Accounting for Bills of Exchange - (Part - 5) | Accountancy Class 11 - Commerce PDF Download

Page No 16.38:

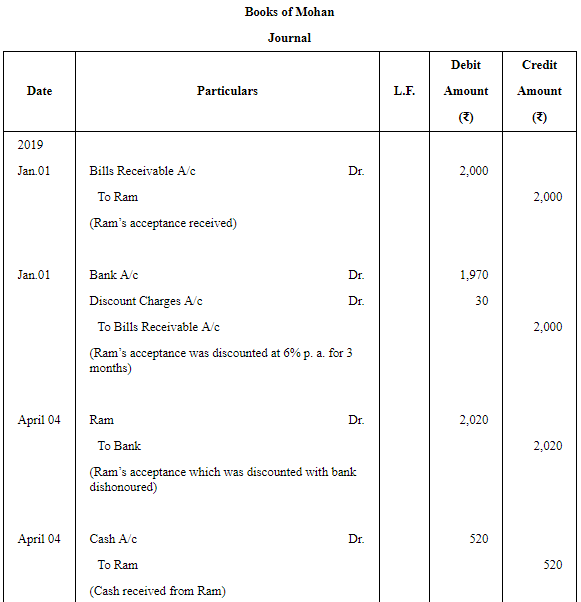

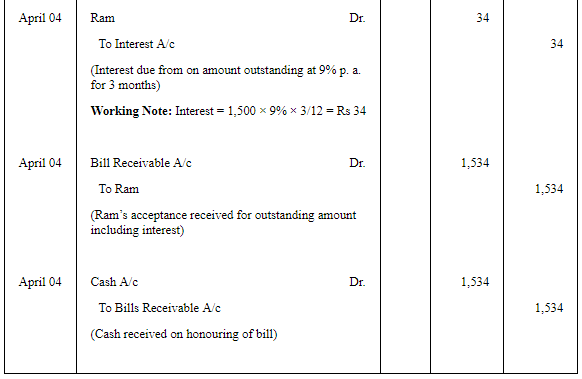

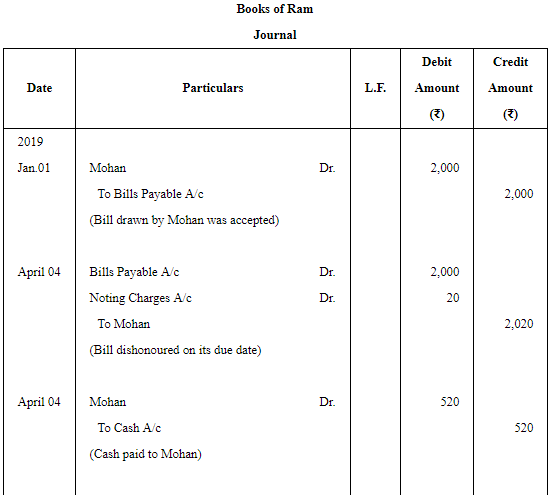

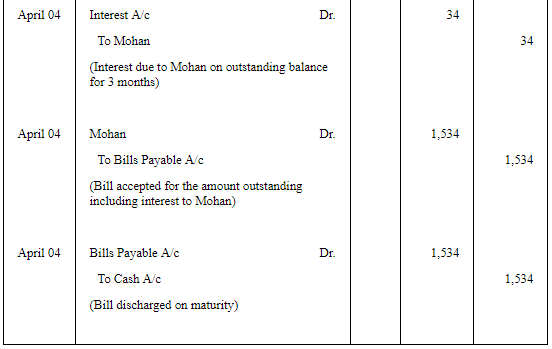

Question 26: Ram owes ₹ 2,000 to Mohan on 1st January, 2019. On this date, he accepted a draft for the amount for 3 months. Mohan got the bill discounted at his bank @ 6% p.a. On the due date, the bill was dishonured, nothing charges ₹ 20. Ram agreed to pay ₹ 520 immediately and accept another bill for the remaining amount for 3 months together with interest at 9% p.a. This bill was met on the due date. Give the Journal entries in the books of both the parties.

