Adjustments in Preparation of Financial Statements (Part - 2) | Accountancy Class 11 - Commerce PDF Download

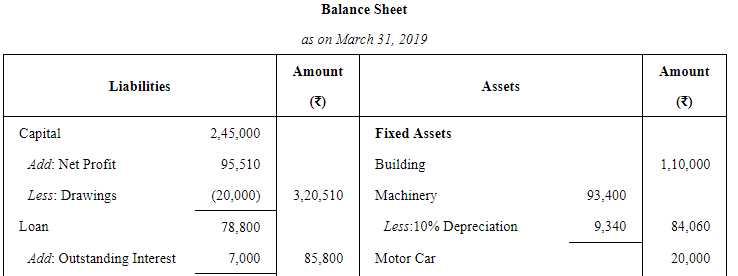

Page No 19.69:

Question 9:

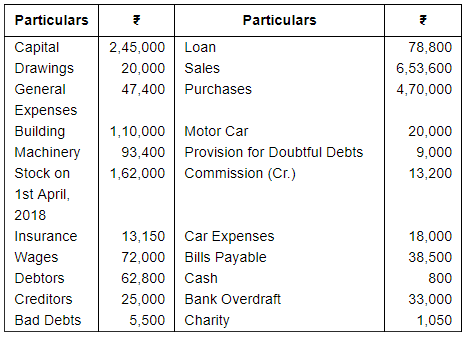

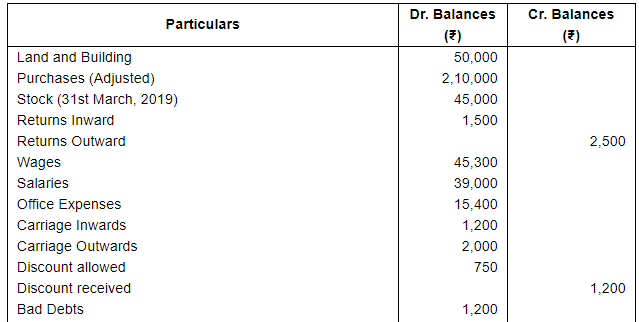

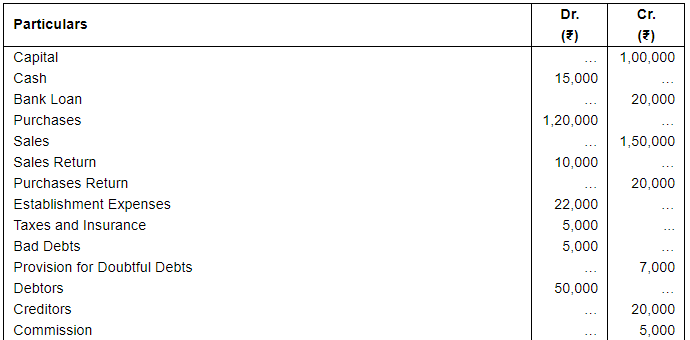

Following balances were extracted from the books of Vijay on 31st March, 2019:

