Accounts of Banking Companies - B Com PDF Download

Ref: https://edurev.in/question/708001/Accounting-of-banking-companies-Related-Specialized-Accounting

Accounts of Banking Companies

Here is a compilation of top four accounting problems on accounts of banking companies with its relevant solutions.

Illustration 1:

From the following information, prepare the Profit and Loss Account of South Indian Bank as on 31st March, 2004:

Illustration 2:

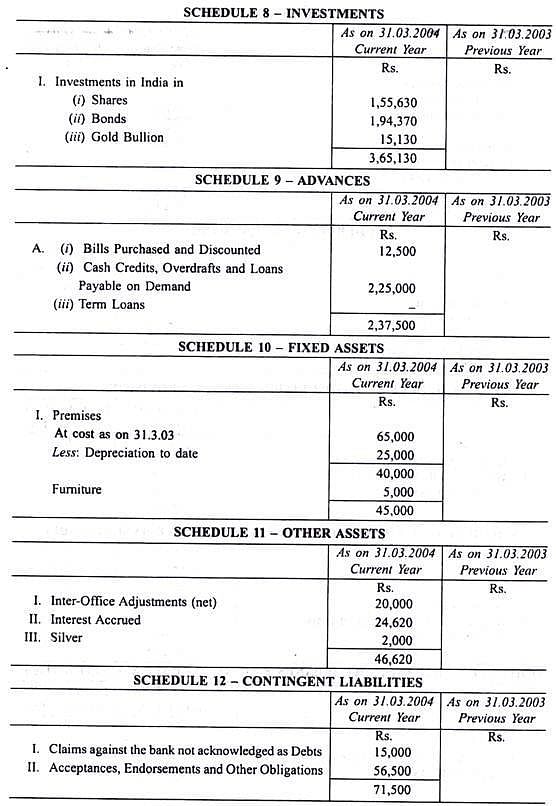

The following Trial Balance was extracted from the books of the United Bank of India as on March 31, 2004:

You are required to prepare a Profit and Loss Account for the year ended 31st March, 2004, and Balance Sheet as at that date after considering the following:

(i) Provide Rebate on bills discounted Rs. 5,000.

(ii) A scrutiny of the Current Account Ledger reveals that there are accounts overdrawn to the extent of Rs. 25,000 and the total of the credit balances is Rs. 1, 22,000.

ADVERTISEMENTS:

(iii) Claims by employees for Bonus Rs. 15,000 is pending award of arbitration,

(iv) Depreciation on building for the year amounts to Rs. 5,000.

(v) Out of profits for the year, 20 per cent transferred to Statutory Reserve and the Directors proposed a dividend of 8 per cent, subject to deduction of tax.

Illustration 3:

On 31st December, 2004, a Bank had the following unmetered Bills:

Illustration 4:

From the following information, find out the amount of provision to be shown in the Profit and Loss Account of a bank:

FAQs on Accounts of Banking Companies - B Com

| 1. What are the different types of accounts offered by banking companies? |  |

| 2. How can I open a bank account with a banking company? |  |

| 3. What are the benefits of having a savings account with a banking company? |  |

| 4. Can I have multiple accounts with different banking companies? |  |

| 5. How can I close my bank account with a banking company? |  |

|

Explore Courses for B Com exam

|

|