Accounting for Bills of Exchange (Part - 6) | Accountancy Class 11 - Commerce PDF Download

Page No 16.38:

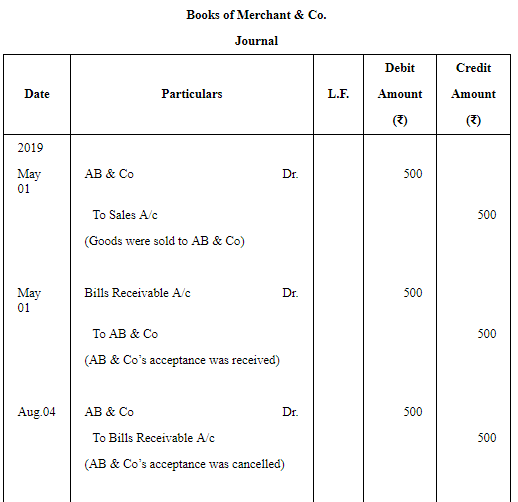

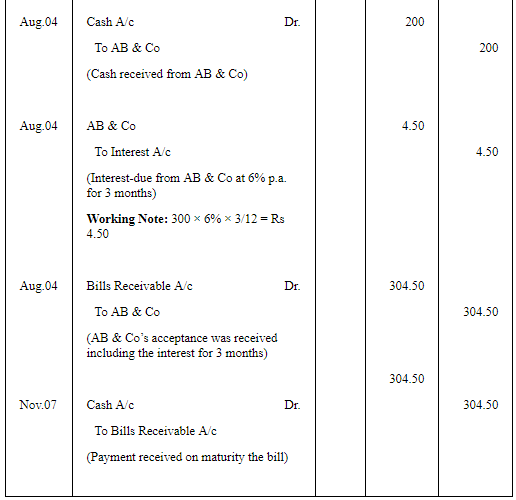

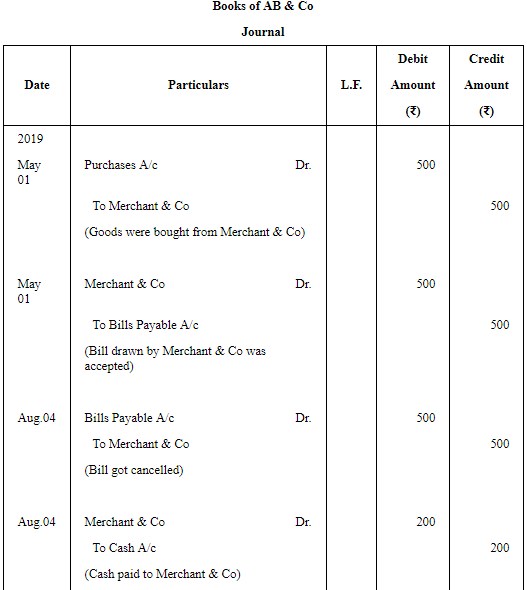

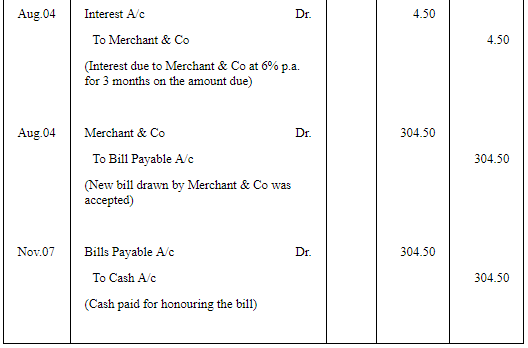

Question 31: On 1st May, 2019 Merchant & Co. sold goods to AB & Co. valued at ₹ 500 and drew upon them a bill at 3 months for the amount. AB & Co. accepted the draft on presentation. When the bill was about to mature. AB & Co. expressed their inability to meet it, and offered to pay Merchant & Co. ₹ 200 in cash and to accept a fresh bill for the balance plus interest at 6% p.a. for 3 months. Merchant & Co. agreed to the proposal and bill was renewed. On maturity, the bill was duly met.