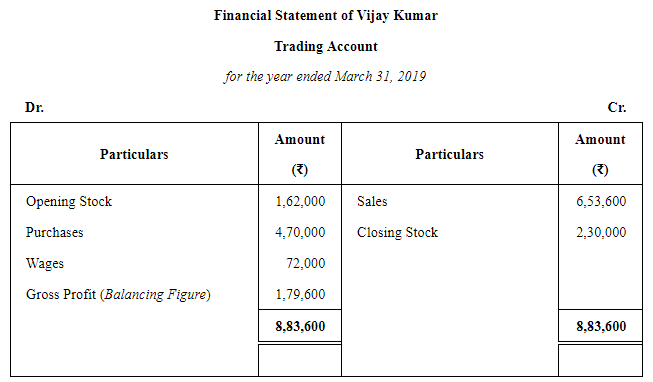

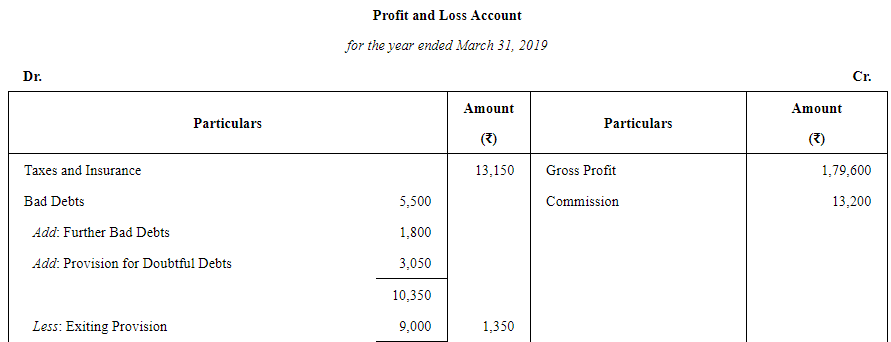

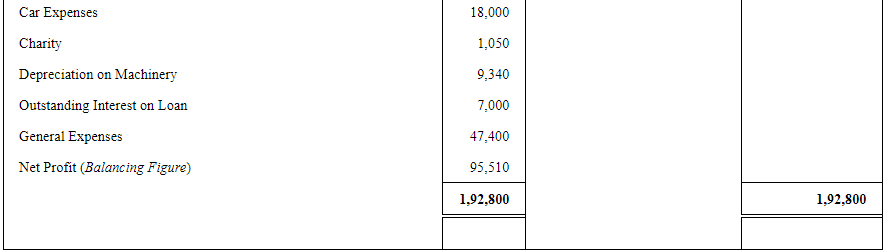

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date after giving effect to the following adjustments:

(a) Stock as on 31st March, 2019 was valued at ₹ 2,30,000.

(b) Write off further ₹ 1,800 as Bad Debts and maintain the Provision for Doubtful Debts at 5%.

(c) Depreciate Machinery at 10%.

(d) Provide ₹ 7,000 as outstanding interest on loan.

ANSWER:

Page No 19.70:

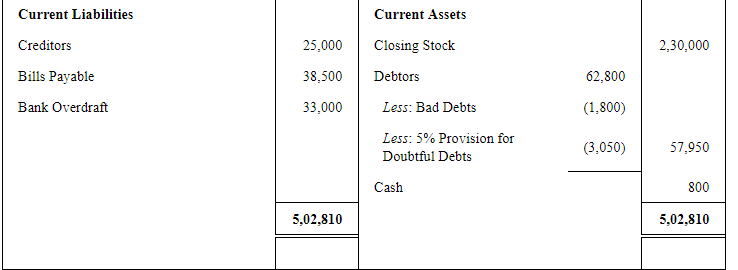

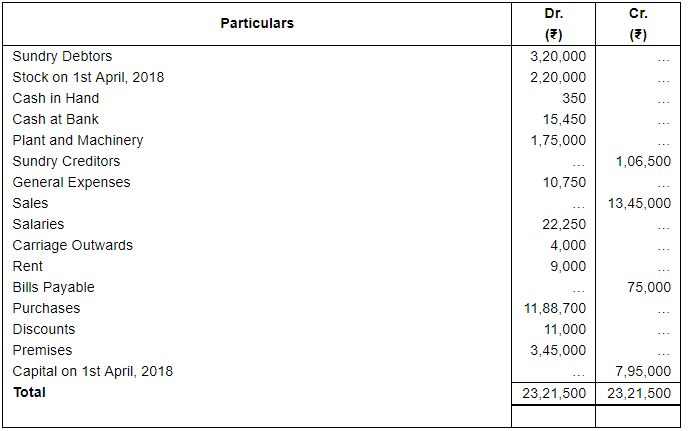

Question 10:

From the following Trial Balance and other information, prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date:

