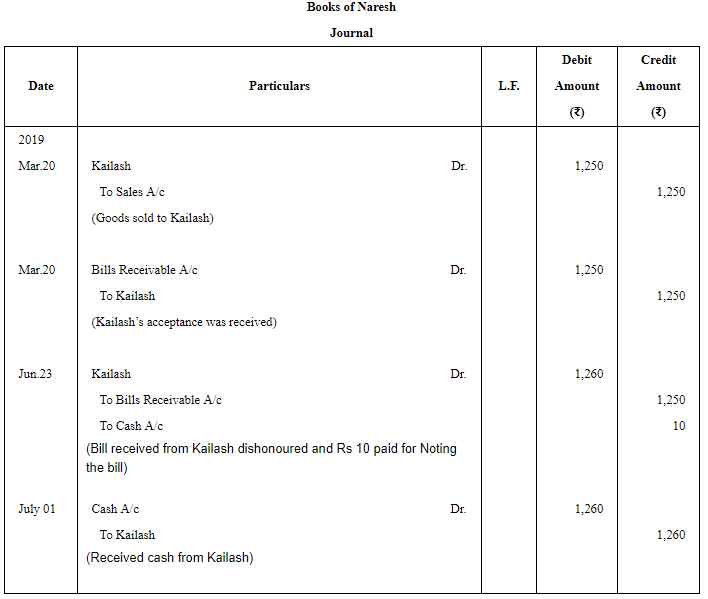

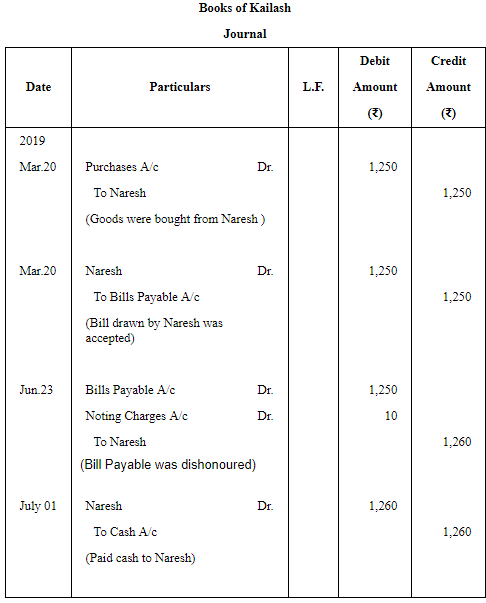

Question 14: On 20th March, 2019, Naresh sold goods to Kailash to the value of ₹ 1,250, taking a bill at 3 months for the amount. On maturity, the bill was dishonoured. Naresh paid ₹ 10 as noting charges. On 1st July, Kailash cleared his account by paying ₹ 1,260.

Make the entries in the books of both the parties to record the above transactions.

ANSWER:

Page No 16.37:

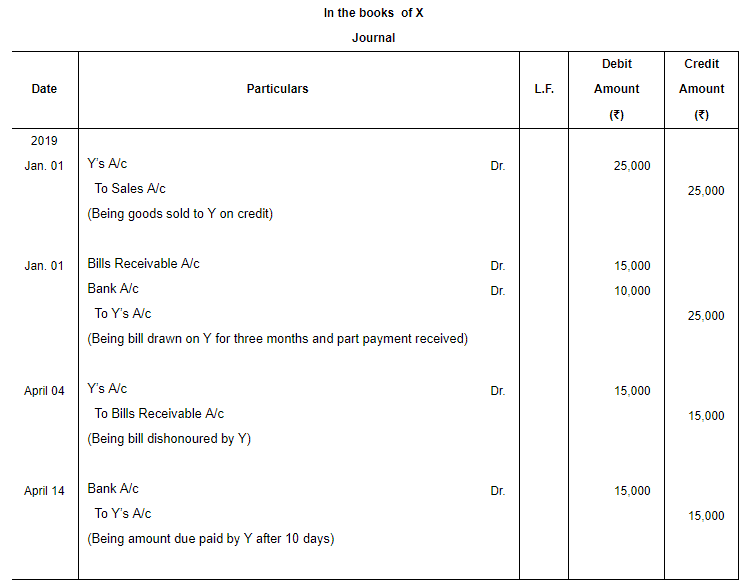

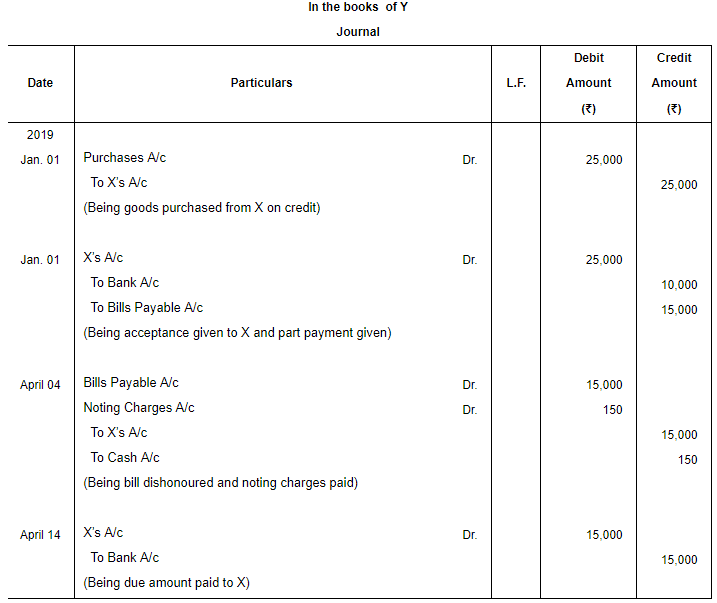

Question 15: On 1st January, 2019, X sold goods to Y for ₹ 25,000 and immediately received from Y ₹ 10,000 by cheque and drew a bill on Y at three months for the balance amount. Bill is accepted by Y. Bill was dishonoured on the due date and Y paid ₹ 150 as noting charges. Ten days later, Y pays the due amount to X. Pass the Journal entries in the books of both the parties.

ANSWER:

Page No 16.37:

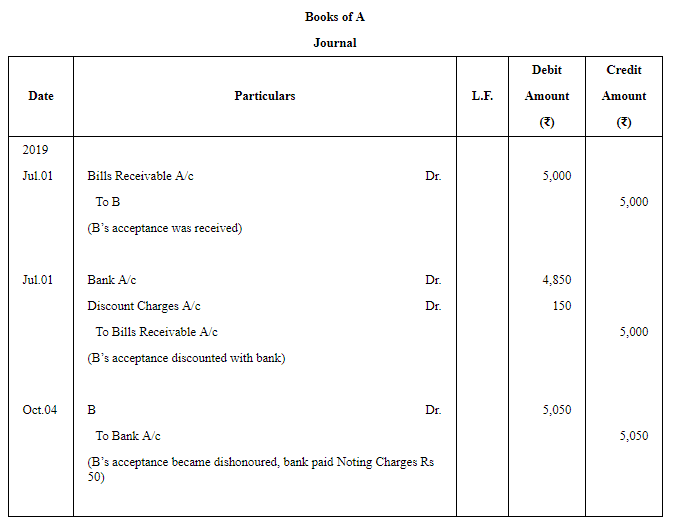

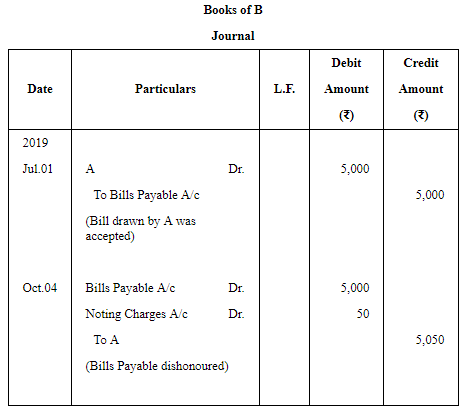

Question 16: On 1st July, 2019, A drew a bill for ₹ 5,000 on B payable after 3 months. A discounted it with the Bank for ₹ 4,850. On maturity, B failed to pay the amount of his acceptance and the bank had to pay ₹ 50 as noting charges.

Pass the necessary Journal entries in the books of A and B.

ANSWER:

Page No 16.37:

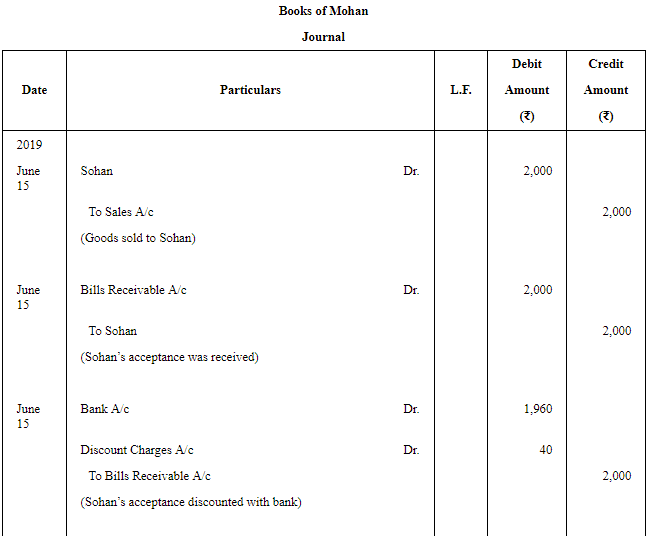

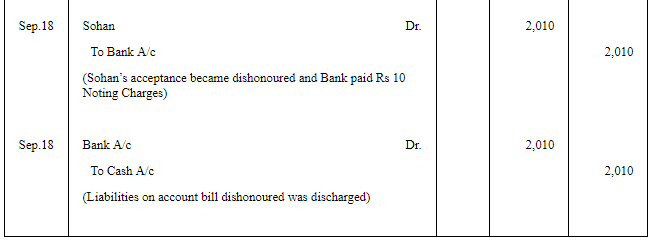

Question 17: On 15th June, 2019, Mohan sold goods to Sohan valued at ₹ 2,000. He drew a bill at 3 months for the amount and discounted the same with his bank for ₹ 1,960. On the due date the bill was dishonoured and Mohan paid to the bank the amount due plus the noting charges of ₹ 10.

Draft the Journal entries in the books of all parties.

ANSWER:

Page No 16.37:

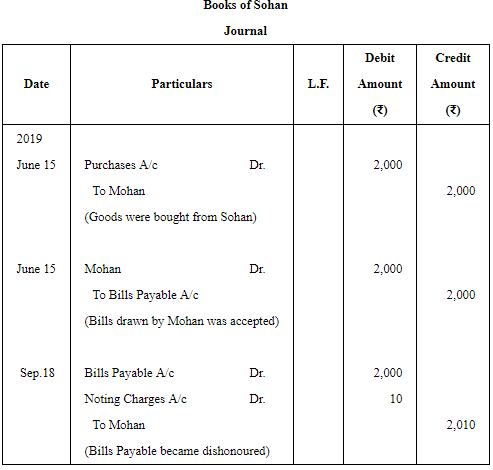

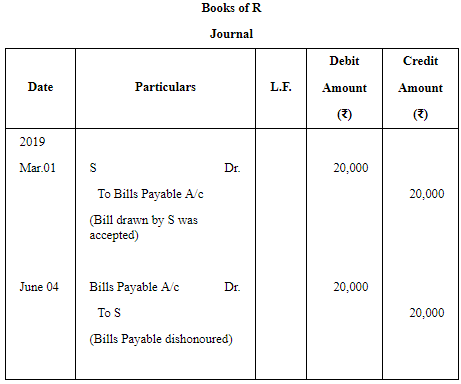

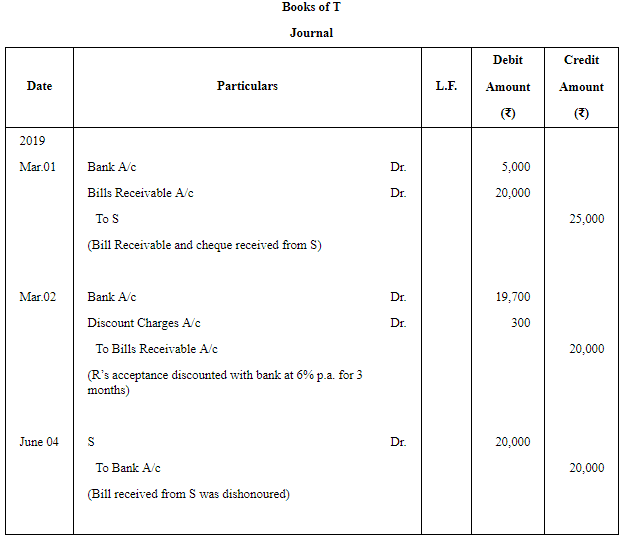

Question 18: On 1st March, 2019, R accepted a Bill of Exchange of ₹ 20,000 from S payable 3 months after date in full settlement of his dues. On the same day S endorsed the Bill of Exchange to T together with a cheque for ₹ 5,000 in settlement of his debt to the latter. On 2nd March, 2019, T discounted the Bill of Exchange @ 6% p.a. with his bank. On maturity the Bill of Exchange was dishonoured.

Journalise the transactions in the books of R and T.