ANSWER:

Page No 16.38:

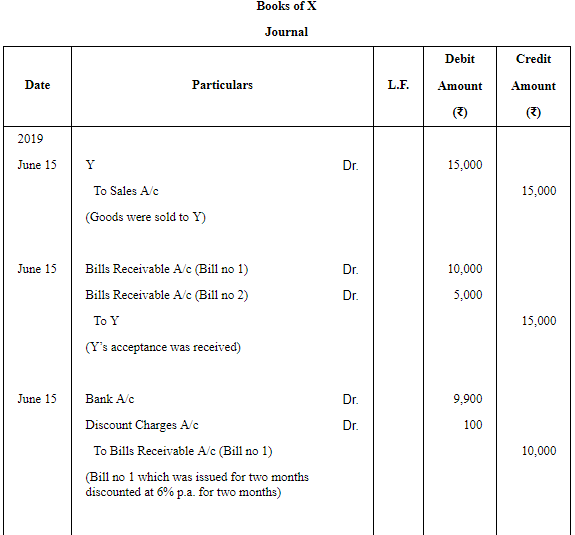

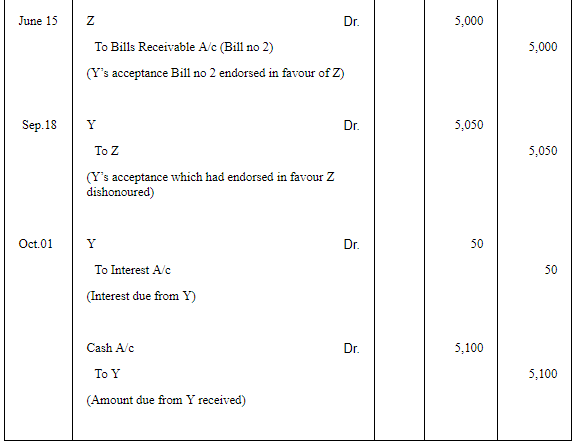

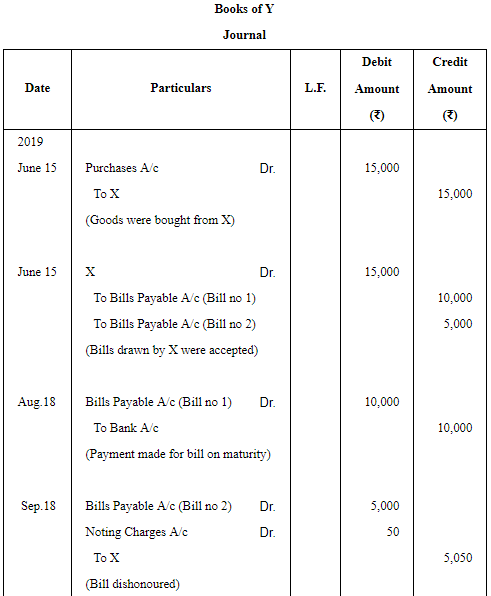

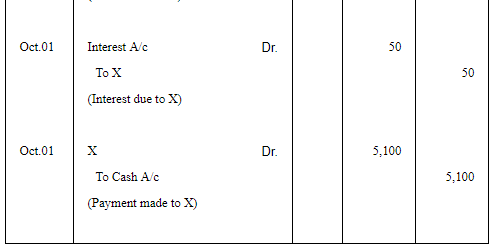

Question 27: On 15th June, 2019, X sold to Y goods to the value of ₹ 15,000 drawing upon the latter two bills, one for ₹ 10,000 payable 2 months after date and other for ₹ 5,000 payable 3 months after date, X discounted the first bill with his bank at 6% p.a. and endorsed the second bill in favour of his creditor, Z. The first bill was met on maturity but the second was dishonoured. Z paid ₹ 50 as noting charges. On 1st October, Y cleared his account to X by paying ₹ 5,100 which included ₹ 50 as interest.

Record the necessary Journal entries in the books of both X and Y.

ANSWER:

Page No 16.38:

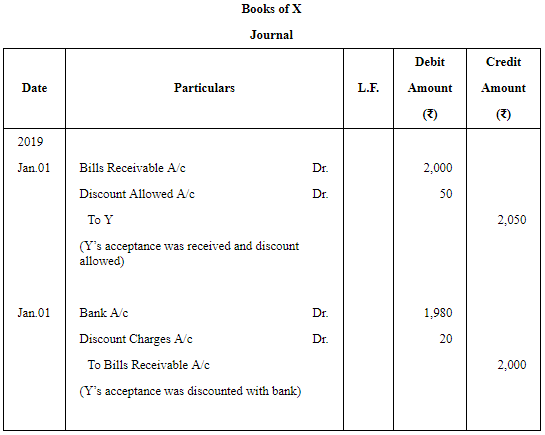

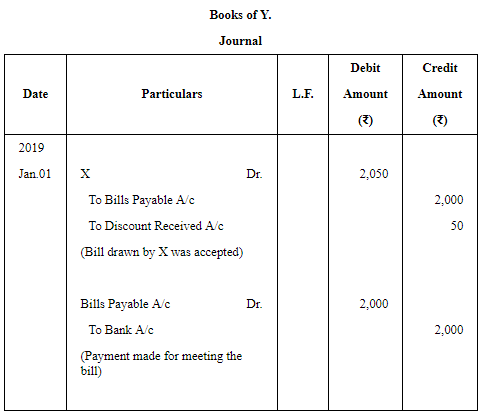

Question 28: X draws a bill on Y for ₹ 2,000 on 1st January, 2019, Y accepts the same and returns it to X. The bill was drawn by X in full settlement of a debt owing by Y amounted to ₹ 2,050. X discounts the bill on the same date with the Central Bank of India for ₹ 1,980. On maturity the bill was duly met by Y.