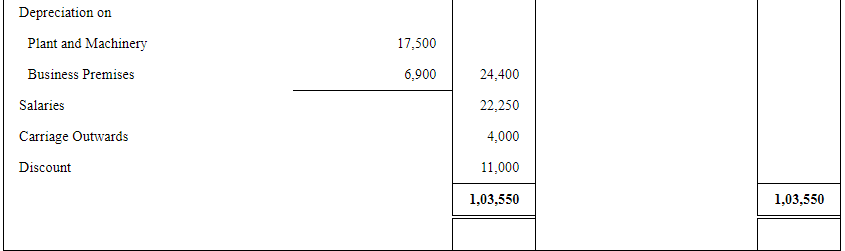

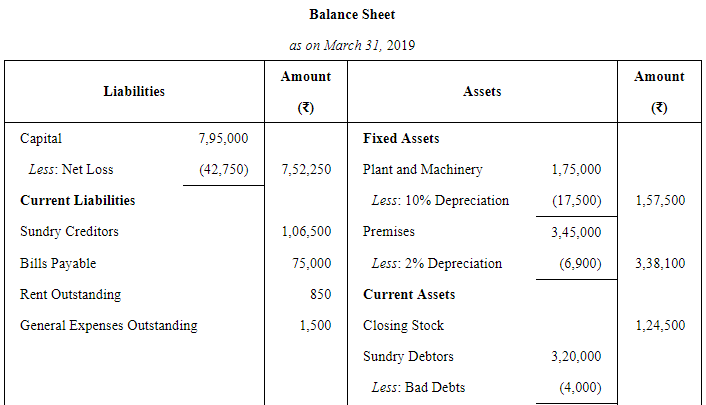

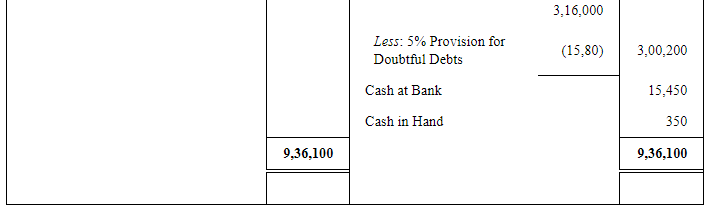

Stock on 31st March, 2019 was ₹ 1,24,500. Rent was unpaid to the extent of ₹ 850 and ₹ 1,500 were outstanding for General Expenses; ₹ 4,000 are to be written off as bad debts out of the above debtors; and 5% is to be provided for doubtful debts. Depreciate Plant and Machinery by 10% and Premises by 2%.

Manager is entitled to a commission of 5% on net profit after charging his commission.

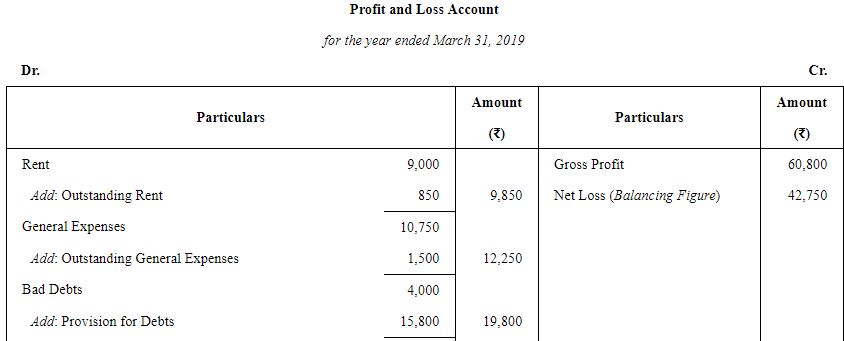

ANSWER:

Note: In the question, Manager Commission is given as 5% on Net Profit after charging commission. But, during the year the firm had a Net Loss of Rs 42,750, therefore, manager commission is not payable.

Page No 19.71:

Question 11:

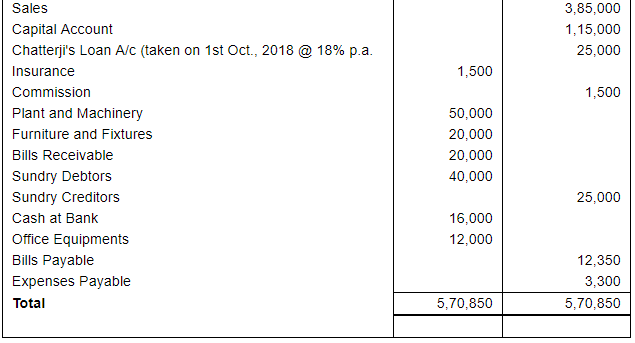

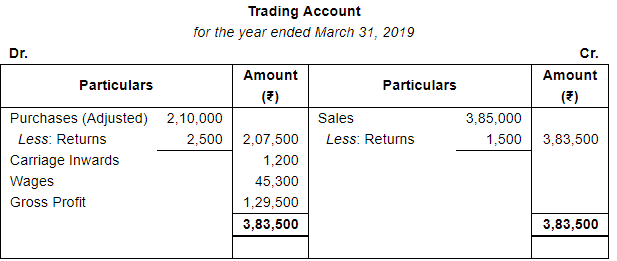

From the following Trial Balance of Shubho, prepare final accounts for the year ended 31st March, 2019 and Balance Sheet as at that date:

The following adjustments be taken care of:

(i) Depreciate Land and Building @ 6%, Plant and Machinery @ 10%, Office equipments @ 20% and Furniture and Fixtures @ 15%.

