Class 10 Exam > Class 10 Notes > Accounting for GCSE/IGCSE > Analysis and Interpretation

Analysis and Interpretation | Accounting for GCSE/IGCSE - Class 10 PDF Download

| Table of contents |

|

| Calculation and Understanding of Accounting Ratios |

|

| Inter-Firm Comparisons |

|

| Interested Parties |

|

| Limitations of Accounting Statements |

|

Calculation and Understanding of Accounting Ratios

- Definitions: Working Capital: Current Assets- Current Liabilities.

- Capital Owned: Capital (in the accounting equation). Amount owed by a business to the owner of that business on a certain date

- Capital Employed: Capital + Non-current liabilities (In the accounting equation). Total funds used by a business.

- ASSETS = CAPITAL + LIABILITIES

- A − CL = C + NCL=Capital Employed

- CL - Current Liabilities

- NCL - Non-Current Liabilities

- C- Capital

Profitability Ratios

- Relating the profit for the year to the capital employed provides insight into the return on investments and demonstrates the efficiency of capital utilization. Hence, expressing net profit as a percentage of the capital employed enables comparison, indicating the profit generated per $100 invested.

- To enhance this ratio:

- Enhance by boosting the selling price of goods.

- Opt for purchasing cheaper goods.

- Reduce the capital investment or withdraw unnecessary funds.

- Conversely, factors that could worsen this ratio include:

- Offering increased trade discounts.

- Selling goods at reduced prices.

- Failing to pass on increased costs to customers.

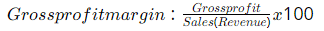

- Expressing gross profit as a percentage of turnover provides an indication of business profitability, with a higher return suggesting greater profitability. This ratio can also be represented as gross profit as a percentage of sales, showing the gross profit or gain per $100 of sales relative to sales factors alone.

- To enhance this ratio:

- Improve by raising the selling price of goods.

- Opt for purchasing cheaper goods.

- Conversely, factors that could worsen this ratio include:

- Offering increased trade discounts.

- Selling goods at reduced prices.

- Failing to pass on increased costs to customers.

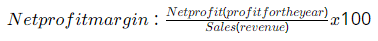

- Return on $100 worth of sales reflects the effectiveness of expense control within a business. It signifies how efficiently expenses are managed to yield returns.

- Net profit as a percentage of sales represents the portion of sales retained by the business, serving as the actual return realized on $100 worth of sales in most instances. This ratio can be influenced by changes in gross profit margin.

- To enhance these ratios:

- Enhance by raising the selling price of goods.

- Opt for purchasing cheaper goods.

- Reduce operational expenses.

- Conversely, factors that could worsen these ratios include:

- Offering increased trade discounts.

- Selling goods at reduced prices.

- Failing to pass on increased costs to customers.

- Increasing overall expenditure.

Liquidity Ratios

Current Ratio/Working Capital Ratio:

- The Current Ratio, also known as the Working Capital Ratio, compares current assets to current liabilities, evaluating the liquidity of assets versus the short-term obligations.

- It assesses a business's capability to meet its short-term debts promptly. Ratios falling between 1.5:1 and 2:1 are considered satisfactory. However, excessively high ratios, like 14:1, may indicate inefficient allocation of funds.

- Insufficient working capital can lead to challenges in meeting obligations, obtaining credit, or seizing business opportunities.

- To improve this ratio:

- Infuse additional capital.

- Secure long-term loans.

- Dispose of surplus non-current assets.

- Sell inventory at a profit.

- Reduce owner's withdrawals or dividends.

- Conversely, actions that could worsen this ratio include:

- Increasing purchases on credit.

- Acquiring additional non-current assets.

Quick Ratio/Acid Test Ratio:

- The Quick Ratio, also known as the Acid-Test Ratio, contrasts a business's current assets excluding inventory with its current liabilities. Inventory is excluded as it's deemed less liquid.