Give the entries in the books of X and Y.

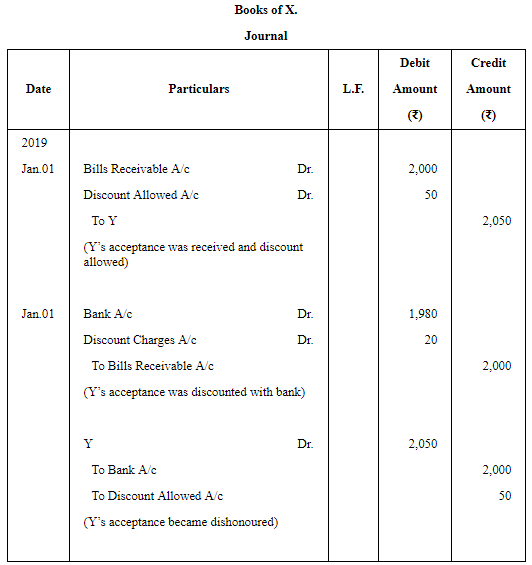

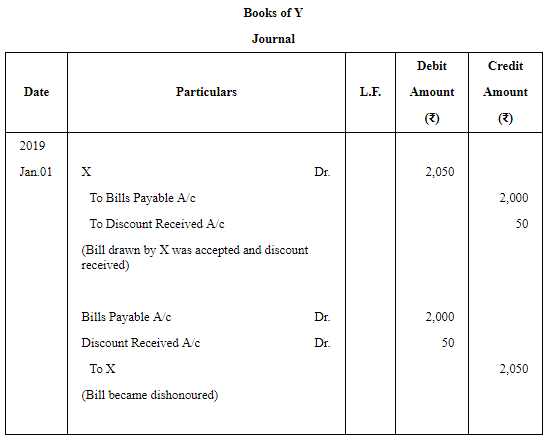

Suppose the bill is dishonoured, what entries will be passed?

ANSWER:

Journal entries – In case bill is dishonoured

Page No 16.38:

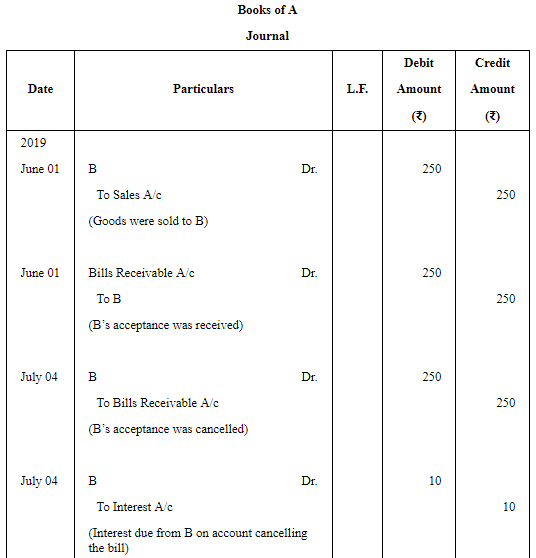

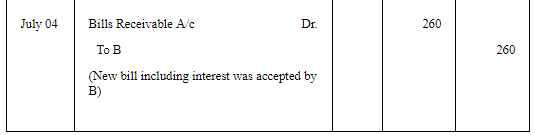

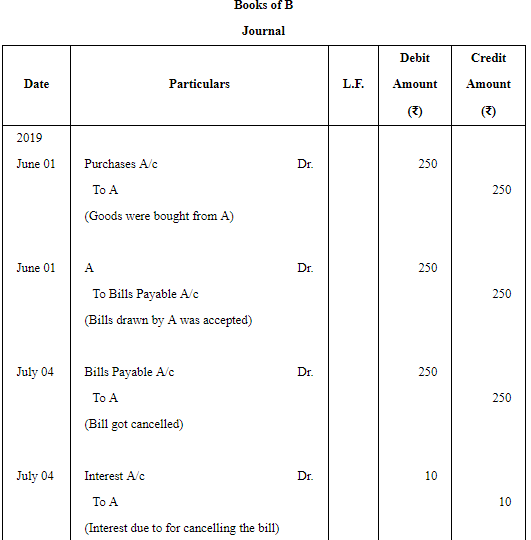

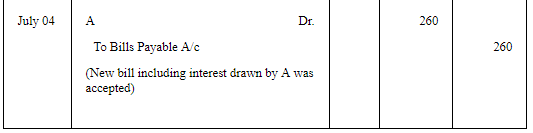

Question 29: On 1st June, 2019, A sold goods to B for ₹ 250. B gave to A his acceptance payable 1 month after date. Before maturity B requests A to renew it, which A does adding ₹ 10 to the new bill for interest.