(ii) Calculate Provision for Doubtful Debts at 2% on Sundry Debtors.

(iii) Insurance premium includes ₹ 250 Insurance Premium paid in advance

(iv) Provide salary to Shubho ₹ 15,000 p.a.

(v) Outstanding Salaries ₹ 11,500.

(vi) 10% of the final profit is to be transferred to General Reserve.

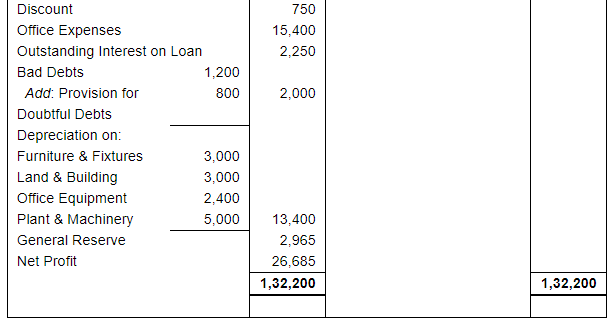

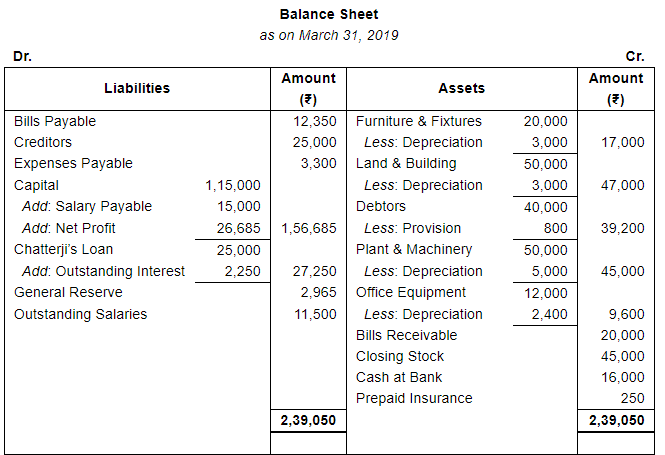

ANSWER:

Page No 19.72:

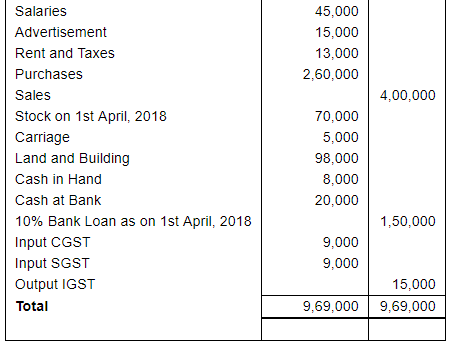

Question 12:

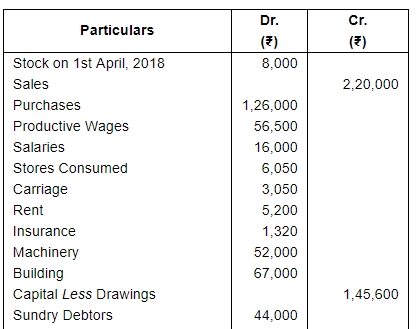

Following is the Trial Balance as on 31st March, 2019. Prepare Trading and Profit and Loss Account and Balance Sheet:

Stock on 31st March, 2019, ₹ 20,600.

You are to make adjustments in respect of the following:

(a) Depreciate Machinery at 10% p.a.

(b) Make a provision @ 5% for Doubtful Debts.

(c) Provide discount on debtors @ 212/212%.

(d) Rent includes Rent deposit of ₹ 400.

(e) Insurance Prepaid ₹ 120.