- It compares assets readily convertible to cash against the company's liabilities. Inventory is viewed as less liquid since it requires selling and debt collection to become cash. A ratio of 1:1 is considered satisfactory as it indicates the ability to settle all liabilities with liquid assets immediately. Similar to the current ratio, a ratio higher than 1:1 suggests poor management of liquid assets.

- To enhance this ratio:

- Infuse additional capital.

- Secure long-term loans.

- Dispose of surplus non-current assets.

- Decrease owner's withdrawals or dividends.

- Sell inventory, even if unprofitable, in dire need of cash.

- Conversely, actions that could deteriorate this ratio include:

- Increasing purchases of goods.

- Acquiring additional non-current assets.

- Purchasing goods for cash.

Rate of Inventory Turnover:

- The Rate of Inventory Turnover, also known as Inventory Turn, calculates the number of times inventory is sold and replaced within a given period.

- It's computed by dividing the cost of sales by the average inventory, indicating how quickly inventory is converted into sales. Alternatively, multiplying the average inventory by 365 and dividing it by the cost of sales provides the number of days, on average, inventory is held before being sold.

- A faster rate of inventory turnover implies reduced funds tied up in inventory, which is the least liquid current asset.

- To enhance this ratio:

- Increase the volume of goods sold.

- Conversely, factors that could worsen this ratio include:

- Decreased sales leading to higher inventory levels.

- Excessive purchasing of inventory.

- Elevated selling prices.

- Declining demand.

- Operational inefficiencies and reduced activity levels.

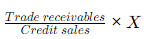

Collection Period for Trade Receivables:

- Calculation:

- The Trade Receivables to Sales Ratio, also known as the Average Collection Period, measures the average time it takes for debtors to settle their accounts.

- If trade receivables equal credit sales, then ideally, the collection period should align with one year, as sales were conducted over this period. The length of time taken for payment should be compared against this benchmark. A longer collection period increases the risk of bad debts, while a decrease indicates efficient credit control.

- To improve this ratio:

- Enhance credit control policies.

- Incentivize early payment with cash discounts.

- Impose interest on overdue accounts.

- Implement measures to withhold supply until debts are settled.

- Consider invoice discounting or debt factoring services, which involve releasing funds tied up in unpaid invoices.

- Conversely, factors that could worsen this ratio include:

- Neglecting follow-up on debt collection efforts.

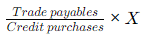

Payment period for trade payables:

- The Trade Payables to Purchases Ratio, also known as the Average Payment Period, represents the average time taken by a business to settle its creditors' accounts.

- This period should be compared against the credit terms extended by the creditors. An increase in the average payment period suggests delays or liquidity constraints in settling immediate obligations. If debtors are also slow in settling their accounts, it can compound difficulties for the business in settling its own accounts.

- Moreover, prolonging the payment period may free up funds for other purposes, but it can also lead to adverse consequences such as suppliers refusing future credit, loss of cash discounts, lower credit scores, and strained supplier relationships.

Inter-Firm Comparisons

- Comparing accounting ratios between businesses provides valuable insights, but this must be approached cautiously due to certain constraints.

- It is advisable for businesses to benchmark themselves against similar entities.

- When engaging in comparisons, it's crucial to consider that:

- Businesses may employ different accounting policies, like methods of depreciation.

- Varying operational strategies such as leasing or financing through loans can impact the balance sheet and profitability.

- Non-financial data such as employee expertise or labor skills, while vital, are not reflected in financial statements.

- Some crucial business details, like the age of non-current assets or average inventory, may not be explicitly stated in financial reports but are relevant for analysis.

- Historical trends of other businesses may not be easily discernible if financial statements from multiple years are unavailable.

- Accounting years differ among companies, affecting factors like seasonal inventory fluctuations (e.g., low air conditioner inventory in winter).

- Financial records typically do not adjust for inflation.

Question for Analysis and InterpretationTry yourself: What is the formula for calculating working capital?View Solution

Interested Parties

Internal Users

- Owners: These individuals are responsible for monitoring the performance and progress of the business. They assess the profitability to ensure the company is on track.