Make the necessary Journal entries to record these transactions in the books of both A and B.

ANSWER:

Page No 16.38:

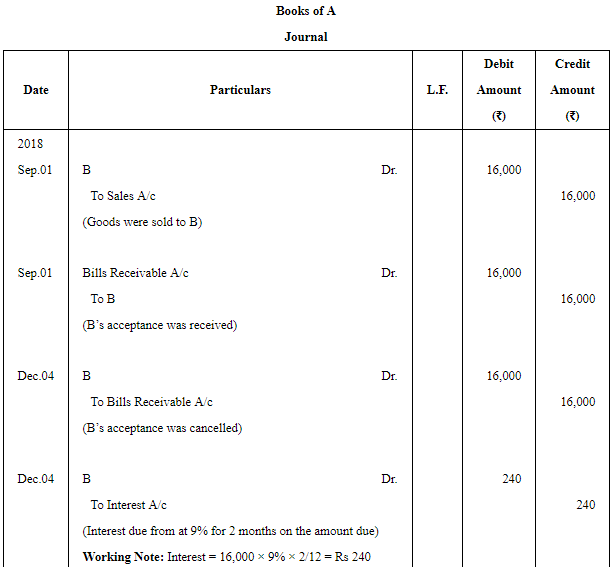

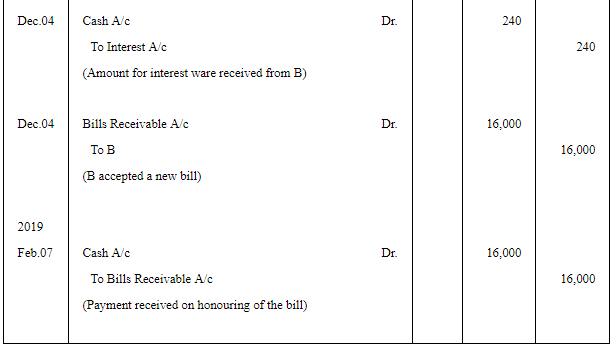

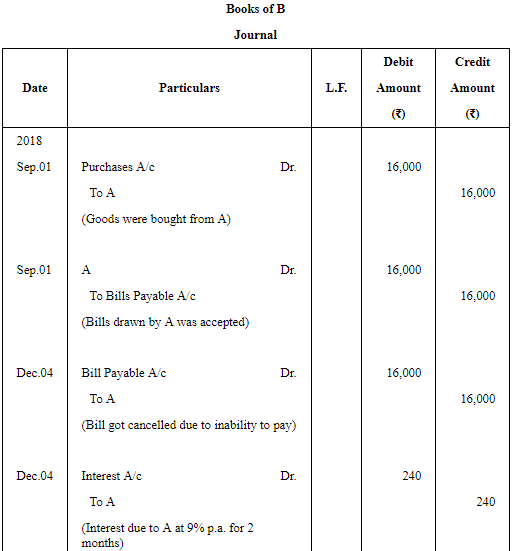

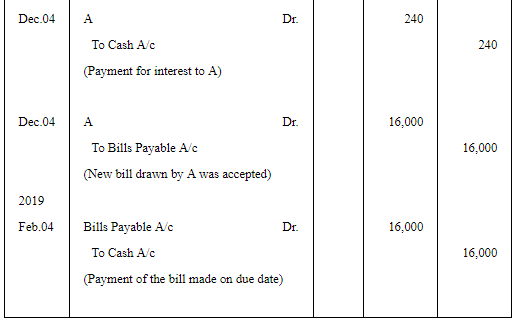

Question 30: A sold goods to B on 1st September, 2018 for ₹ 16,000. B immediately accepted a 3 months bill. On the due date, B requested that the bill be renewed for a further period of 2 months. A agreed provided interest at 9% p.a. was paid immediately in cash. To this B was agreeable. The second bill was met on the due date. Give the Journal entries in the books of A.

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Accounting for Bills of Exchange - (Part - 5) - Accountancy Class 11 - Commerce

| 1. What is a bill of exchange? |  |

| 2. How does accounting for bills of exchange work? |  |

| 3. What are the different stages in the accounting for bills of exchange? |  |

| 4. How are bills of exchange valued in accounting? |  |

| 5. What are the accounting entries for a bill of exchange? |  |

|

Explore Courses for Commerce exam

|

|