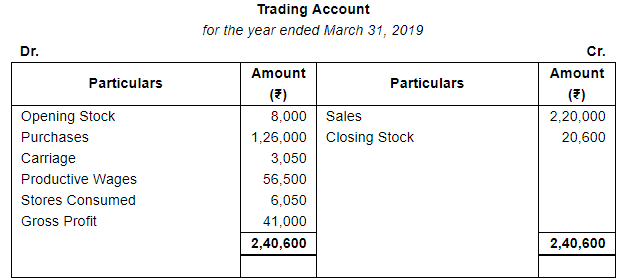

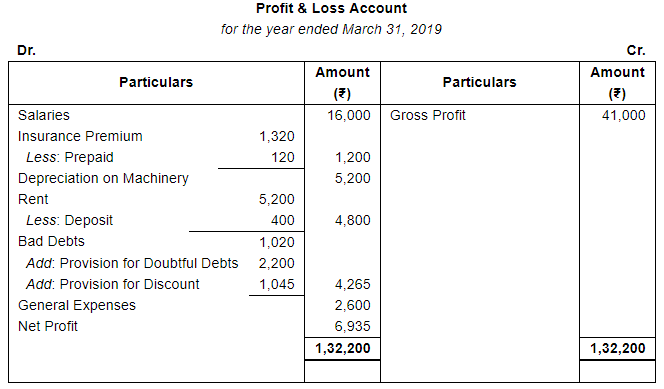

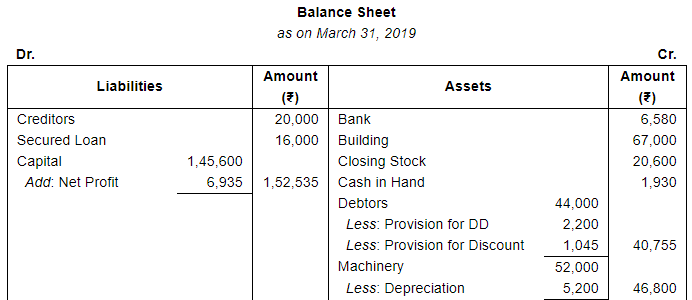

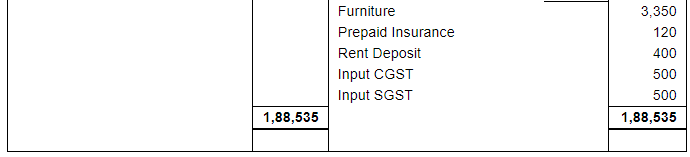

ANSWER:

Page No 19.73:

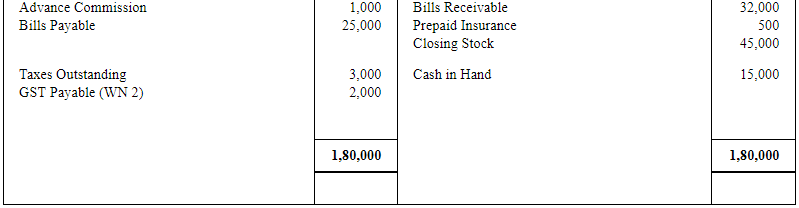

Question 13:

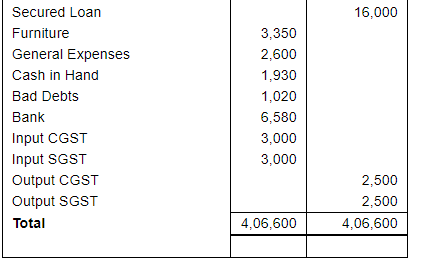

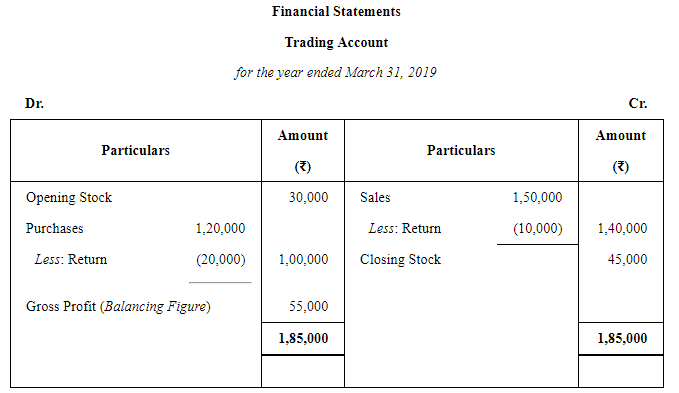

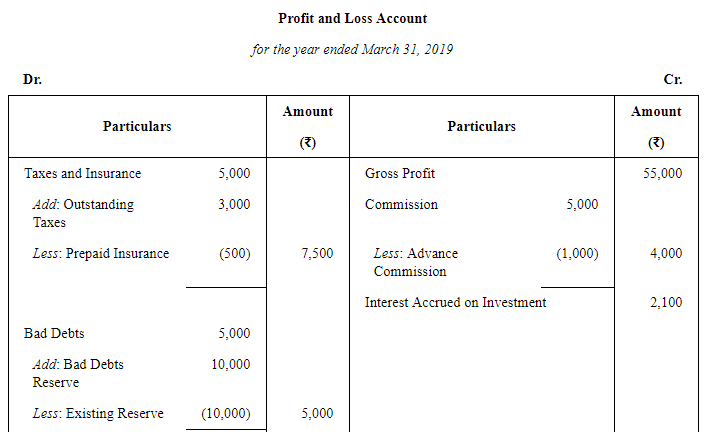

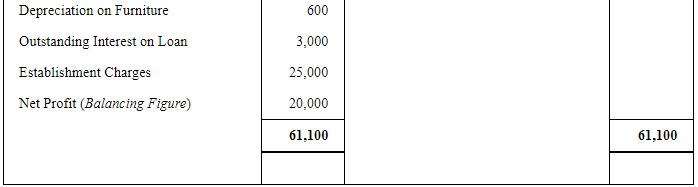

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date from the following Trial Balance:

Adjustments:

(i) Taxes ₹ 3,000 are outstanding but Insurance ₹ 500 is prepaid.

(ii) Commission ₹ 1,000 received in advance for the next year.

(iii) Interest ₹ 2,100 is to be received on Deposits and Interest on Bank Loan ₹ 3,000 is to be paid.

(iv) Provision for Doubtful Debts to be maintained at ₹ 10,000.

(v) Depreciate Furniture by 10%.

(vi) Stock on 31st March, 2019 is ₹ 45,000.

(vii) A fire occurred on 1st April, 2019 destroying goods costing ₹ 10,000. These goods were purchased paying CGST and SGST @ 6% each.

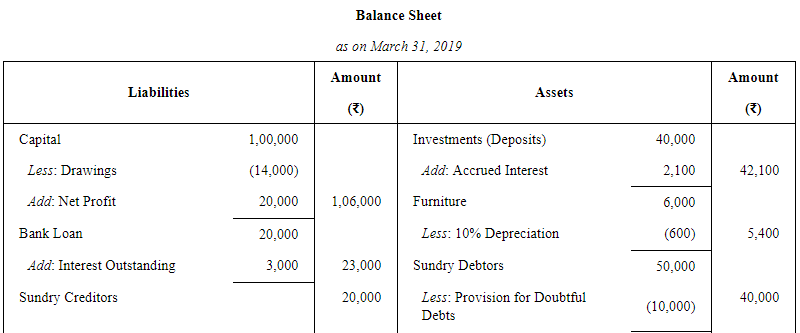

ANSWER:

Working Notes:

(1) Loss of stock by fire has ocurred on 1st April, 2019. Hence, it will not affect the Balance Sheet dated 31st March, 2019.

(2)GST Set off

First:CGST Payable/(Receivable)=Output CGST-Input CGST=8,000-10,000=(2,000)

Second:SGST Payable/(Receivable)=Output SGST-Input SGST=8,000-10,000=(2,000)

Third:IGST Payable/(Receivable)=Output IGST-Input CGST-Input SGST=6,000-2,000-2,000=2,000

Final:GST Payable=Output IGST=2,000

Page No 19.74:

Question 14:

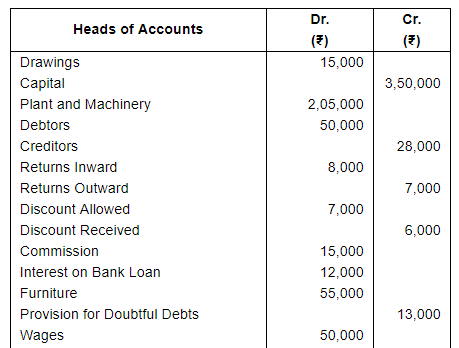

From the following Trial Balance of Ramesh, prepare Trading, Profit and Loss Account for the year ending 31st March, 2019 and a Balance Sheet as on that date:

Adjustments:

(i) Cost of stock on 31st March, 2019 was ₹ 37,000. However, its market value was ₹ 35,000.