Make the entries in the books of both the parties to record the above

transactions.

ANSWER:

Page No 16.39:

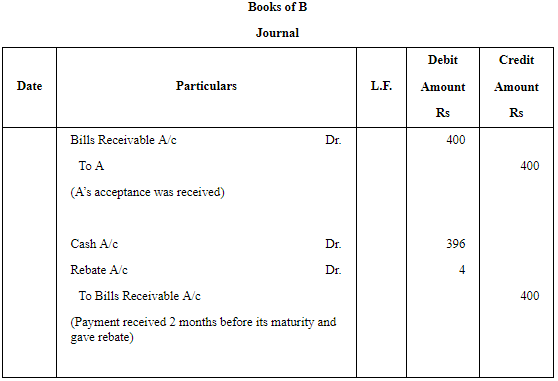

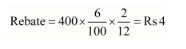

Question 32: A owed B ₹ 400. A accepted a Bill of Exchange at 3 months for this amount which B discounted for ₹ 380.

Give the necessary Journal entries in the books of A and B if this bill is:

(a) dishonoured on the due date;

(b) met at maturity and

(c) retired under rebate at 6% p.a. 2 months before its maturity.

ANSWER:

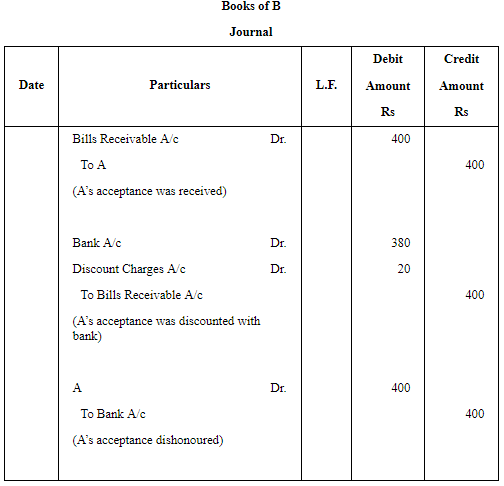

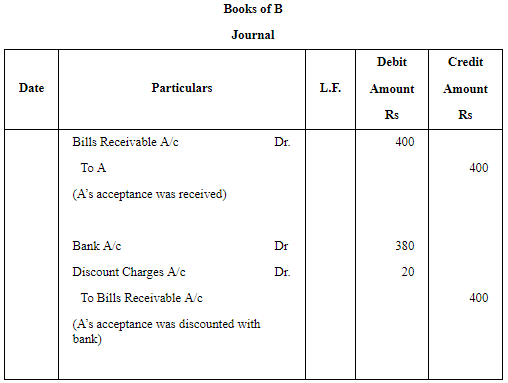

Case (a) If the bill is dishonoured

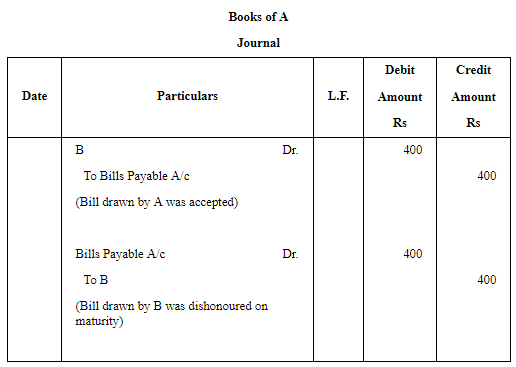

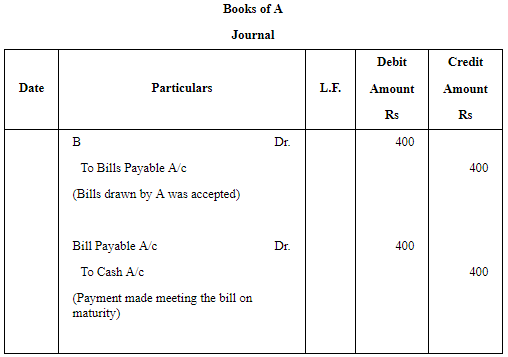

Case (b) The bills met at maturity

Case (c) If bill is retired under rebate at 6% p.a. 2 months before its maturity

Working Note:

Page No 16.39:

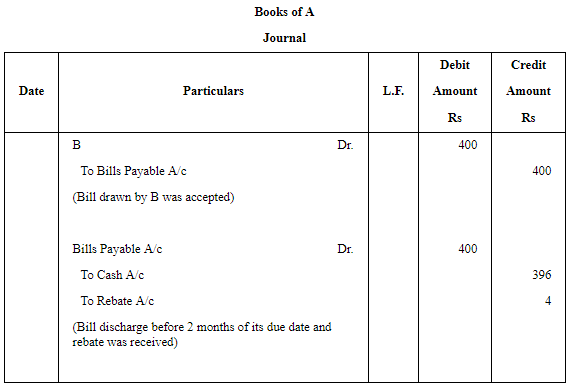

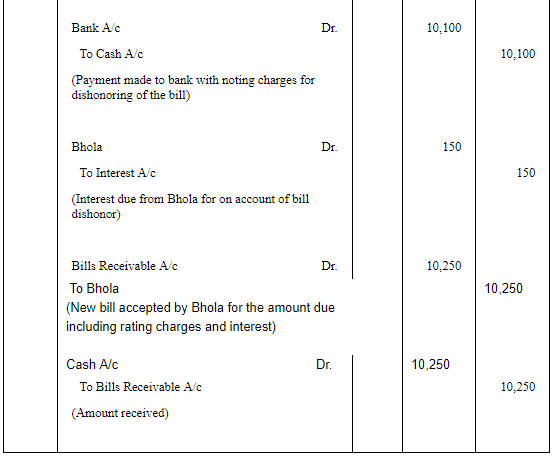

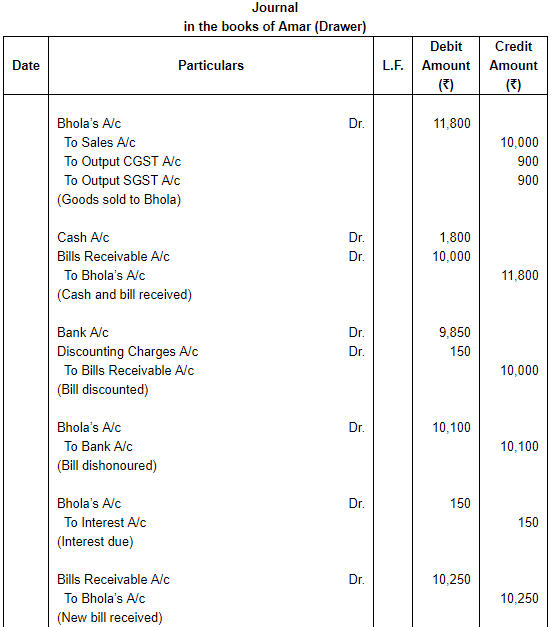

Question 33: Amar sells goods to Bhola for ₹ 10,000 and draws upon him a bill for the amount payable 3 months after date. The bill is accepted by Bhola. Amar discounts the bill with his bankers at a discount of ₹ 150 inclusive of all charges. Bhola fails to meet this bill on maturity. Amar pays off his banker and his expenses amounting to ₹ 100. Bhola gives a fresh bill, 2 months' date to Amar for ₹ 10,250, which he met at maturity.

Show the necessary Journal entries in Amar's books.