- Managers: Similar to owners, managers, who are employees overseeing the business's operations, also focus on performance monitoring and profitability assessment.

External Users

- Bank Managers: They analyze financial information to determine whether loans or overdrafts can be granted. Additionally, they assess if the business has sufficient funds for repayment.

- Other Lenders: These parties review financial data to evaluate the business's ability to make repayments.

- Creditors/Trade Payables: They assess the credit limit, credit period, liquidity position, and trade payables collection period.

- Potential Buyers and Investors: Interested in the profitability and market value of the business's assets.

- Club Members: Concerned about the business's ability to sustain operations.

- Customers: They ensure continuity in the supply of goods.

- Employees and Trade Unions: They look at the business's ability to sustain operations, provide jobs, pay fair wages, and possibly contribute to pension schemes.

- Government Departments: Utilize business statistics and verify tax compliance.

Limitations of Accounting Statements

Accounting statements have constraints as they are unable to comprehensively encompass every facet of a business. These limitations include:

- Time (Historic Cost): The concept of historic cost emphasizes that historical financial data should not be solely relied upon to predict future outcomes accurately. This is because the financial status of a business evolves from the end of an accounting period to the point when financial statements are generated, as the business continues to operate. For instance, a company's current financial health may differ from what is reflected in past financial records due to ongoing operations and market changes.

- Accounting Policies: Diverse businesses adopt varying accounting policies, complicating comparisons between different firms. When companies alter their accounting methods, it hampers year-on-year evaluations. This variation in policies makes it challenging to draw meaningful conclusions when comparing financial data across firms.

- Difference in Definition: Profits adjustments can differ between years and among companies, necessitating a careful comparison that ensures consistency. It is crucial to compare similar aspects across different entities to obtain accurate insights. For example, comparing net profits between two companies should account for any variations in accounting treatments to ensure a fair assessment.

- Money Measurement: Financial statements often overlook non-monetary factors that can significantly impact a company's financial standing. Factors like employee morale, adaptability to market shifts, governmental policies, and technological advancements influence a business's performance but may not be quantified in financial reports. For instance, while a company's financial statements may indicate profitability, they may not reflect the positive impact of a motivated workforce on overall productivity.

The document Analysis and Interpretation | Accounting for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Accounting for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

22 videos|29 docs|13 tests

|

FAQs on Analysis and Interpretation - Accounting for GCSE/IGCSE - Class 10

| 1. What are some commonly used accounting ratios for inter-firm comparisons? |  |

Ans. Some commonly used accounting ratios for inter-firm comparisons include profitability ratios (such as return on assets and return on equity), liquidity ratios (such as current ratio and quick ratio), and efficiency ratios (such as asset turnover and inventory turnover).

| 2. Who are the interested parties that may use accounting ratios for analysis and interpretation? |  |

Ans. Interested parties that may use accounting ratios for analysis and interpretation include investors, creditors, management, and regulators. These parties use accounting ratios to assess the financial performance and position of a company.

| 3. What are some limitations of using accounting statements for analysis and interpretation? |  |

Ans. Some limitations of using accounting statements include the use of historical data, the potential for manipulation by management, the lack of qualitative information, and the impact of external factors on financial performance.

| 4. How can accounting ratios help in understanding a company's financial health? |  |

Ans. Accounting ratios can help in understanding a company's financial health by providing insight into its profitability, liquidity, efficiency, and solvency. By analyzing these ratios, stakeholders can assess the company's overall financial performance and make informed decisions.

| 5. How can one effectively calculate and interpret accounting ratios for inter-firm comparisons? |  |

Ans. One can effectively calculate and interpret accounting ratios for inter-firm comparisons by ensuring the consistency of financial data, using relevant industry benchmarks for comparison, and considering the unique characteristics of each company. It is important to analyze multiple ratios together to gain a comprehensive understanding of a company's financial performance.

Related Searches