(ii) Wages outstanding were ₹ 6,000 and salaries outstanding were ₹ 5,000 on 31st March, 2019.

(iii) Depreciate Land and Building @  %, Plant and Machinery @ 10% p.a. and Furniture @ 15% p.a.

%, Plant and Machinery @ 10% p.a. and Furniture @ 15% p.a.

(iv) Purchase includes purchase of machinery for ₹ 10,000 on 1st October, 2018.

(v) Debtors include bad debts of ₹ 2,000. Maintain a provision for doubtful debts @ 10% on Debtors.

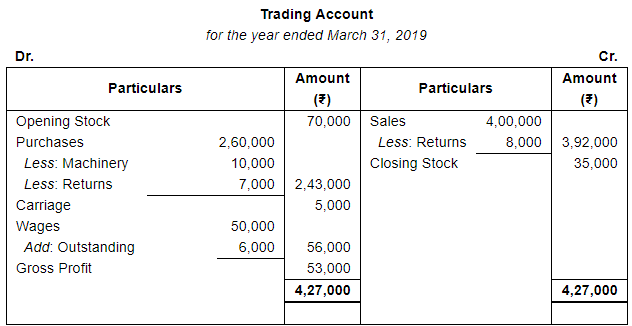

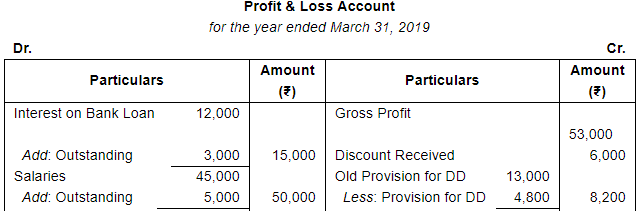

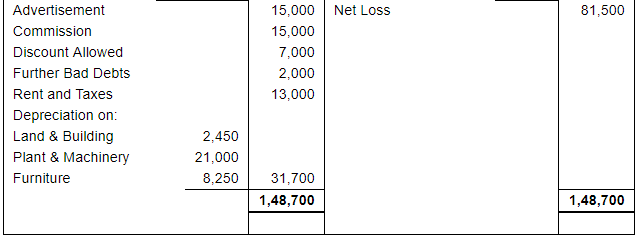

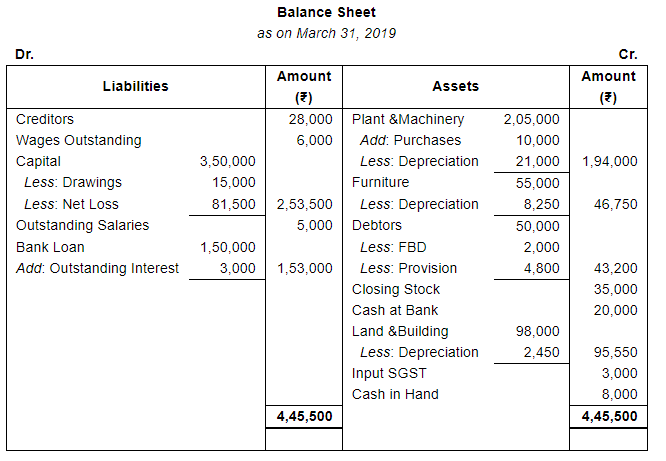

ANSWER:

|

64 videos|153 docs|35 tests

|

FAQs on Adjustments in Preparation of Financial Statements (Part - 2) - Accountancy Class 11 - Commerce

| 1. What are the types of adjustments made in the preparation of financial statements? |  |

| 2. How are accruals and deferrals different in the preparation of financial statements? |  |

| 3. Why are estimates important in the preparation of financial statements? |  |

| 4. How are reclassifications used in the preparation of financial statements? |  |

| 5. What is the purpose of making adjustments in the preparation of financial statements? |  |

|

Explore Courses for Commerce exam

|

|