ANSWER:

Page No 16.39:

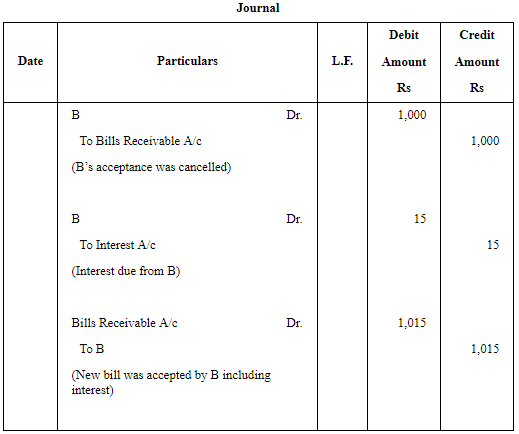

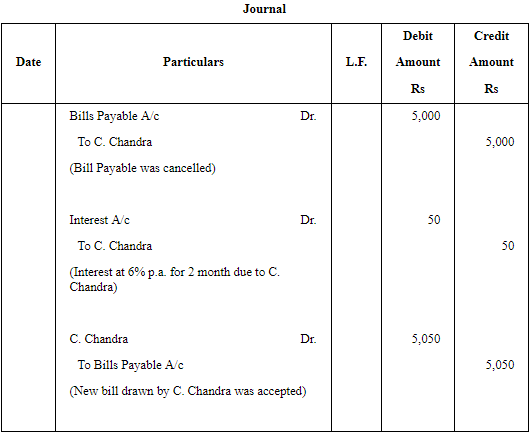

Question 34: Give the Journal entries for the following:

(a) B's acceptance to us for ₹ 1,000 due this day, renewed at his request for 3 months with interest @ 6% p.a.

(b) Our bill to Chandra for ₹ 5,000 renewed for 2 months with interest @ 6% p.a.

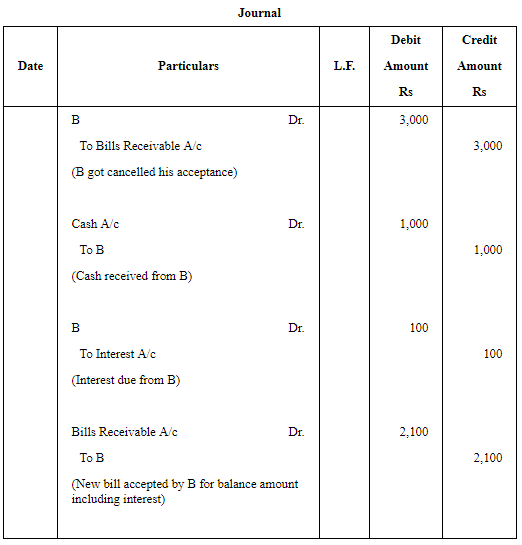

(c) B's acceptance of ₹ 3,000 is discharged on his paying us cash ₹ 1,000 and accepting a fresh bill for the balance with interest ₹ 100.

ANSWER:

(a)

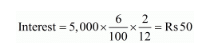

Working Note:

(b)

Working Note:

(c)

Page No 16.39:

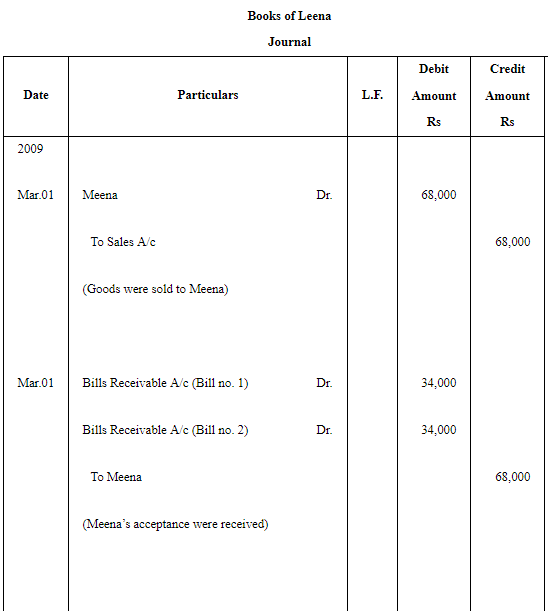

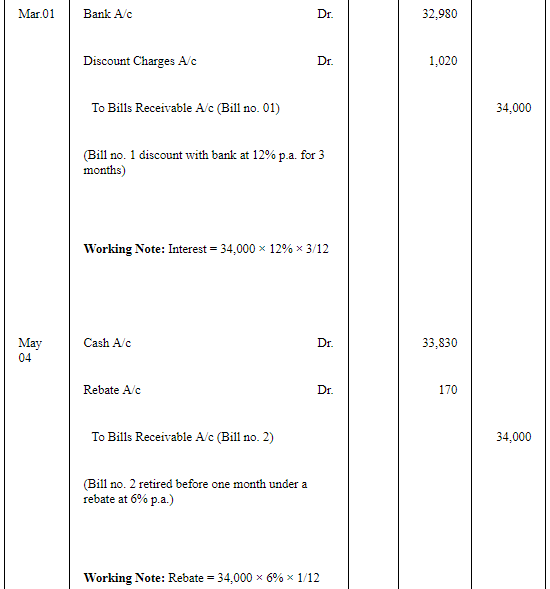

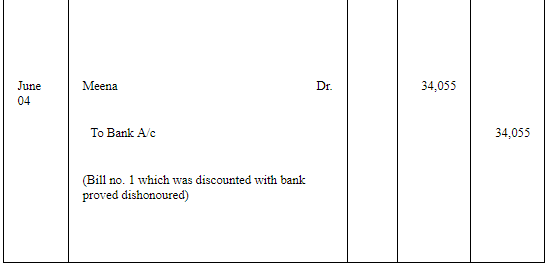

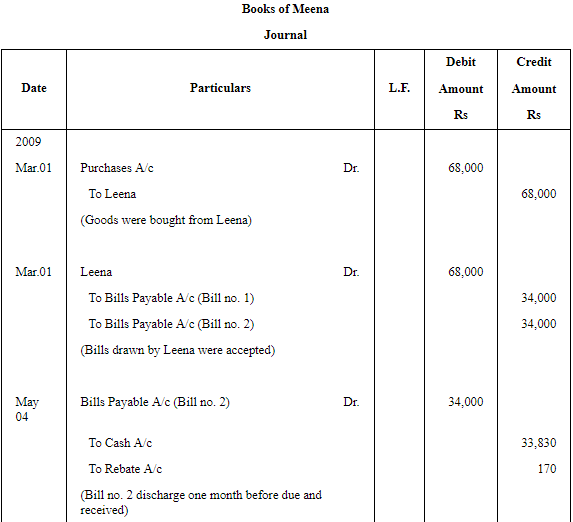

Question 35: Leena sold goods to Meena on 1st March, 2009 for ₹ 68,000 and drew two Bills of Exchange of the equal amount upon Meena payable after three months. Leena immediately discounted the first bill with her bank at 12% p.a. The bill was dishonoured by

Meena and Bank paid ₹ 55 as noting charges.

The second bill was retired on 4th May, 2009 under a rebate of 6% p.a. with mutual agreement.

Journalise the above in the books of Leena and Meena.

ANSWER:

Page No 16.39:

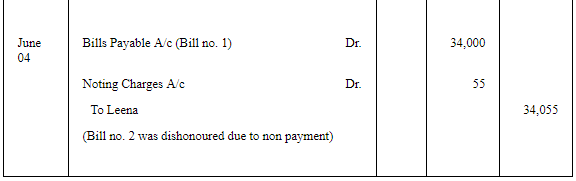

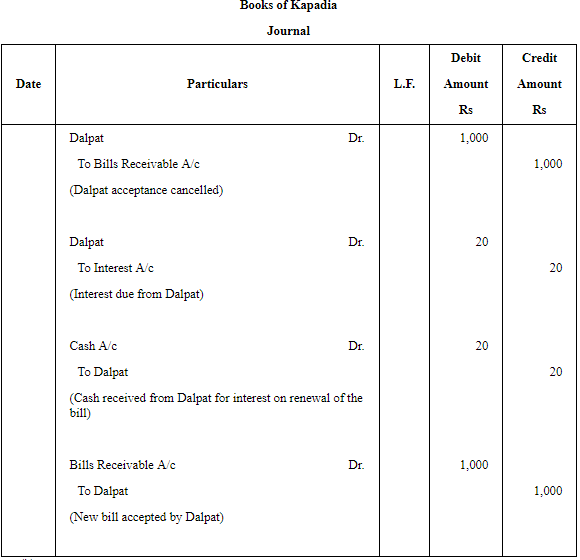

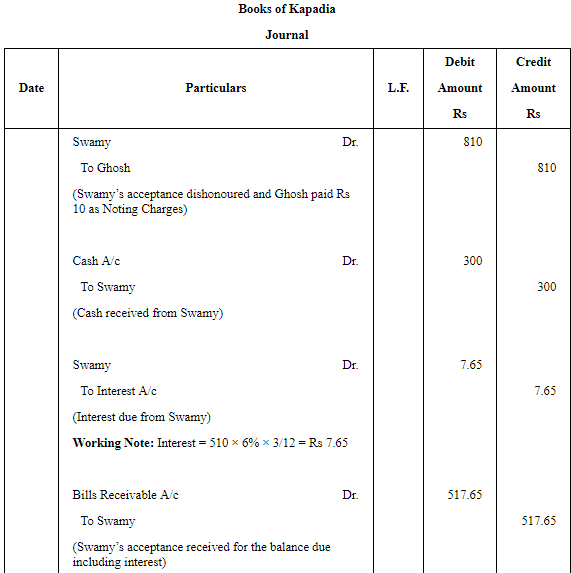

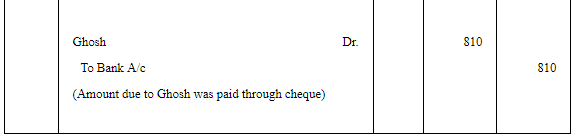

Question 36: How will you record the following transactions in the books Kapadia?

(a) A bill received from Dalpat for ₹ 1,000 has to be renewed, Dalpat agrees to pay ₹ 20 as interest.

(b) Swamy's bill for ₹ 800 endorsed in favour of Ghosh dishonoured, Ghosh pays ₹ 10 as noting charges. Swamy pays ₹ 300 immediately and agrees to accept a new bill for 3 months for the balance together with interest at 6% p.a.

Ghosh's Account is settled by cheque.

ANSWER:

(a)

(b)

Page No 16.39:

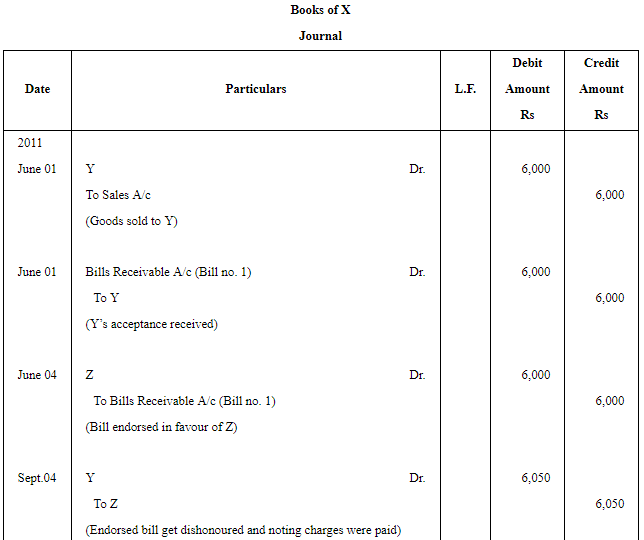

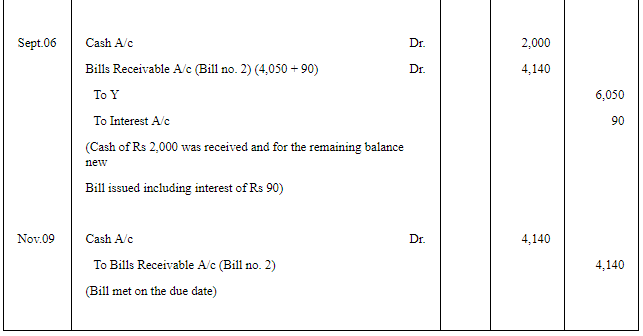

Question 37: Y purchased goods for ₹ 6,000 on 1st June, 2011 from X and on the same date accepted a bill payable after three months. 3 days later, X endorsed the bill to Z. On maturity, the bill was dishonoured for non-payment and Z had to pay ₹ 50 as noting charges. Two days after the dishonour of bill, Y paid ₹ 2,000 to X and requested him to draw a second bill for the balance plus ₹ 90 for the amount of interest, payable after two months. X accepted the proposal and draws the bill on Y, which was accepted by Y and was duly met on maturity.

Pass Journal entries for the above transactions in the books of X.

ANSWER:

Page No 16.40:

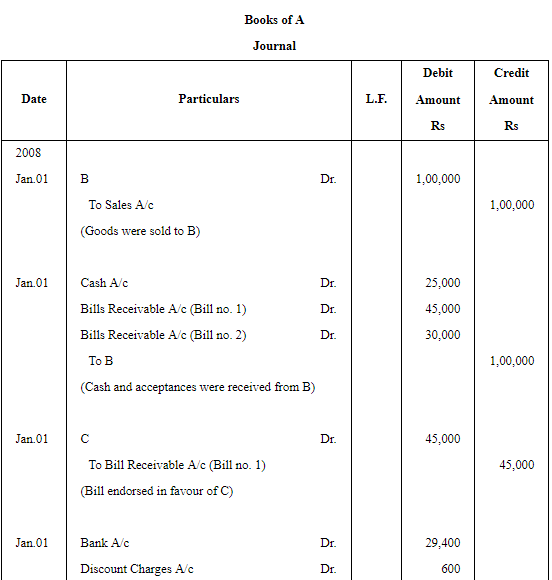

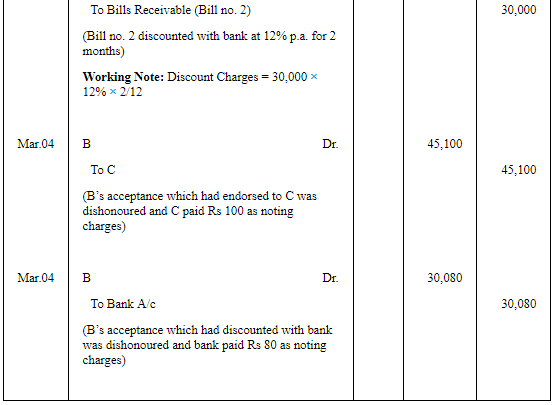

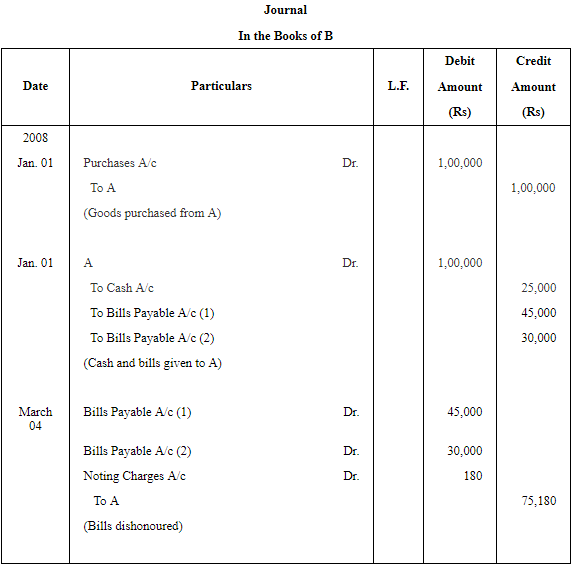

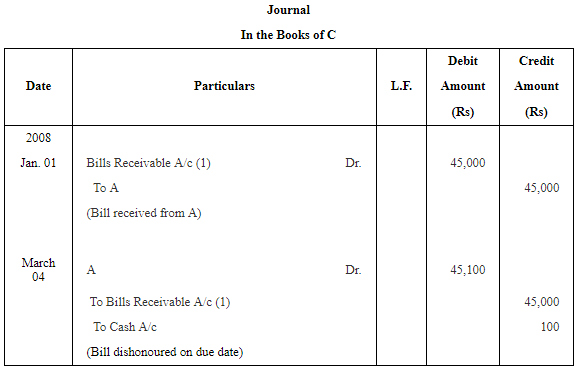

Question 38: On 1st January, 2008, A sold goods to B for ₹ 1,00,000 received ₹ 25,000 in cash and drew two bills, first ₹ 45,000 and second for ₹ 30,000 of two months each. Both bills were duly accepted by B. First bill was endorsed to C in settlement of his account of ₹ 45,000 and second bill was discounted from the bank at the rate of 12% p.a. On the due date of these bills, both bills were dishonoured, C has paid ₹ 100 and bank has paid ₹ 80 as noting charges.

Pass Journal entries in the books of A, B and C.

ANSWER:

Page No 16.40:

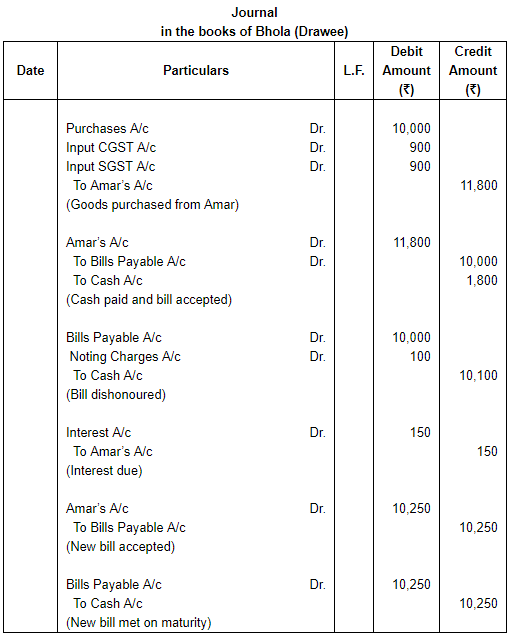

Question 39: Amar sells goods to Bhola for ₹ 10,000 plus CGST and SGST @ 9% each. He receives the GST amount in cash and draws upon Bhola a bill for the balance amount payable 3 months after date. The bill is accepted by Bhola. Amar discounts the bill with his bank at a discount of ₹ 150 inclusive of all charges. Bhola fails to meet this bill on maturity. Amar pays off his bank and his expenses amounting to ₹ 100. Bhola gives a fresh bill of 2 months' date to Amar for ₹ 10,250, which he meets at maturity. Show necessary Journal entries in Amar's books.

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Accounting for Bills of Exchange (Part - 6) - Accountancy Class 11 - Commerce

| 1. What is a bill of exchange in accounting? |  |

| 2. What are the key features of a bill of exchange? |  |

| 3. How does accounting for bills of exchange work? |  |

| 4. What are the accounting entries for a bill of exchange? |  |

| 5. How does discounting a bill of exchange affect accounting? |  |

|

Explore Courses for Commerce exam

|

|