ANSWER:

Page No 16.37:

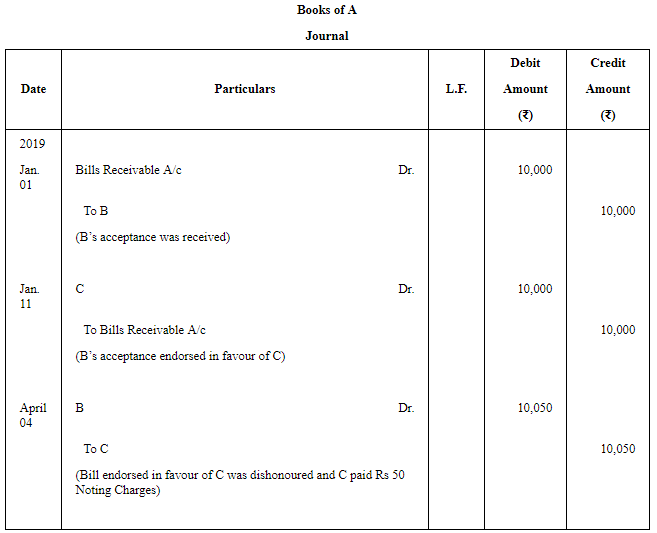

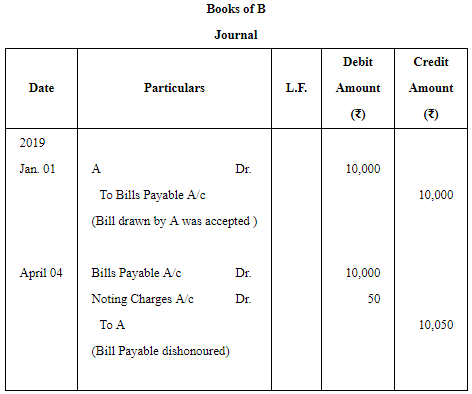

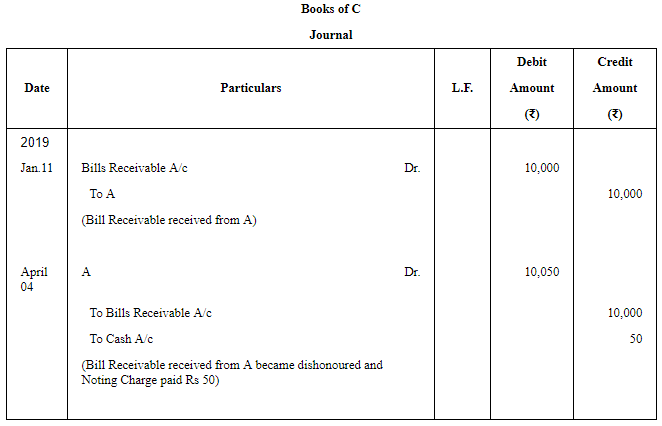

Question 19: On 1st January, 2019, A drew a bill on B for ₹ 10,000 payable after 3 months. B accepted the bill and returned it to A. After 10 days, A endorsed the bill to his creditor C. On the due date, the bill was dishonoured and C paid ₹ 50 as noting charges.

Record the transactions in the books of A, B and C.

ANSWER:

Page No 16.37:

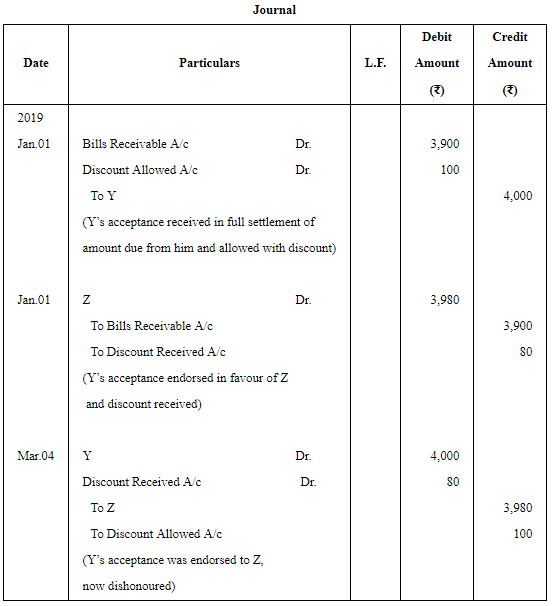

Question 20: Y owes X ₹ 4,000. On 1st January, 2019, Y accepts a 3 months bill for ₹ 3,900 in satisfaction of his full claim. On the same date, it was endorsed by X to Z in satisfaction of his claim of ₹ 3,980. The bill is dishonoured on the due date. Give the Journal entries in the books of X.

ANSWER:

|

64 videos|153 docs|35 tests

|

FAQs on Accounting for Bills of Exchange (Part - 3) - Accountancy Class 11 - Commerce

| 1. What is a bill of exchange in accounting? |  |

| 2. How does accounting for bills of exchange work? |  |

| 3. What are the advantages of using bills of exchange in accounting? |  |

| 4. How are bills of exchange different from promissory notes in accounting? |  |

| 5. Are there any risks associated with accounting for bills of exchange? |  |

|

Explore Courses for Commerce exam

|

|